How does modified car insurance work?

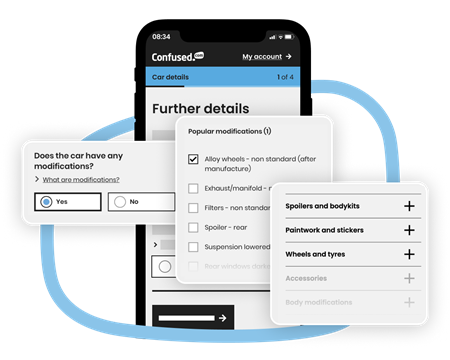

Buying insurance for a modified car works the same way as any other car. Whether you're comparing classic car insurance or 4x4 insurance, the only difference with a modified car is that you'll need to tell us what modifications you've made to it.

We'll then use this information to find you the best quote we can.

Insurers usually have a list of modifications they automatically cover and a list of those they might charge you more for. These vary depending on the insurer.

For example, if you’ve fitted a roof rack or had your windows tinted, it might make little or no difference to your insurance costs.

The insurer will take a view on whether they think your modifications put you at a higher risk of being in an accident or having your vehicle stolen.

The price you're quoted should reflect any modifications you've told the insurer about. For the policy to be valid, you must have told them about all modifications you've made.

If you have a heavily customised car, with lots of different modifications, you might find you have fewer insurance options and need to shop around for specialist policy.

This is because insurers might consider your car to be a higher risk.

What does modified car insurance cover?

Modified insurance covers everything a standard car policy covers. But it also covers non-standard changes or modifications you've made to your car.

Depending on these modifications, your car may be more powerful or more appealing to thieves. This means it could be more expensive than insuring a standard version of your car.

The cost depends on several factors including:

- The specific modification and how it changes your car

- Whether your car is imported

- Your age

- Your address

- Your driving history

You may find that most insurers have clauses in their policies that only replace damaged parts with standard manufacturer parts.

This can be a particular issue for disabled drivers, who may require specialist adaptations to be made to their cars in order for them to drive them.

If this is the case for you, it's worth checking your policy details to be clear on what your insurer's policy for replacement parts is, as your modifications may not be covered.

If you need a policy that provides like-for-like replacements on parts you've modified, you may need a provider who specialises in covering modifications.

Does modified car insurance cost more?

Not always. This depends on the modifications you've made. Modifications like security improvements can lower your price, whereas things like performance modifications, adding in-car entertainment or expensive alloys can increase the cost of your car insurance policy.

As well as modifications, your driving history plays a big part in working out how much you pay. For example, if you’re a young driver, car insurance is already more expensive because of your age. If you start making changes to your car – particularly modifications that affect its performance – your insurer is likely to consider you a higher risk than a more experienced motorist.

To make sure you get the right cover for your car, make sure to declare what and how many modifications it has as the diagram to the right shows.

What are the different levels of cover available?

There are 3 options to choose from when buying car insurance. Third-party offers the lowest level of cover and comprehensive offers the highest. Even though they come with less cover, you might find that the lower level policies aren't always the cheapest and you could find get a higher level of cover at a cheaper price.

| Fully comprehensive | Third Party Fire and Theft | Third Party Only |

|---|---|---|

|

£757*

|

£1,2081

|

£1,6311

|

- Third-party car insurance is the lowest level of cover and the minimum legal level of cover required to drive. It covers you if you damage someone else’s property or injure them. These policies cover your passengers too.

- Third-party fire & theft offers everything that third-party covers. But it also covers your car for repair or replacement costs if it's stolen or damaged by fire.

- Comprehensive car insurance, also known as ‘fully comprehensive’, gives you the highest level of protection. It covers you and your car as well as other people and their property.

If you’ve made minimal modifications, the price could be the same as standard insurance. But if you’ve completely revamped and personalised your car with modifications, it’s likely to be a lot more.

And if you’ve made lots of modifications you might need to buy a specialist policy.

1Confused.com data Q2 2025.

*UK car insurance prices report, March - May 2025.

How can I get cheap modified car insurance?

There are ways you can help cut the costs of your policy:

- Safe storage

- Pay annually

- Add a second driver

- Lower your mileage

- Consider black box technology

Safe storage: If your modified car is out on the street for anyone to see, there’s a higher chance of it getting stolen. Store it safely inside, ideally in a locked unit or garage.

Pay annually: Paying monthly is usually more expensive than making a single, annual payment. In fact, according to our data, it's up to 50% more expensive to pay monthly than it is to pay annually1. This is because interest is added to the monthly amount. If you can, pay it all in one go.

Add a second driver: Younger drivers, or those with little driving experience, tend to pay the most for insurance. If you can add a second driver to your policy who has more experience, such as a parent. This could lower the overall cost.

But there are no guarantees. Also, the other driver can’t be put as the main driver of the car unless this is true - otherwise this is an illegal practice known as fronting.

Lower your mileage: The more miles you rack up, the higher the chance of having an accident and needing to repair your car. If you can keep your mileage down, this could lower the cost.

Consider black box technology: Telematics, or black box technology, monitors the way you drive. If you drive consistently well, it should help lower costs.