"Black box van insurance can be a good starting point for young drivers looking to get on the road and save some money. But aside from the cost savings, there are other benefits to this kind of insurance. If you get into an accident that wasn't your fault, your insurer should be able to use details like your speed data to help support any claims you make. It can also help if you need to disprove any false claims made against you by another driver."

How does black box van insurance work?

Black box van insurance policies are a type of telematics policy that monitors your driving using an app or a small device installed in your van. The device collects data on how you drive - including your speed, mileage and location - which are used to calculate your driver score. Your insurer uses this score to review your insurance costs and can reward safe driving with lower prices.

Whether your price is reviewed monthly, mid-term or at renewal depends on your policy. Check the policy documents before you buy to make sure you’re happy with how it works.

When you buy a policy, the insurance company will give you instructions on where to fit your black box. They may send you a ‘plug and drive’ box that you can fit to the windscreen or dashboard. If the black box needs to be fitted to the interior of the van, they should arrange for a technician to install it.

Most policies have an app that lets you check how you’re driving and see your driver score. But some insurers also use their app to monitor your driving via GPS rather than installing an actual box.

Who is black box insurance best suited for?

Anyone can buy black box van insurance. It's typically targeted at younger, inexperienced drivers who face the highest insurance bills, though.

But there are a number of ways black box van insurance could benefit other types of drivers:

New drivers

Delivery drivers

Other drivers

(2)Based on Confused.com data, November 2023 - April 2024

What our van insurance expert says

Why choose Confused.com?

-

Each year we help over 1 million van drivers compare insurance quotes. We’re rated ‘Excellent’ on Trustpilot and 4.7 / 5 on Reviews.io.

-

We've given out £20m in rewards so far, with no gimmicks and no catches. Simply buy car, home, van or life insurance through us, and we'll give you your choice of 4 great rewards.

-

We compare 541 van insurance providers and we're regulated by the Financial Conduct Authority (FCA). This means we work to strict rules and regulations so you know you're in safe hands when you use our site.

-

Our experts and consumer champions are dedicated to helping our customers find the best deal for their needs and budget

What levels of cover are available?

Black box van insurance has 3 main cover levels - exactly like regular van insurance.

Third party only provides the lowest level of cover. It covers damage or injury to another vehicle or person (including your passengers), but you’ll be responsible for any damage to your van or yourself.

Third party, fire, and theft gives you the same protection as third party only, but you’re also covered if your van is stolen or damaged by fire.

Comprehensive is the highest level of cover available. You're covered for third-party, fire and theft, and it also covers you and your van if you’re in an accident.

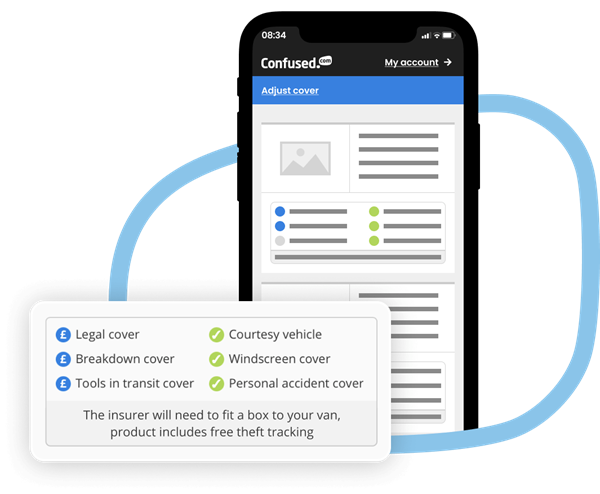

You can also choose to add extra cover, such as breakdown cover or a replacement van if yours needs to be repaired.

When you get a quote, you need to tell us how you use your van. The different options available are:

- Social only, sometimes called private van insurance, is useful if you only use your van for trips to the shops, school runs or hobbies.

- Social and commuting is for those who travel to a single place of work using their van.

- Carriage of own goods suits vans used for business purposes, particularly where you're carrying your own tools in your van.

- Haulage is for delivery drivers and couriers who transport other people's goods over long distances. This is usually intended for delivery drivers who only make a few stops.

It’s always worth taking the time to compare van insurance policies so you can find a policy that works for you. There are lots of insurers in the market, so don’t go for the first one you find.

How do I get black box van insurance?

You can compare black box policies alongside standard van insurance policies when you compare van insurance with us.

- Your driving licence number

- The make, model and registration number of your van

- Your personal details including your occupation

- Details of any claims or motoring convictions you have

- How many years' no-claims bonus you have

- How many miles you drive a year - it can help save you money if you’re accurate about this

Look out for black box policies in your list of results. You’ll also be able to see details about each policy, like whether they include a physical device or use an app.

Our customers say:

Need more help?

What happens if I change my van?

If you change your van during the policy term you need to tell your insurance company so that it can update your policy. Depending on how your black box has been installed, you may need a new one fitted to your new van.

If you have a plug and go box or your driver score is monitored via an app, your insurer may not need to do anything to update your black box to work in your new van. But it’s always best to check with them before you start driving with it.

How easy is it to remove the black box from my van?

It’s relatively easy to remove a black box from your van if you decide you no longer want to continue using it after your policy ends.

If you fitted the black box yourself, it can be as easy as unplugging it from your windscreen or dashboard.

If an engineer fitted your black box, you’ll probably need to pay for someone to remove it.

Removing the black box isn’t really necessary though. Once your policy ends and you’ve let your insurer know you don’t want to renew with them, they should deactivate your black box straight away. You can carry on driving your van, sell it or even scrap it with the device in place if you wanted.

Will the black box interfere with my van?

A black box device shouldn’t interfere with your driving, your van or any of its systems. While it reports information on your driving back to the insurance company, you shouldn’t even be aware of it while you’re on the road.

If you notice anything unusual or suspect your black box is affecting your van in any way, contact your insurer who should investigate.