Key statistics overview

- The current average cost of car insurance in the UK is £941

- Men are paying £160 more than women for car insurance on average

- Drivers aged 18 pay an average of £3,145, compared to £1,353 for 28-year-olds

- Inner London remains the most expensive place for car insurance, now costing £1,501 on average

- Admiral Group remains the largest car insurance provider in the UK, now with a market share of around 11%

- LV= remains the most trusted car insurance company, with an average score of 4.2/5

- There are 141 car and van insurance companies in the UK

- The UK car insurance industry paid £2.54 billion in claims in Q3 of 2023

- There were over 42,500 fraudulent car insurance claims in 2022

- There were 3,869 new complaints about car or motorcycle insurance in Q1 of 2023/24

Latest estimates put the value of the UK car insurance industry at around £19.1 billion.

Here we’ll dive into the latest industry figures and look at the current state of the market.

How much does a car insurance policy cost?

The current average cost of car insurance in the UK is £941 per year.

That's according to the latest Confused.com average cost of car insurance study (Q1 2024). The index is based on over 6 million quotes over the quarter and is analysed in partnership with WTW.

The average car insurance cost increased by £284 (43%) over the last 12 months. Inflation has caused car parts and labour prices to rise. This means it has become more expensive for insurers to pay for repairs. The cost of repairs has reportedly risen by a third since the start of 2023.

The Covid-19 pandemic is also still causing garages to experience supply chain issues. This then leads to delays and backlogs with claims that involve vehicle repairs. This increases not only the cost of claims but the cost of car insurance too.

The UK also experienced extreme weather conditions last year. This can make driving dangerous, particularly in snowy or icy conditions. It can also cause unexpected incidents, such as a tree falling on your car. Severe weather conditions can lead to increased car insurance claims which insurers consider when calculating their insurance prices.

The cost of car insurance can also vary depending on a variety of other factors, such as age, driving history and location.

What are the different levels of car insurance cover?

There are three main types of car insurance. They all provide different levels of coverage and can vary in cost.

- Third-party-only (TPO) insurance - this is the most basic type of car insurance. It provides coverage for any damage caused to someone else that you’re responsible for. This includes damage to the person, their car or their property. However, it doesn’t cover damage to your own vehicle.

This kind of policy tends to be more expensive despite being the lowest level of cover. This is because more high-risk drivers tend to choose this type of policy to reduce their insurance costs. More claims tend to be made on this type of policy, causing insurers to increase their prices. - Third-party fire and theft (TPF&T) insurance - this type of insurance provides the same coverage as TPO policies. But it also provides protection against theft and fire damage to your own vehicle. Attempted theft is also covered in these policies.

This kind of policy can fluctuate in price depending on how high risk an individual is to insure. Again, despite offering lower cover than comprehensive cover, they can often be more expensive as more claims tend to be made. However, the price compared to TPO policies can differ depending on the individual. - Comprehensive car insurance - this is the highest level of car insurance you can get. It covers you, your car and a third party if you’re involved in an accident. This is regardless of who is at fault. It also covers repairs, property damage, and personal injury claims.

This kind of policy tends to be the cheapest. This may be surprising as it offers the most coverage. However, more claims were being made on other types of policies by high-risk drivers. This then caused the price of those other policy types to increase. Comprehensive car insurance now tends to be the cheapest policy for most drivers.

Prices by gender

On average, men pay £160 more than women for car insurance.

Insurers aren’t allowed to use a person’s gender to determine the cost of their insurance. This rule is part of the 2012 EU Gender Directive.

However, according to recent data, men tend to pay more for their car insurance. This is because males often have a higher risk profile than females. They also tend to drive more high-tech, expensive cars. This means it costs more to repair their vehicles if they’re involved in an accident.

According to the latest Confused.com price index, men pay £1,001 a year for car insurance, on average. This is an increase of £299 (43%) since last year.

Women have seen a £258 (44%) increase in their car insurance costs over the past year. On average, they’re now paying £841 per year.

Prices by age

17-year-olds have seen the biggest price increase for car insurance.

On average, those under 43 are paying £1,000 or more for car insurance. Drivers aged 22 and under are paying over £2,000 in car insurance costs, on average.

17-year-olds have seen the biggest percentage increase in car insurance costs. On average, they’re now paying £2,919 per year. This is an increase of 81% over the past year, equal to £1,307.

Those aged 18 pay the highest prices overall, at £3,145 on average per year. Prices for this age group rose by 70% in the last year, equal to £1,300 annually.

Young drivers tend to pay more for their car insurance as they’re less experienced. Insurers see inexperienced drivers as more likely to be involved in an accident, increasing their risk profile.

| Age range | Premium price increase |

|---|---|

|

Under 25s

|

73.10%

|

|

25-49

|

63.90%

|

|

Over 50s

|

57.20%

|

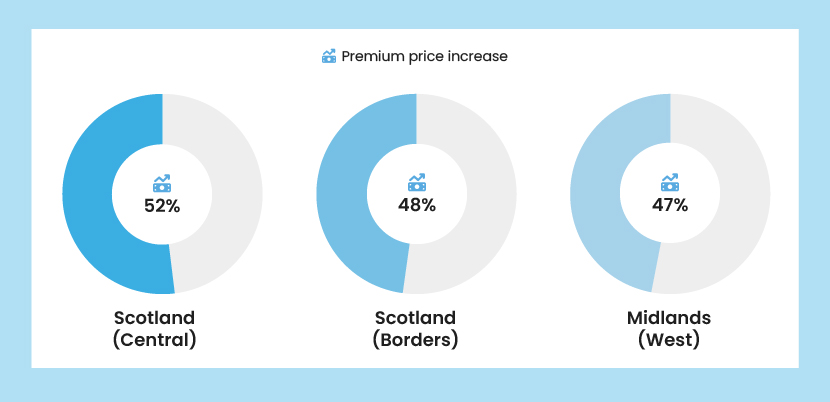

Price by region

Inner London remains the most expensive place for car insurance.

The price of car insurance is rising for drivers all over the UK. Some regions are feeling the effects more than others.

Drivers living in Inner London have seen their car insurance costs increase by £434 (41%). This means they’re now paying £1,501 a year, on average. This is the highest insurance cost across all regions.

Those living in Outer London have also seen a considerable increase. On average, these drivers are now paying £1,220 each year for car insurance. This is an increase of £375 (44%).

Car insurance costs have increased the most throughout Scotland. Prices in Central Scotland have risen by £298 (52%) over the last year. Drivers in this area are now paying an average of £871 for car insurance every year.

Those living in the Scottish Borders have seen car insurance prices increase by £206 (48%). This means they are now paying £634 per year, on average.

| Region | Premium price increase |

|---|---|

|

Scotland - Central

|

52%

|

|

Scotland - Borders

|

48%

|

|

Midlands - West

|

47%

|

|

Scotland - East & NE

|

46%

|

|

Midlands - East

|

45%

|

|

South East

|

45%

|

|

East

|

45%

|

|

London - Outer

|

44%

|

|

Leeds / Sheffield

|

44%

|

|

North West

|

43%

|

|

South Central

|

43%

|

|

Scotland - Highlands & Islands

|

43%

|

|

Manchester / Merseyside

|

42%

|

|

Midlands - North

|

42%

|

|

North

|

42%

|

|

London - Inner

|

41%

|

|

South

|

41%

|

|

West

|

41%

|

|

North East

|

40%

|

|

South West

|

40%

|

|

Wales - South

|

39%

|

|

Northern Ireland

|

38%

|

|

Wales - Central & North

|

37%

|

Who are the UK’s biggest car insurance providers?

There are over 140 car and van insurance companies in the UK.

Currently, the biggest car insurance company in the UK is Admiral Group. They hold a market share of 11.3%. The group is estimated to make over £1.8 billion per year from gross written premiums.

Admiral Group includes the following brands:

- Admiral

- Bell

- Diamond

- Elephant.co.uk

- Gladiator

In second place is Aviva, who have a market share of 10.6%. It’s estimated that the group makes almost £1.7 billion from gross written premiums every year.

Aviva includes the following brands:

- Aviva

- Quotemehappy

Direct Line Group now takes third place after being overtaken by Aviva. The group previously had a market share of 10.8%, but this has now fallen to 10.2%. They are estimated to make over £1.6 billion per year from gross written premiums.

Direct Line Group includes the following brands:

- Direct Line

- Churchill

- Darwin

| Rank | Motor Insurance Company | Motor Insurance Gross Premiums Written (£million) | Estimated UK Market Share |

|---|---|---|---|

|

1

|

Admiral Group (including Admiral, Bell, Diamond, elephant.co.uk, Gladiator)

|

£1,805

|

11.28%

|

|

2

|

Aviva (Aviva, Quotemehappy)

|

£1,689

|

10.56%

|

|

3

|

Direct Line Group (including Direct Line, Churchill and Darwin)

|

£1,634

|

10.22%

|

|

4

|

Hastings

|

£1,096

|

6.85%

|

|

5

|

LV=

|

£1,058

|

6.61%

|

|

6

|

RSA

|

£1,042

|

6.52%

|

|

7

|

AXA

|

£1,002

|

6.26%

|

|

8

|

NFU Mutual

|

£668

|

4.17%

|

|

9

|

esure (Sheila's Wheels, esure)

|

£619

|

3.87%

|

|

10

|

Ageas

|

£598

|

3.74%

|

Who are the UK’s most trusted car insurance providers?

LV= remains the most trusted car insurance provider, with an average score of 4.2/5.

The brand has a satisfaction rate of 78% on Which? and scores 4.5 on Trustpilot. LV= are available 24/7, meaning that you can make a claim straight away if you are involved in an accident. They also provide lifetime guarantees on repairs when you use their recommended service.

In second place is NFU Mutual, with an average score of 4.1/5. They score 4.4 on Trustpilot and have a satisfaction rate of 77% on Which?. NFU Mutual are a Which? Recommended Provider for car insurance. They also pay out on 99% of insurance claims.

AXA has now knocked Saga from the third most trusted provider spot. They have a satisfaction rate of 72% on Which? and score 4.3 on Trustpilot. This means AXA has an average score of just less than 4/5. Their AXA Plus car insurance includes extras such as 90 days European cover, stolen key cover and wrong fuel cover.

| Rank | Brand | Average score |

|---|---|---|

|

1

|

LV

|

4.2

|

|

2

|

NFU Mutual

|

4.13

|

|

3

|

AXA

|

3.95

|

|

4

|

Saga

|

3.93

|

|

5

|

Churchill

|

3.88

|

|

5

|

AA

|

3.88

|

|

7

|

Tesco Bank

|

3.83

|

|

7

|

Admiral

|

3.83

|

|

9

|

Aviva

|

3.75

|

|

10

|

Direct Line

|

3.73

|

|

10

|

Hastings Direct

|

3.73

|

|

12

|

RAC

|

3.6

|

|

13

|

esure

|

3.13

|

|

14

|

Halifax

|

2.25

|

How much is paid out in car insurance premiums?

Over £19 billion in gross motor insurance premiums are written annually in the UK.

This is according to the most recent statistics available using Confused.com data.

In Q3 of 2022, insurers settled over 540,000 car insurance claims, amounting to over £2.1 billion in payouts. By Q3 of 2023, the total number of settled claims increased by 6% to over 570,000. This caused a 21% increase in payouts, standing at over £2.5 billion.

In the same quarter of 2022, insurers processed over £108 million in replacement cars. A year later, this figure had risen by 48% to over £160 million.

There was also a year-on-year increase in payouts for vehicle theft. In Q3 of 2022, vehicle theft claims amounted to over £132 million. During the same quarter of 2023, insurers paid out over £178 million in vehicle theft claims. This is an increase of 35%.

Despite these increases, the amount of personal injury claim payouts has decreased. Q3 of 2022 saw insurers paying out over £647 million in personal injury claims. By Q3 of 2023, this figure had fallen to £611 million, showing a decrease of 6%.

| Quarter | Total motor insurance claims payout (£Billion) | Claims settled | Cost of vehicle repairs (£Billion) | Cost of replacement cars (£Million) | Payouts for vehicle theft (£Million) | Motor insurance premium | Personal injury claims payout (£Million) |

|---|---|---|---|---|---|---|---|

|

2022 Q3

|

£2.10

|

540,000

|

-

|

£108

|

£132

|

£434

|

£647

|

|

2023 Q3

|

£2.54

|

570,000

|

£1.60

|

£160

|

£178

|

£561

|

£611

|

|

Change

|

21%

|

6%

|

-

|

48%

|

35%

|

29%

|

-6%

|

Car insurance complaints

Complaints about car and motorcycle insurance have increased by over 50% year-on-year.

In Q1 of 2023/24, over 3,800 new complaints were made about car or motorcycle insurance. Of these cases, 558 were then referred to the Financial Ombudsman Service, with a 36% uphold rate.

This is compared to a total of 2,524 complaints and an uphold rate of 29% in Q1 of 2022/23.There has been a considerable increase (90%) in the number of complaints about delays in claims. Many factors have had an impact on the speed of repairs. This includes both contractor availability and the ability to source the correct materials.

| Product | Enquiries | New cases | Cases referred for an ombudsman's decision | % of cases upheld |

|---|---|---|---|---|

|

Car or Motorcycle Insurance

|

6,192

|

3,869

|

558

|

36%

|

|

Commercial Vehicle Insurance

|

448

|

333

|

73

|

41%

|

|

Roadside Assistance Insurance

|

411

|

205

|

34

|

36%

|

|

Motor Warranties

|

112

|

58

|

15

|

46%

|

|

Caravan Insurance

|

56

|

57

|

10

|

40%

|

|

GAP (Guaranteed Asset Protection Insurance)

|

32

|

27

|

<10

|

<30

|

Is car insurance fraud a big problem?

There were over 42,500 fraudulent car insurance claims in 2022. This accounts for around 59% of the total 72,600 fraudulent claims throughout the year.

The total value of fraudulent claims in 2022 was over £1.1 billion. This means that the average value per fraudulent claim was £15,000.

Car insurance fraud is committed in two ways. The first way is by withholding information from your insurance provider. This includes anything from your age or occupation to any previous motoring convictions. Withholding this information is considered fraud, whether it was intentional or not.

The second way is by providing false or misleading information when making a claim. For example, exaggerating the extent of injuries or the value of your car. Submitting a fraudulent claim can lead to serious consequences, such as prosecution. This includes anything from community service to six months or more imprisonment.

| Year | Fraudulent Claims | Value (£Billion) | Average fraud | Motor Insurance Fraud Claims | Motor Insurance Fraud Claims as % of all fraud |

|---|---|---|---|---|---|

|

2022

|

72,600

|

£1.10

|

£15,000

|

42,500

|

59%

|

“Car insurance fraud can be committed by withholding information from your insurer. Whether you do this intentionally or not, your insurance policy may be invalidated.

Always update your car insurance provider on the following:

“It’s important that you do all these things to avoid accidentally committing fraud. Otherwise, any claims you make may be rejected.

“You can also commit car insurance fraud by providing false or misleading information. Doing this can lead to serious consequences, such as fines or prosecution. Your insurance policy will also be invalidated.

There are several ways people can intentionally commit car insurance fraud. For example:

“There are various ways in which you can avoid falling victim to a car insurance scam. It’s a good idea to invest in a dashcam for your vehicle. This allows you to collect footage of any accidents to show what actually happened. You should also always take photos of the accident and get the details of the other driver involved. All these points will help to protect you against any scams or fraudulent claims.”

What our motor insurance expert says

Methodology

Average costs were sourced from Confused.com average cost of car insurance data based on 6 million quotes and analysed to be representative of the market. TPO and TPFT data are based on Confused.com internal data only, without additional weighting.

The market share of the UK’s biggest car insurance providers was sourced from NimbleFins’ Top 10 Largest UK Car Insurance Companies 2024 (updated December 31, 2023).

The number of motor vehicle liability and other motor vehicle insurance companies was sourced from insuro.co.uk.

Average ratings were taken from Trustpilot and Which?. The scores out of 100 from Which? were converted into a score out of 5, to allow an average to be taken with the Trustpilot scores.

We can record motor insurance payouts and other stats (cost of vehicle repairs and replacement cars) from ABI.

The number and value of fraudulent claims were sourced from the Association of British Insurers.

Number of customer complaints was sourced from the Financial Ombudsman Service's quarterly complaints data: Q1 2023/24.