How does mortgage life insurance work?

Once you’re accepted, you'll start paying your monthly payments. If you die during the policy term, your policy should pay out to the people you named as your beneficiaries, who can use this money how they want.

Mortgages are usually the biggest financial burden, so this payout could be used to clear that outstanding debt.

Buy life insurance and choose a £75 gift card with Confused.com Rewards*

*Get reward after 6 months of your policy being active. Can’t be used alongside cashback offers. T&Cs apply. **Restrictions apply, see https://www.amazon.co.uk/gc-legal

£75 gift card*

£75 gift card*

£75 gift card

£75 gift card

£75 gift card

£75 gift card

What's covered by mortgage life insurance?

According to the Association of British Insurers, 98% of all life insurance claims are accepted. So your policy should pay out in the majority of circumstances.

Most policies cover you if you die due to an accident or an illness, including terminal conditions diagnosed after you took out the policy.

Generally, an illness is terminal when it can't be cured, or limits your life expectancy to 12 months or less.

Some insurers might have a different definition of what a terminal illness is, so it’s worth checking before you buy a policy.

If your policy covers a terminal condition, you could claim the full payout while you’re still alive. You can then use it to pay off your mortgage before you die, making your remaining time a little easier for you and your family.

Terminal illness cover is included as standard in most policies with no additional cost. This is different to critical illness cover, which is a life insurance policy add-on that comes at an extra cost. Critical illness cover pays out if you’re diagnosed with a life-changing illness or injury.

- The full amount you’re covered for on your life insurance policy

- A separate amount you choose when signing up

There are also a few situations where your mortgage life cover might not pay out. These can include death as result of:

- Drug or alcohol abuse

- A reckless act

- Suicide

Failing to pay your insurance costs could also affect your cover. Miss too many, and your policy could be terminated. You would then lose everything you’d paid so far and are unlikely to get a payout if you died.

Most policies have a grace period, though. So if you do miss a payment, you might be able to make up that balance and keep your cover. If you’re struggling to meet your monthly payments, it’s best to contact your life insurance provider before things get that far.

What our life insurance expert says

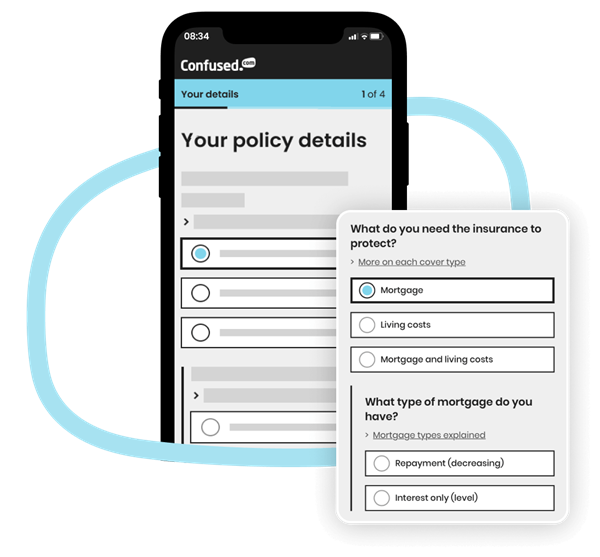

What do I need to get a quote?

To get a quote we just need a few details from you, like:

- Your name and age

- The amount of cover you need

- An overview of your medical history

- Whether you have any pre-existing conditions

If you’re applying for a joint policy, we’ll also need the joint applicant’s details. Some insurers might ask you to have a medical examination before they offer you cover, depending on your age, health and lifestyle.

If you’re a fit, non-smoking 30-year-old with no pre-existing medical conditions, you’re unlikely to be asked to have a medical. Whereas someone older with a more complicated medical history, or who’s smoked their whole adult life might be required to have a medical.

How much cover do I need?

The amount of cover you get should match the amount you owe on your mortgage. As everyone’s mortgage is different, the amount you need is specific to you. You can check your latest mortgage statement or speak to your lender to get your most recent mortgage balance.

The amount your policy pays out reduces over time, so you should check that it decreases at the same rate as your mortgage. Get too little cover, and your payout might not be enough to clear your mortgage if you die. Get too much cover and you could be paying more each month than you need to.

If you extend your mortgage or increase the amount you borrow, contact your insurer to update your policy to be sure it covers your new mortgage.

Try our life insurance calculator to estimate how much cover you need

Alternatives to mortgage life insurance

Decreasing term is the most common type of mortgage life insurance. But there are other options that might also work for you, depending on your needs.

Level term

Family income benefit

How much is mortgage life insurance?

The actual cost of your mortgage life insurance varies, as insurers work this out based on a range of factors including:

-

The amount of cover you want: A larger payout typically means your monthly payments are higher.

-

The length of your cover period: The longer the policy, the more it’s likely to cost.

-

Your age: The older you are, the more your cover is likely to cost.

-

Your health and medical history: Most mortgage life insurance policies cover non-life-threatening pre-existing conditions, but you may have to pay more if you have one. Insurers have their own list of what counts as a pre-existing condition, so it’s worth checking with them before buying a policy.

-

Your lifestyle: This includes things like your weight, activity levels, if you smoke and how much you drink.

-

If you choose to add critical illness cover: This policy add-on costs extra but offers a payout if you suffer a severe injury or become seriously unwell during your cover term.

Mortgage life insurance policies start from

£3.50 per month**

**Dependant on age, cover term and cover amount selected. Example of a 25 year old non-smoker in good health, taking £100,000 cover over 25 years. Based on data from online sales May 2025.

Do you have to pay tax on your mortgage life insurance pay-out?

In some cases, yes. Your life insurance payout forms part of your estate, which is everything you leave behind after you die.

Generally, your beneficiaries don't pay inheritance tax if:

- If you leave your estate to your spouse, civil partner or a charity

- If your estate amounts to less than £325,000, even after your payout

If your estate is more than £325,000, your beneficiaries have to pay 40% inheritance tax on anything above that amount.

There are legal ways to avoid this. Writing life insurance in trust allows you to keep your payout separate from your estate. So your beneficiaries get the full amount tax free, even if your estate is more than £325,000.

After tax, there might not be enough life insurance to cover your mortgage. So putting your policy into a trust is a smart way to ensure they get the full amount. Read more on inheritance tax and rules on GOV.UK.

Why choose Confused.com?

-

We're FCA regulated. This means that we follow their strict operational guidelines to do things right for you. So when you use our site, you know you’re in safe hands.

-

We have a robust security and privacy policy in place and promise to look after your personal details with the utmost care.

- We’re 100% independent and not owned by an insurance company. We’ll always show you our best prices that are available at the time, no matter who they’re from.

- Our experts and consumer champions are dedicated to helping our customers find the best deal for their needs and budget.

What are the different types of life insurance?

Life insurance guides

Explore more life insurance guidesThe Confused.com Life Insurance service is arranged by Reassured Ltd, who is authorised and regulated by the Financial Conduct Authority and entered on the Financial Services Register under reference 616144. Registered Office: 1st Floor, Belvedere House, Bading View, Basingstoke, Hampshire, RG21 4HG. 06838409 registered in England and Wales.

Our service is free and compares a wide range of trusted household names. Confused.com is an intermediary and receives commission from Reassured Ltd which is based on a percentage of the total annual premium if you decide to buy through our website. We pride ourselves on impartiality on independence - therefore we don't promote any one insurance provider over another.