Why is the cost of driving increasing?

Our latest research of 2,000 UK drivers reveals that 3 in 5 (63%) have seen their personal motoring costs increase in the last year. And 1 in 5 (18%) have considered selling their car in the past 12 months.

Fuel is costing drivers collectively around £5.76 billion each year2 and car insurance a further £41.79 billion1. Combine this with expenses from MOTs, repairs and road tax3 and the total for these basic necessities alone is £66.17 billion4.

Our research reveals that...

63%

of UK drivers have seen their personal motoring costs increase in the last year

have considered selling their car to spend less

Key factors contributing to higher costs for drivers include:

Manufacturers are raising prices due to increased production costs and global supply chain disruptions. The market is shifting more towards electric vehicles too, which are typically more expensive than cars with a combustion engine.

Fuel prices are fluctuating at different rates around the country, and supermarkets are pricing competitively. Drivers remain desperate to find the cheapest pump near them, and it seems that these worries aren’t going away.

The cost of repairs and parts are increasing as vehicles are becoming more technologically advanced.

Insurers have increased their premiums following increased claims and to compensate for advanced car technologies which can make repairs more expensive.

Councils are encouraging greener driving habits to tackle congestion and environmental challenges which comes at an extra cost to some drivers.

How does where you live affect how much you pay?

Your postcode and driving routes significantly influence your car-related expenses. While a vehicle's purchase price and road tax are constants, other costs like fuel, insurance, tolls, and parking can fluctuate based on location.

Our analysis3 reveals that London-based driver's bear the brunt of these location-dependant costs. They face steeper charges for insurance, congestion, Ultra Low Emission Zones (ULEZ) and parking fees than their counterparts in other regions. The city's higher living standards also mean inflated fuel prices and higher labour rates for repairs.

At the opposite end of the spectrum drivers in the North East of England and Scotland pay the least to their councils for parking-related fees. Research also found that insurance costs are typically lower in Wales, Scotland and the North of England.

3 common costs that affect all drivers, but leave some paying more depending on where they live are:

- Fuel costs

- Car insurance costs

- Fines and other charges

Drivers in South East England pay the highest fuel costs

In 2022, drivers paid £5.76 billion2 in total to fill their tanks with petrol and diesel.

Fuel prices fluctuate based on many factors, from global oil prices, to taxation policies and supply chain costs. In 2022, fuel prices reached more than 200p-per-litre following global events.

A study of fuel prices found that between 2016 and 2022 the most expensive place to buy fuel was in Bedford, in the East of England.

In 2022, the most expensive place for a litre of petrol was South East England at an average of 177.9p. In contrast, the cheapest fuel was found in Northern Ireland, where drivers could fill up for just 168.9p per litre. That’s a 5.3% difference between the two areas.

It’s uncertain how prices might change in the future because of global events. Last year, the average price of fuel per litre was 175.34p, which was up from the previous year at 119.1p.

£5.76 billion2

average fuel costs

View fuel costs for all regions

| Region | Fuel cost (January to July 2023) |

|---|---|

| East Midlands | 147.32p |

| East of England | 147.6p |

| London | 148.24p |

| North East England | 144.5p |

| North West England | 145.3p |

| Northern Ireland | 142.13p |

| Scotland | 146.9p |

| South East England | 148.5p |

| South West England | 147.74p |

| Wales | 147.77p |

| Wales | 147p |

| Yorkshire and the Humber | 146.4p |

Car insurance prices have risen by 58%

The price you pay for your car insurance policy depends on your personal circumstances, including where you live.

Insurance companies use location alongside other personal factors to calculate your level of risk and how likely you are to make a claim. It’s this level of risk that's reflected in your price.

Typically, women get cheaper car insurance than men and younger drivers often have more expensive premiums.11

Our view of average car insurance prices 7 shows the cost of insurance premiums have risen by 58% in the last year. The cost of a comprehensive car policy is now £995 – an increase of £366 per year.

This surge is likely due to increased post-pandemic road usage, a corresponding rise in accidents, and inflation affecting repair costs.

Geography plays a key role in determining insurance premiums. In inner London, residents have an average annual premium of £1,607.

At the opposite end of the spectrum, Hebrides in Scotland boats the UK's lowest average at £577. Llandrindod Wells is close behind at £584.

£41.79 billion1

Scotland

View car insurance prices for all regions

| Region | Average annual insurance premium |

|---|---|

| Inner London | £1,607 |

| Outer London | £1,291 |

| West Midlands | £1,224 |

| Manchester and Merseyside | £1,233 |

| Leeds and Sheffield | £1,127 |

| Northern Ireland | £1,051 |

| East Midlands | £982 |

| North West England | £940 |

| South Central | £952 |

| Midlands North | £916 |

| Scotland Central | £897 |

| North East | £848 |

| North | £844 |

| South East | £837 |

| East of England | £829 |

| South Wales | £778 |

| South | £774 |

| West | £738 |

| Scotland East and NE | £735 |

| Scotland - Highlands and Islands | £712 |

| Scottish Borders | £657 |

| Wales - Central and North | £652 |

| South West | £636 |

Fines and other charges cost motorists £637 million

Councils up and down the country earned £637 million5 from drivers last year (22/23). They might’ve earned this money from:

- Parking fees

- Permits

- Parking fines

- Penalties levied for driving in bus lanes or other areas where vehicles are banned

Motorists who break the law often have to pay if they're caught. Drivers might be issued fixed penalty notices, normally of around £100, for a variety of offences from speeding, to careless driving or jumping a red light.

Sometimes motorists have the chance to avoid a fine and the penalty points by opting for a driver education course. But these usually cost around £100.

Drivers taken to court for their driving offences can be fined much more with £2,500. This is the top penalty for exceeding the motorway 70mph limit.

In 2020/21, UK drivers had to pay:6

- £154 million in fines for motoring offences in court

- £81 million for driver training courses

- £58 million in fixed penalty notices

And as technology continues to advance, companies are developing more high-tech methods to catch dangerous drivers, such as AI speed cameras. So the number of drivers caught breaking driving and parking laws could increase.

£637 million5

Scotland

View fines and charges for all regions

| Region | Fixed penalty notices 2021 - 2022 | Training courses 2021 - 2022 | total fines and charges 2021 - 2022 |

|---|---|---|---|

| East Midlands | £1,373,800 | £3,065,600 | £4,439,400 |

| East of England | £7,379,180 | £11,421,260 | £18,800,440 |

| London | N/A | N/A | N/A |

| North East England | £1,184,400 | £1,795,000 | £2,979,400 |

| North West England | £8,945,750 | £13,608,720 | £22,554,470 |

| Northern Ireland | N/A | N/A | N/A |

| Scotland | N/A | N/A | N/A |

| South East England | £7,186,600 | £11,428,400 | £18,615,000 |

| South West England | £15,074,400 | £13,783,400 | £28,857,800 |

| Wales | £4,145,800 | £7,053,400 | £11,199,200 |

| West Midlands | £6,972,300 | £10,455,760 | £17,428,060 |

| Yorkshire and the Humber | £5,639,500 | £8,741,300 | £14,380,800 |

London drivers pay £683 million in congestion charges

The Congestion Charge is a fee imposed on drivers moving around central London. The aim is to reduce traffic congestion, and in turn reduce pollution.

The scheme encourages people not to drive into city centres and improves air quality by targeting the most polluting vehicles. Our research reveals that 1 in 5 (17%) avoid driving into a congestion zone due to the cost.

of drivers avoid congestion zones due to the cost

In 2021/22, motorists heading into London saw total charges of £683.9million. This was made up of:

- £423 million from congestion charges, paid by nearly all vehicles going into central London.

- £226 million from the ULEZ charge which hits the drivers of older more polluting vehicles visiting inner London areas.

- £35 million from the TFL’s Low Emissions Zone to commercial vehicles.

In 2021/22, the total hit to UK motorists was £717 million6, more than double the total for the previous year of £398 million. This is because traffic levels were lower due to pandemic lockdowns and TFL suspended some of the charges.

Other UK cities contributing to this cost to drivers through Low Emission Zones include:

- Bath

- Birmingham

- Bradford

- Bristol

- Portsmouth

- Sheffield

- Tyneside (Newcastle and Gateshead)

Rules are a bit different in Scotland’s LEZs, but charges are in place in zones in:

- Aberdeen

- Dundee

- Edinburgh

- Glasgow

As inner-city pollution levels get worse, more cities around the UK are also likely to bring in Low Emission Zone rules for more vehicles.

And as ULEZ zones expand around the country, congestion charges are set to increase driving costs even more.

£717 million6

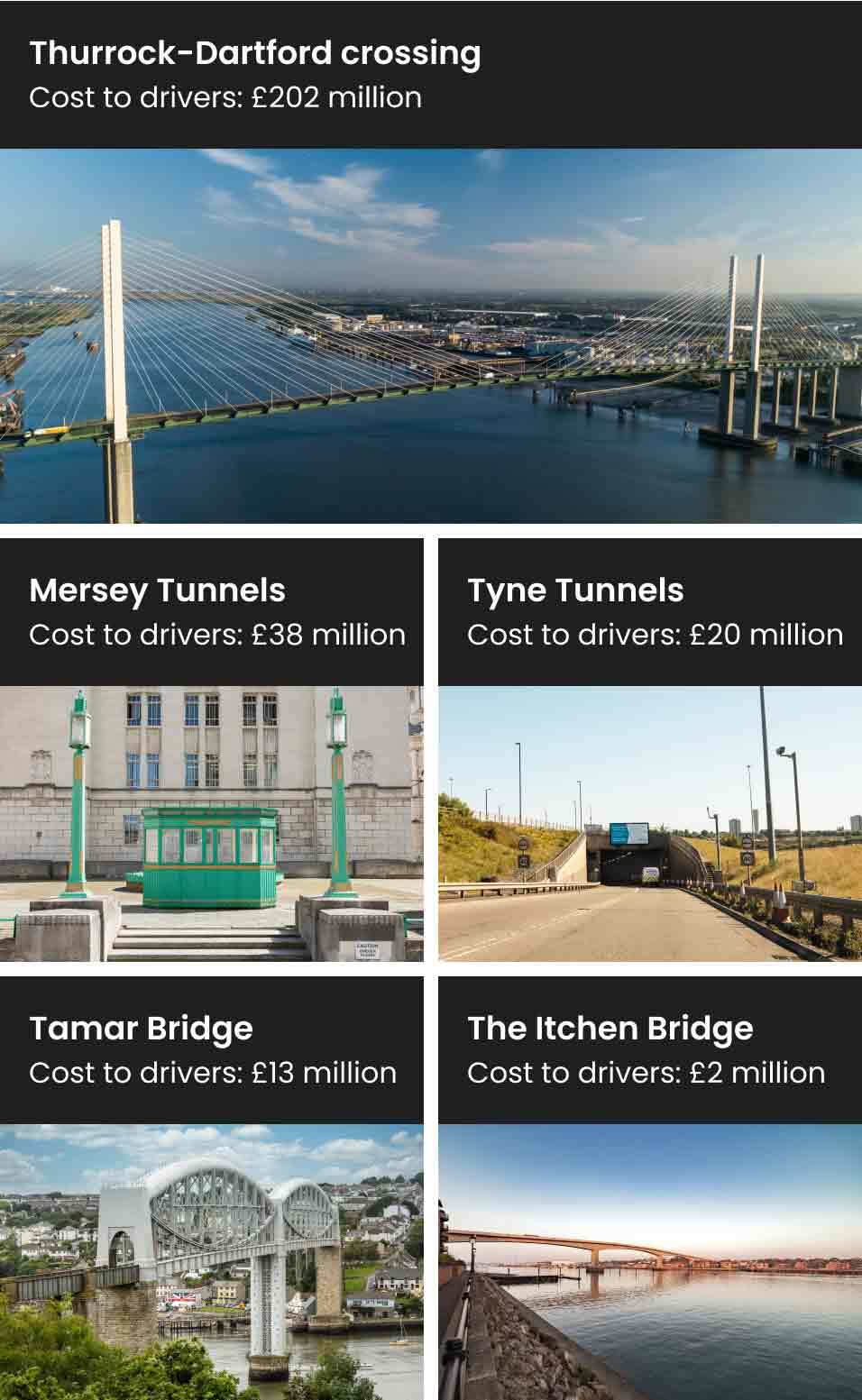

Drivers spend millions on toll roads, bridges and crossings

Drivers must also pay if they need to use toll roads, bridges and tunnels.

The Thurrock-Dartford crossing on the eastern side of the M25 was by far the most costly of these. In 21/22 it pulled in £202 million from motorists using the northbound tunnels and the southbound bridge.

Other crossings that charged motorists were the:

- Mersey Tunnels - £38 million

- Tyne Tunnels - £20 million

- Tamar Bridge - £13 million

- Itchen Bridge - £2 million

£275 million6

Road Tax increased by £400 million in 2022

Every car needs to be road taxed annually, this is also known as Vehicle Excise Duty (VED). And after 3 years from registration, a vehicle has to have an annual MOT test. This is to ensure they‘re safe for the road.

Figures from the government show VED reached a total of £7.1 billion3 in 2021/223, a rise of £400 million from the previous year. The level of VED is staggered so that generally bigger vehicles with larger, more polluting engines end up paying more.

£7.1 billion3

MOT, servicing and repairs are getting more expensive

According to data, UK motorists spent £8.979 billion1 on repairing and servicing their vehicles in 2020/21 according to the Office of National Statistics (ONS)1.

And they spent a further £2.717 billion buying replacement parts.

According to Who Can Fix My Car, between 2018 and 2023 the cost of a full service and MOT for the average car has risen from £184 to £219.9

And the cost of keeping your car roadworthy could increase even more. This is because the price of car parts is increasing due to inflation. Labour costs are rising too as wage levels increase.

£8.979 billion1

UK drivers spend £41 billion a year buying cars

Buying a car is often the second biggest purchase a person ever makes after buying a home. While some may be in a position to pay for their vehicle outright,some might pay for it with a finance arrangement.

This could be a loan, hire purchase (HP) or a personal contract purchase (PCP). Estimates from the ONS1 have put the expense of buying and owning vehicles in 20/21 at £41.46910 billion.

They also found that £13.11 billion7 is being spent every year on new cars. Drivers also spent £28.35 billion5 on second-hand vehicles.

But inflation means the cost of new cars is higher. Interest rates determine the cost of lending charges, and these rates have soared from their historic lows.

Because of this, it looks like the cost of buying a car could also rise.

£41.469 billion10

What our car insurance expert says

“With driving costs at an all-time high, millions of drivers could risk being priced off the road. That’s as our latest research found that more than half (63%) of drivers have seen their motoring costs increase in the past year.

“Driving is a necessity and lifeline for many, and while there are alternatives, such as using public transport, it’s not always an option. Especially if you live near unreliable transport links or far from day-to-day amenities.

“With new driving laws set for 2024, drivers may be paying out even more in fines, on top of their current driving expenses. But doing your research and being savvy as a driver could really help to keep costs down. And that means any money you save could go towards other financial commitments on a rainy day.”

What can drivers do to keep their cost of driving down?

Drivers can look to reduce their motoring costs through changing their driving habits. Some things that could help reduces costs include:

- Adapting how they drive to get cheaper car insurance

- Ensuring a good awareness of traffic laws to avoid charges

- Using navigation apps to try and avoid expensive toll roads and congestion zones where they can

- Comparing petrol prices to avoid paying more than they have to

- Getting quotes from multiple garages for MOTs and repairs to find the best deal. It’s also smart to check reviews if you’re using a new garage to avoid paying more in the long run

- Comparing car insurance quotes on a price comparison site to find the best prices. Be accurate with your details and never accept a higher auto-renewal quote without shopping around first.

Our research shows how much the cost of driving has increased over time, but driver's shouldn't be put off. There's lots drivers can do to keep on top of their spending and ensure they're not paying more than they need.

To help, download the Confused.com app and use our vehicle search tool to see estimated costs for your fuel, MOT, servicing and more.

References

Unless otherwise stated, all research was carried out by OnePoll on behalf of Confused.com of 2,000 UK drivers who have car insurance policies. This was conducted between 19 and 21 February 2024.

2. Fuel prices data: taken from Confused.com

3. In April 2023, Confused.com issued a Freedom of Information request to HMRC, requesting the following information:

- In each of the last three financial years (18/19) (19/20) and (20/21) please state what the income to the Government was from levying vehicle excise duty, commonly referred to as ‘road tax’.

4. Calculation: total fuel costs + total insurance costs + repairs and services (ONS data) + spares and accessories (ONS data) + VED (from HMRC)

5. In April 2023, Confused.com issued a Freedom of Information request, requesting the following information:

- In the (a) 19/20, (b) 20/21, (c) 21/22 and (d) 22/23 financial years please state what the total income was to your authority from all and any fees charged to motorists.

- This figure should include but not necessarily be limited to all income from Fixed Penalty Charges, all car park and pay-and-display charges and all permit charges.

- If possible please also supply me with the data for the (d) 22/23 financial year.

- In total 238 responded, 154 District Councils + Welsh, Scottish and Northern Irish, 39 Unitary Councils, 27 London Borough Councils and 39 Metropolitan Councils.

6. In April 2023, Confused.com issued a Freedom of Information request, requesting the following information:

- Highways England: In each of the last four financial years (18/19) (19/20) (20/21) and (21/22) please state how much money has been accrued from motorists for using the Dartford Crossing / [insert other]

- Other Authorities relevant to Wales, Scotland, N.Ireland: In each of the last three financial years (18/19) (19/20) and (20/21) please state how much money has been accrued from motorists for using the [xx] toll.

- i. Total 19 toll roads, some are private or charity owned and therefore didn't get data, 6 shared data.

- Police forces: In each of the last three financial years (18/19) (19/20) (20/21) and (2021/22) please state how much income has been accrued as a result of (a) police issuing fixed penalty notices to motorists and (b) motorists paying for driving training education courses which were offered as an alternative to a Fixed Penalty Notice.

- i. We submitted requests to 46 constabularies, 6 didn't respond

- In each of the last three financial years (18/19) (19/20) and (20/21) please state the total value of the fines levelled on people who were fined in court for motoring offences. If possible could you please break this down by the different types of motoring offences that were dealt with in court. E.g. speeding offences, careless driving, dangerous driving, drink driving etc.

7. More than 6 million quotes are used in the construction of each quarter’s insurance price index. This makes it the most comprehensive insurance index in the UK. Unless otherwise stated all prices referred to are for comprehensive cover.

- The following web pages will be updated to reflect the new figures and can be linked to: https://www.confused.com/compare-car-insurance/average-car-insurance-cost-uk

8. In April 2023, Confused.com issued a Freedom of Information request, requesting the following information:

- Transport for London: In each of the last five financial years (18/19) (19/20) (20/21) (2021/22) and (2022/23) please state how much money has been accrued from motorists for (a) the congestion charge, (b) bus lane contraventions, (c) stopped in yellow hatched areas and (d) the ULEZ zone.

- Other councils with ULEZ: In each of the last five financial years (18/19) (19/20) (20/21) (2021/22) and (2022/23) or from their introduction, please state how much money has been accrued from motorists from the ULEZ zone.

- We sent off 14 requests, 8 responded with data (the others responded with 0) - Oxfordshire, Durham, Birmingham, Bradford, Portsmouth, TLK Low Emissions, TFL ULEZ and TFL congestion charge.

9. A data request was submitted to Who Can Fix My Car on 14th June 2023 asking for the average costs of car servicing and MOTs between 2018 and 2023.

10. Car financing data: taken from Confused.com

11. While the EU gender directive prohibits insurers from assessing a driver based on their sex, there are other risk factors which cause men to have higher premiums. For example, men tend to drive more expensive cars with larger engines and loaded with new technology, on average, which makes for higher-value claims. They also tend to have significantly more motoring convictions than women.