Confused.com, 2nd Floor, Greyfriars House, Greyfriars Road, Cardiff, CF10 3AL, United Kingdom. Confused.com is a trading name of Inspop.com Limited and is authorised and regulated by the Financial Conduct Authority (Firm reference no. 310635).

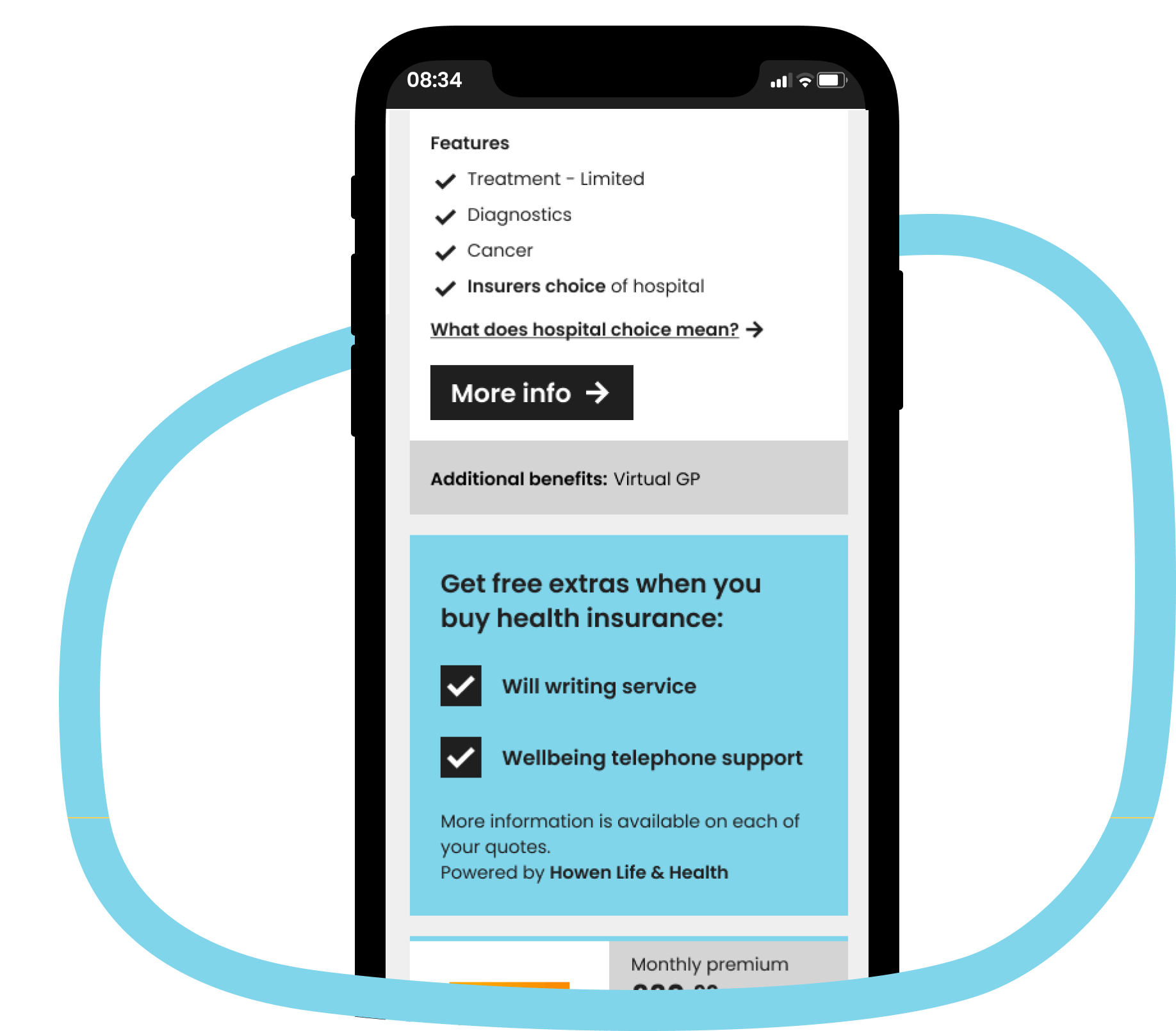

The Confused.com medical insurance comparison service is provided by Howden Life & Health. Howden Life & Health is a trading name of Howden Employee Benefits & Wellbeing Limited, which is part of the Howden Group, registered in England and Wales under company number 2248238, with its registered office at One Creechurch Place, London EC3A 5AF. Authorised and regulated by the Financial Conduct Authority (Financial Services Register No. 312841). The Financial Services Register can be accessed through www.fca.org.uk.

Our service is free and compares a wide range of trusted household names. Confused.com is an intermediary and receives commission from Howden Life & Health Ltd which is based on a percentage of the total annual premium if you decide to buy through our website. We pride ourselves on impartiality on independence - therefore we don't promote any one insurance provider over another.