- Damage caused to someone else’s vehicle if the accident is your fault

- Damage to another person’s property during a road accident

- Personal injury claims made against you (e.g. by another driver or their passengers)

- Injury to a passenger in your car

Why is third-party insurance more expensive than comprehensive?

Third-party car insurance is often more expensive because historically insurers have seen higher risk drivers taking out these policies who are more likely to make a claim.

Third-party was originally the cheapest type of cover available, but when insurers saw that more high value claims were being made on these policies, they gradually raised the prices to account for it.

Now, comprehensive policies are usually better value for money for most drivers. However the cost of your insurance is calculated on personal factors, such as your age, occupation, the make and model of your car and your claims history.

The average prices for each policy type are:

Third-party only

£1,631*

Third-party, fire and theft

£1,208*

Comprehensive

£757(2)

(2)UK car insurance prices report, March - May 2025.

*Confused.com data Q2 2025.

What our expert says

What does third-party only insurance cover?

Third-party car insurance, sometimes called ‘third-party only’ (TPO), offers the most basic level of protection you’ll need to drive on the roads. It covers 3rd party liability only. Let's take a look at what this could include:

If you need more cover than third-party offers, consider other levels of car insurance like third-party fire and theft (TPFT) and comprehensive car insurance policies

How do I compare different cover levels?

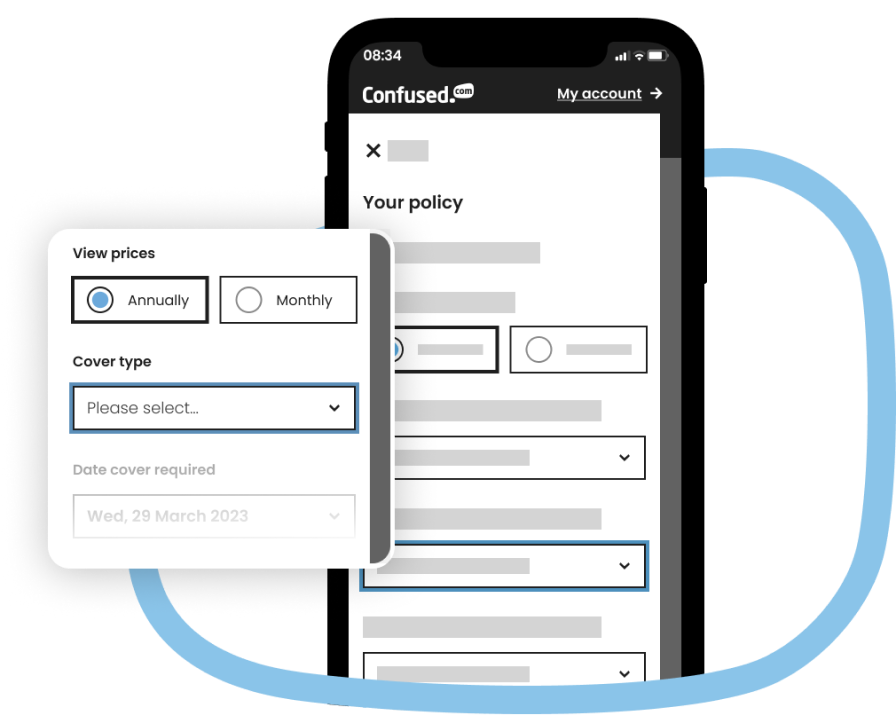

Some important details can be updated on the results page including the cover level, excess and payment type. To make sure you're getting the best cover, try switching between third-party and comprehensive insurance and checking the price difference.

What can I do to get cheaper car insurance?

There are lots of ways to reduce the cost of your car insurance. Here, we’ve included 5 ideas to help keep your insurance cost low when you talk to your insurer:

- Increase your voluntary excess

- Add a named driver

- Enhance your car's security

- Build your no-claims bonus

- Check your mileage

- Try pay as you go insurance

Increase your voluntary excess, which is the amount you pay voluntarily toward any claim you make. This could lower your car insurance costs, however it does mean that you’re likely to pay more towards any future car insurance claims.

Add a named driver, such as a spouse or partner, to your car insurance policy. Less experienced or younger drivers in particular may find adding a named driver with a good driving history can help make their insurance more affordable.

Enhance your car's security with features like an alarm, immobiliser or tracker. This makes it harder to steal and shows your insurer you're less likely to make a claim for theft.

Build your no-claims bonus and you could get discounted prices as a reward for several years of safe driving. For each year you go without making a claim, you get another year added to your no-claims bonus (NCB). The higher your NCB, the bigger the discount you could get.

Check your mileage as part of your insurance costs are calculated on how much time you’re on the road. If you drive 8,000 miles a year rather than 10,000 miles, tell your insurer, as your cover could be cheaper.

Try pay as you go insurance if you're a low mileage driver. These telematics policies track the number of miles you drive and charge you based on how far you travel. For infrequent drivers they can work out cheaper than standard car insurance policies.

Our customers say:

Need more help?

Why is it called ‘third party’?

The term 'third-party' comes from insurance law, where the driver themself is the first party, the insurance party taking on the risk for them is the second party, and the vehicle or driver involved in any accident is the the third party.

The term is used for the cover levels because they protect other road users, not the driver named on the insurance themselves.

Can I still get a no-claims discount with third-party insurance?

Yes, you can build up a no-claims discount with all types of annual car insurance, including third-party insurance.

For every year that goes by without making a claim, you build up a discount that’s taken off your next year’s cost.