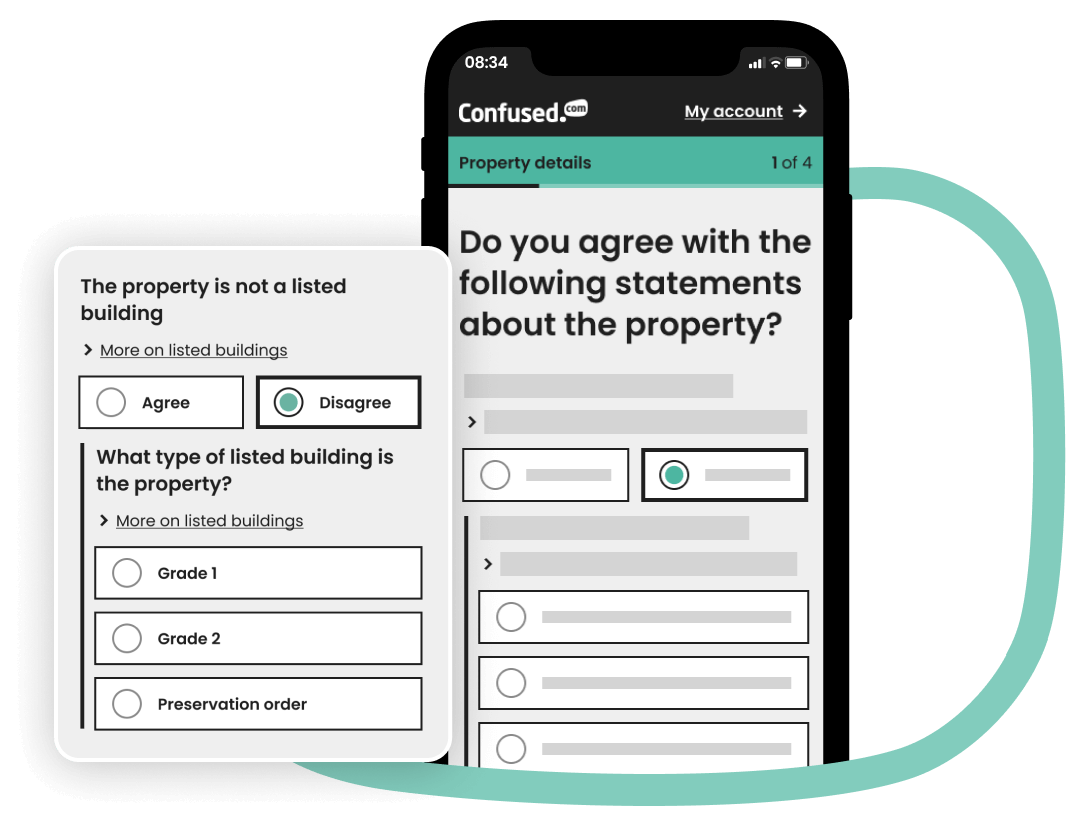

"Restoring your listed property if it's damaged can be expensive. To bring your home back to its former glory, you may be bound by law to use traditional materials and specialist construction methods, which could be a big financial burden.

Getting the correct cover for your historic building from a specialist insurer offers peace of mind that whatever happens, your property is covered."