This page includes relevant UK student finance facts and stats for 2024, such as:

- How much student debt is expected to rise

- The average level of student debt across the UK

- How much the UK government spends on maintenance loans

According to the latest student finance facts and statistics, there were around 2.86 million students across the UK in the 2021-22 academic year. Government spending on tertiary education (those in education above school age) for 2022-23 amounted to £4.55 billion, averaging at £1,590 per student.

After the introduction of tuition fees in 1998, students were initially charged £1,000 a year to attend university. This rose to £3,000 a year in 2006, and then £9,000 from the start of 2012-13. As of 2023-24, tuition fees now sit at £9,250 a year.

Given these drastic changes, and the current cost of living crisis, we’ve collated a range of student finance statistics for 2023. This includes:

- Average student loan debt statistics across the UK

- Government spending figures on maintenance loans

- How student loan interest rates are affecting repayments

Top 10 student finance facts and stats 2024

- The UK government spent over £4.5 billion on higher education in 2022-23

- As of 2022-23, the total value of student maintenance loans stood at £205.6 billion (up 13% from 2021-22)

- In 2023, the average student maintenance loan in the UK was £5,820

- The UK average student debt in 2022-23 was £45,600

- Average student debt was almost 3 times higher in England (£44,940) than in Scotland (£15,430) in 2022-23

- In 2022-23, around 1.2 million people took out a student loan, to the value of £17.8 billion

- As of 2022-23, total UK student debt exceeded £225.9 billion – a 13% rise from 2021-22.

- Between 2022 and 2028, the number of students with a student loan is predicted to increase by 6%, to over 1.6 million

- As of 2022-23, the amount of interest paid on student loans stood at £8.35 billion (+78% from the previous academic year)

- More than a quarter (27%) of students from 2022-23 are expected to repay their student loan in full, rising to three-fifths (61%) of the 2023-24 cohort.

How much does the UK government spend on higher education?

As of 2022-23, the UK government spent £4.55 billion a year on higher education – a 3.4% decrease from the previous year.

A breakdown of how much the UK government spends each year on higher education (2009-23)

Since 2010-11, the UK government has gradually spent less on higher education. This fell from around £15.78 billion to a low of £4.37 billion in 2019-20, representing a fall of 72% in a 9-year period.

How much does the UK government spend on student maintenance loans?

Between 1990 and 2006, the annual number of student maintenance loans taken out jumped from 180,000 to 881,000 – an increase of nearly 390%.

In 2015, the average maintenance loan for students was £4,000. This jumped to £6,100 in 2016, and £7,000 for those starting university in 2021-22.

A breakdown of how much the government spends on student maintenance loans

As of 2022-23, the total value of student maintenance loans stood at £205.6 billion – an increase of 13% from 2021.

Since 2012, there’s been year-on-year growth in the amount spent on maintenance loans by the UK government. Between 2012-13 and 2016-17, this figure almost doubled, from £46.6 billion to £89.3 billion.

In 2017-18, total maintenance loan spending exceeded £100 billion and grew by approximately £20 billion a year up until 2022-23.

What is the minimum student maintenance loan for 2024-25?

The minimum student maintenance loan amount available in the UK for 2024-25 varies depending on which part of the country you’re from, your joint household income, and where you’ll be studying while at university.

A breakdown of the minimum student maintenance loan amount in the UK for 2024-25

| Part of the UK that student is from | Minimum student maintenance 2024-25 (living at home) | Minimum student maintenance 2024-25 (living away from home and studying outside London | Minimum student maintenance 2024-25 (living away from home and studying in London |

|---|---|---|---|

|

England

|

£3,790 (loan)

|

£4,767 (loan)

|

£6,647 (loan)

|

|

Scotland

|

£8,400 (loan)

|

£8,400 (loan)

|

£8,400 (loan)

|

|

Wales

|

£3,430 (loan) and £6,885 (grant) for a total of £10,315

|

£4,050 (loan) and £8,100 (grant) for a total of £12,150

|

£5,046 (loan) and £10,124 (grant) for a total of £15,170

|

|

Northern Ireland

|

£3,989 (loan)

|

£5,084 (loan)

|

£7,121 (loan)

|

(Source: Save the Student)

The minimum student maintenance loan available in the UK is for students from Wales living at home while at university (£3,430).

In contrast, those studying in Scotland and living at home are eligible for a minimum maintenance loan of £8,400 – 84% more by comparison.

What is the maximum student maintenance loan for 2024-25?

Similar to the minimum amount, the maximum student maintenance loan for 2024-25 also depends on which part of the UK you’re from and where you’ll be studying while at university.

A breakdown of the maximum student maintenance amount in the UK for 2024-25

| Part of the UK that student is from | Maximum student maintenance 2024-25 (living at home) | Maximum student maintenance 2024-25 (living away from home and studying outside London) | Maximum student maintenance 2024-25 (living away from home and studying in London) |

|---|---|---|---|

|

England

|

£8,610 (loan)

|

£10,227 (loan)

|

£13,348 (loan)

|

|

Scotland

|

£9,400 (loan) and £2,000 (bursary) for a total of £11,400

|

£9,400 (loan) and £2,000 (bursary) for a total of £11,400

|

£9,400 (loan) and £2,000 (bursary) for a total of £11,400

|

|

Wales

|

£9,315 (loan) and £1,000 (bursary) for a total of £10,315

|

£11,150 (loan) and £1,000 (bursary) for a total of £12,150

|

£14,170 (loan) and £1,000 (grant) for a total of £15,170

|

|

Northern Ireland

|

£3,315 (loan) and £3,475 (grant) for a total of £6,610

|

£4,661 (loan) and £3,475 (grant) for a total of £8,13

|

£7,377 (loan) and £3,475 (grant) for a total of £10,852

|

(Source: Save the Student)

The maximum student maintenance loan for students in the UK is for Welsh students who are living away from home and studying in London (£14,170).

By contrast, those from Northern Ireland living at home while at university are eligible for a maximum student loan of £3,315 – around 125% less by comparison.

What is the average maintenance loan for students in the UK?

In 2023, the average maintenance loan for students in the UK was £5,820. But, this depends on your household income, where you'll be studying while at university, and where you normally live.

Need help with budgeting while at university? Check out our student budget calculator to help you make the most of your money while studying at uni.

Future costs of student loans for the UK government

As of 2022-23, the UK government’s total up-front outlay for student loans in England was around £20 billion. This figure is expected to reach £24 billion by 2027-28 (+20%).

Borrowing from the government usually costs less than the interest rates charged on student loans. But this is now expected to change. Government bonds have risen a lot since 2020-21. They're now higher than the expected retail price index (RPI) for inflation. This will determine the interest rates on newly issued student loans. This means the government is likely to make a loss on loans that are not repaid.

This additional cost is not reflected in the government’s official measure of how much student loans cost the taxpayer. This figure is estimated to be around £10 billion per year and is dependent on graduates’ future earnings and rates of RPI inflation.

A breakdown of the cost of student loans in the UK based on the Retail Prices Index (RPI)

In other words, with the student loans system of 2023 and the government cost of funding for 2021, the UK government would have expected a net loss of £3.2 billion from student loans in 2023. This would have equated to £6,700 per student.

But, the expected total net cost of student loans for the 2022-23 student cohort stands at £7.3 billion. This would result in an average loss of £15,200 per student.

UK average student loan debt statistics

How much is the average student loan debt in the UK?

According to the Student Loans Company (SLC), the average student debt in the UK is £45,600 for students who started their course in 2022-23. This is expected to be £42,900 for those starting in the reformed system for 2023-24.

Average student debt statistics across the UK

As of 2022-23, the average student loan debt across the UK was highest in England (£44,940), followed by:

- Wales (£35,780)

- Northern Ireland (£24,500)

- Scotland (£15,430)

A breakdown of the average student loan debt statistics in England, Scotland, Wales and Northern Ireland

Average student loan debt statistics in England reveal it almost doubled (+84%) between 2014-15 and 2022-23.

In other parts of the UK during the same period:

- Scotland’s average student loan debt rose by almost half (+48%).

- Typical student debt in Wales more than doubled (+124%).

- Average student loan debt in Northern Ireland rose by almost a quarter (+24%)

A breakdown of UK student loan statistics between 1990 and 2023

| Number of loans taken out (000s) | Total value (£mn) | Average value per student (£) | % of eligible students taking out student loans | |

|---|---|---|---|---|

|

1990/91

|

180

|

70

|

390

|

28%

|

|

2000/01

|

760

|

2,204

|

2,900

|

78%

|

|

2010/11

|

909

|

5,601

|

6,160

|

86%

|

|

2020/21

|

1,188

|

17,863

|

15,030

|

95%

|

|

2021/22

|

1,218

|

18,371

|

15,080

|

-

|

|

2022/23

|

1,223

|

17,798

|

14,560

|

-

|

(Source: House of Commons Library)

As of 2022-23, around 1.2 million students took out a student loan, totalling nearly £17.8 billion. This resulted in an average student loan value of £14,560 per student. This is in contrast to 1990-91 when just over 1 in 4 (28%) eligible students took out a loan for university.

Since 1990-91, there’ve been some significant changes in UK student loan statistics, including:

- A 579% increase in the number of students applying for student loans in the UK

- A rise of more than 25,000% in the value of student loans, when the value stood at just £70 million for 1990-91

- An increase of 3,633% in the average value of student loans, from a low of £390 in 1990-91

- A 239% rise in the number of students eligible for student loans over this 30-year period

Also, the number of UK university students rose by 0.4% from 2021-22 to 2022-23. But, the total value of student loans fell by 3% during this time.

Heading to university this year? Check out our guide to starting university for information on finding accommodation, dealing with insurance, and advice on how to budget while away from home.

The average student loan balance on entry into repayment in England

As of 2021-22, the average student loan balance in England stood at £30,490. This figure has grown year-on-year since 2006-07 and has more than doubled since 2014-15 (+109%).

A breakdown of average student loan balance statistics for England over time

The biggest jump in average student loan balance came between 2018-19 and 2019-20. The typical amount on an English student’s loan balance rose by £3,370. This represented a rise of almost a sixth (15.5%) in just one year.

A breakdown of total student loan balance statistics for England over time

The total student loan balance in England has risen gradually since 2006-07.

As of 2022-23, English students had a collective student loan balance of almost £153.7 billion. This was almost a sixth (15.9%) higher than in 2021-21.

The average student loan balance on entry into repayment in Scotland

In 2021-22, the average student loan balance of students in Scotland was £12,940 – a 5.5% rise from the previous year.

A breakdown of average student loan balance statistics for Scotland over time

Back in 2006-07, the typical student loan balance of Scottish students was just £6,690. This figure had almost doubled (+93.4%) by 2021-22.

A breakdown of total student loan balance statistics for Scotland over time

The average student loan balance on entry into repayment in Wales

The average student loan balance for Welsh students in 2021-22 was £20,770 – a rise of 10.4% from the previous year.

A breakdown of average student loan balance statistics for Wales over time

The average loan balance of a typical Welsh student has risen year-on-year since 2006-07, when the respective figure stood at £9,340.

The average student in Wales in 2021-22 now owes more than twice as much as their counterparts in 2006-07.

A breakdown of total student loan balance statistics for Wales over time

In terms of total student loan balance, Welsh students collectively owed just over £6 billion in 2021-22 – a rise of 16.8% compared to the previous year.

Back in 2006-07, the total loan balance for students in Wales stood at £789 million, a figure 7 times greater in 2021-22.

The average student loan balance on entry into repayment in Northern Ireland

As of 2021-22, the average student loan balance for a student in Northern Ireland stood at £18,840 – an increase of 3.4% since 2020-21.

A breakdown of average student loan balance statistics for Northern Ireland over time

Much like the rest of the UK, the average student loan balance for Northern Irish students has increased year-on-year since 2006-07, when a typical student owed £8,930 on their student loan. By 2021-22, this figure had increased by 52.6%.

A breakdown of total student loan balance statistics for Northern Ireland over time

In terms of total student loan balance, students in Northern Ireland collectively owed £3.8 billion, as of 2021-22. This represented a rise of 8.3% from 2020-21.

In 2006-07, students in Northern Ireland owed £529 million in debt. The debt has grown every year since. By 2021-22, student debt in Northern Ireland has risen by over 600% in 16 years. This is the biggest increase of all 4 UK nations over this period

Highest student loan debt in the UK

As of 2023, the highest outstanding student loan debt in the UK stood at more than £230,000, according to a study by the BBC.

They also found that:

- The largest repayment made by a UK student stood at £110,112

- The highest level of accumulated interest reached £54,048.

- The largest amount of non-compliance interest (NCR) accrued reached £17,578.

Note: NCR is a rate applied to those on a Plan 2 student loan deemed “non-compliant”. It applies to students who have failed to notify the Student Loans Company (SLC) about their circumstances (i.e. a change of address or overseas residence).

Back in 2021, the Guardian reported the highest student loan debt in the UK stood at £187,000. The figure of £231,384 for 2023 represents an increase of almost a quarter (23%) in just 2 years.

A breakdown of the highest student loan debt in the UK by payment plan

When broken down by payment plan, the highest student loan debt figures vary considerably. This ranges from £231,384 for those on Plan 2 down to £20,321 for students on Plan 5.

Plan 2 loans were introduced in 2012 by the Conservative-Lib Dem coalition government. Students on Plan 2 pay 9% of their income above £27,295 towards their repayments.

What is the UK student debt total?

As of 2022-23, total UK student loan debt reached £225.9 billion – a 13% increase from 2021-22, when the figure stood at £200 billion.

A breakdown of UK student debt total by year

Data from the Student Loans Company (SLC) shows that UK student loan debt has gradually risen over time. In 2006-07, it stood at £17.7 billion, increasing to more than £100 billion just 10 years later (+465%).

In 2021-22, total UK student loan debt surpassed the £200 billion mark for the first time and has continued to rise.

Overall student loan outlay and repayment statistics

As of 2022-23, the total amount of outstanding student loans in the UK stood at almost £206.6 billion – a rise of 13% from the previous year and 341% from 10 years earlier.

The amount of student loan lending in 2022-23 reached more than £19.9 billion – a figure that has increased more than 3 times since 2012-13.

A breakdown of overall student loan outlay and repayment statistics over time in the UK (£mn)

| Financial year | Total outstanding at end of previous year | Lending during year | Repayments | Total outstanding at end of year |

|---|---|---|---|---|

|

2012-13

|

40,272

|

7,144

|

1,407

|

46,590

|

|

2013-14

|

46,590

|

9,021

|

1,461

|

54,355

|

|

2014-15

|

54,355

|

10,643

|

1,613

|

64,735

|

|

2015-16

|

64,735

|

11,765

|

1,786

|

76,253

|

|

2016-17

|

76,253

|

13,396

|

2,016

|

89,344

|

|

2017-18

|

89,344

|

14,991

|

2,339

|

104,457

|

|

2018-19

|

104,457

|

16,249

|

2,526

|

121,813

|

|

2019-20

|

121,813

|

17,384

|

4,779

|

140,093

|

|

2020-21

|

140,093

|

18,874

|

3,009

|

160,594

|

|

2021-22

|

160,594

|

19,813

|

3,394

|

181,612

|

|

2022-23

|

181,612

|

19,932

|

4,230

|

205,569

|

(Source: Student Loans Company)

Student loan repayment statistics for 2022-23 stood at more than £4.2 billion. This is just over a fifth (21.2%) of the total loaned amount. It’s about half the interest added (50.9%) — £8.3 billion — for the year.

Since 2012, the amount of UK student loan lending has increased by 180%, while total student loan repayments have doubled (+200%).

How much student debt is written off each year in the UK?

The amount of student debt written off in the UK in 2022-23 stood at £59 million. This represented a drop of 6.8% from the previous year, which stood at a peak of £63 million.

A breakdown of how much student debt is written off each year in the UK

The amount of student debt written off in the UK has fluctuated since 2012-13, reaching a low of £27 million in 2015-16.

The largest change was seen between 2019-20 and 2020-21 when the amount of student debt written off rose by almost two-fifths (38.5%) in the space of a year.

Is UK student loan debt expected to rise?

As of 2021-22, the total amount of outstanding UK student debt stood at £160.7 billion. By 2031-32, this is expected to double, reaching £321.3 billion.

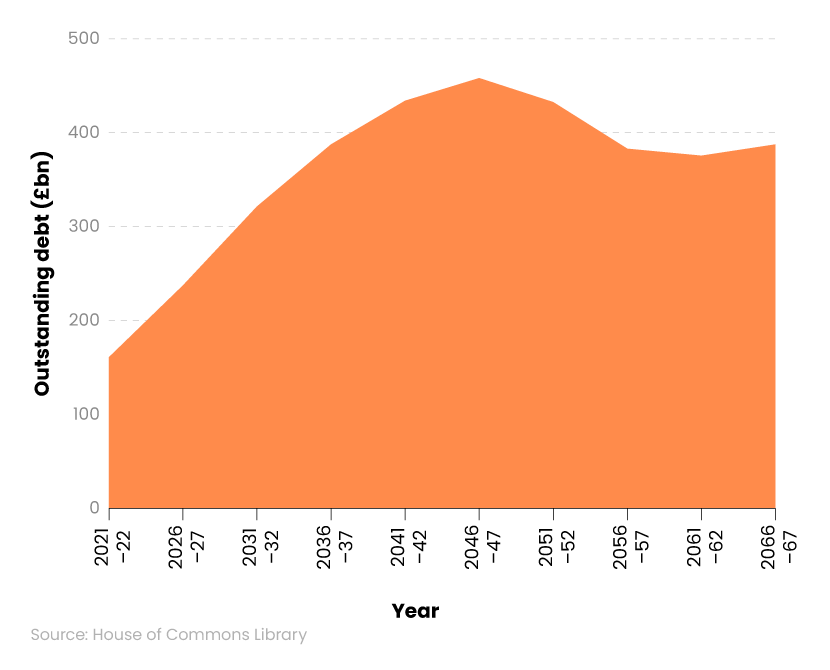

A breakdown of how UK student debt statistics are expected to increase between 2021 and 2067

Total UK student debt is expected to rise year-on-year between 2021-22 and 2046-47, where it’s forecast to reach a peak of £458 billion. After this point, long-term government predictions suggest a fall in the amount of UK student debt, to around £375.4 billion in 2061-62.

A breakdown of projected student loan outlays between 2022 and 2028

| 2022/23 (£bn) | 2023/24 (£bn) | 2024/25 (£bn) | 2025/26 (£bn) | 2026/27 (£bn) | 2027/28 (£bn) | Changes 2022/23 to 2027/28 | |

|---|---|---|---|---|---|---|---|

|

Undergraduate

|

19.2

|

20.2

|

20.7

|

21.1

|

21.9

|

22.8

|

+19%

|

|

Postgraduate

|

0.8

|

0.9

|

0.9

|

0.9

|

1

|

1

|

+31%

|

|

Advanced Learner Loans

|

0.1

|

0.1

|

0.1

|

0.1

|

0.1

|

0.1

|

0%

|

|

Total

|

20.1

|

21.2

|

21.8

|

22.2

|

23

|

24

|

+20%

|

(Source: House of Commons Library)

As of 2022-23, the projected loan outlays for UK students is around £20.1 billion. This is forecast to grow year-on-year to 2027-28, when it could reach £24 billion (+20%).

We see a similar pattern in the student loan statistics for undergraduate students. Their loan outlays are projected to rise by almost a fifth (19%) between 2022-23 and 2027-28 (£19.2 billion vs £22.8 billion).

Postgraduate students are expected to see the biggest percentage increase in student loan outlays between 2022-23 and 2027-28 (+31%), growing from £0.8 billion to £1 billion.

A breakdown of the projected number of students receiving loans between 2022 and 2028

| 2022/23 (thousands) | 2023/24 (thousands) | 2024/25 (thousands) | 2025/26 (thousands) | 2026/27 (thousands) | 2027/28 (thousands) | Changes 2022/23 to 2027/28 | |

|---|---|---|---|---|---|---|---|

|

Undergraduate

|

1,359

|

1,389

|

1,398

|

1,413

|

1,433

|

1,452

|

7%

|

|

Postgraduate

|

100

|

100

|

102

|

104

|

107

|

109

|

9%

|

|

Advanced Learner Loans

|

56

|

50

|

50

|

50

|

50

|

50

|

-11%

|

|

Total

|

1,515

|

1,539

|

1,550

|

1,567

|

1,590

|

1,611

|

6%

|

(Source: House of Commons Library)

Student finance statistics from the House of Common Library reveal the following trends:

- The number of students with a loan is expected to grow by 6% between 2022 and 2028, from just over 1.5 million to more than 1.6 million.

- In 2022-23, around 9 in 10 (89%) student loans were for undergraduates, accounting for almost 1.35 million students. By 2027-28, this figure is predicted to rise to 1.45 million (+7%).

- Postgraduate students accounted for less than 7% of student loans in 2022-23. Their numbers are expected to rise by 9% by 2028, but will still account for a similar percentage of the total for the year.

- Advanced learner loans are predicted to fall by 11% between 2022 and 2028, from 56,000 to 50,000.

Student loan interest rate statistics

Amount of interest added to student loans over time in the UK

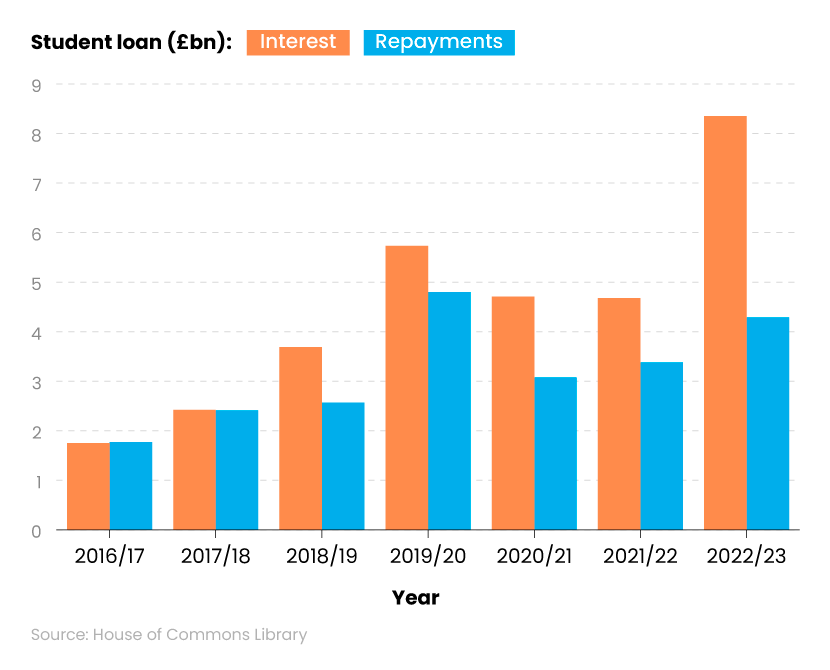

As of 2022-23, the amount of interest added to UK student loans stood at approximately £8.3 billion – a rise of more than three-quarters (+78.3%) from the previous year.

A breakdown of how much interest is added to student loans in the UK over time

Since 2012-13, the interest on UK student loans has risen each year. It has grown by more than 12 times (+1,241%) since 2012-13.

How does the student loan interest rate affect repayments?

Full-time UK undergraduate students starting in the academic year 2022-23 are predicted to borrow an average of £42,100 over their time at university. This is typically over a 3-year period.

Of these, more than a quarter (27%) are expected to repay their loan in full, rising to 61% for the 2023-24 cohort.

The UK government is anticipated to subsidise more than a quarter (28%) of student loans for the financial year 2022-23, at a cost of nearly £6.7 billion.

For the financial year 2022-23, the government issued almost £20.1 billion in student loans. This was made up of:

- 94% plan 2, full-time higher education loans

- 4% Master’s loans

- 2% plan 2, part-time higher education loans

- 1% advanced learner loans

A breakdown of how student loan interest rates affect student loan repayments

Statistics on student finance show:

- The amount of interest paid on student loans stood at £8.35 billion, as of 2022-23. This is a 78% increase compared to figures from 2021-22.

- Between 2016 and 2019, the interest paid on UK student loans more than tripled, from £1.75 billion to £5.73 billion. This figure dropped slightly during the pandemic years to around £4.7 billion, before rising again in 2022-23.

During the same period, student loan repayment statistics followed a similar pattern of growth and decline, but with less extremes. Student loan repayments in 2016-17 stood at £1.77 billion, and more than doubled by 2019-20, reaching a peak of £4.8 billion. This figure dropped to around £3 billion between 2020-22, before rising again to nearly £4.3 billion as of 2023.

A breakdown of how the average graduate pays back their tuition fees

| Year | Salary (£) | Student debt (£) | Interest rate | Paid (£) | Interest this year (£) | Total paid (£) | Total interest (£) |

|---|---|---|---|---|---|---|---|

|

2023

|

25,000.00

|

44,940.00

|

7.80%

|

0

|

3,505.32

|

0

|

0

|

|

2024

|

26,500.00

|

48,445.32

|

7.80%

|

135

|

3,778.73

|

135

|

7,284.05

|

|

2025

|

28,090.00

|

52,089.05

|

7.80%

|

278.1

|

4,062.95

|

413.1

|

11,347.00

|

|

2026

|

29,775.40

|

55,873.90

|

7.80%

|

429.79

|

4,358.16

|

842.89

|

15,705.17

|

|

2027

|

31,561.92

|

59,802.28

|

7.80%

|

590.57

|

4,664.58

|

1,433.46

|

20,369.74

|

|

2028

|

33,455.64

|

63,876.28

|

7.80%

|

761.01

|

4,982.35

|

2,194.47

|

25,352.09

|

|

2029

|

35,462.98

|

68,097.63

|

7.80%

|

941.67

|

5,311.61

|

3,136.13

|

30,663.71

|

|

2030

|

37,590.76

|

72,467.57

|

7.80%

|

1,133.17

|

5,652.47

|

4,269.30

|

36,316.18

|

|

2031

|

39,846.20

|

76,986.88

|

7.80%

|

1,336.16

|

6,004.98

|

5,605.46

|

42,321.16

|

|

2032

|

42,236.97

|

81,655.69

|

7.80%

|

1,551.33

|

6,369.14

|

7,156.79

|

48,690.30

|

|

2033

|

44,771.19

|

86,473.51

|

7.80%

|

1,779.41

|

6,744.93

|

8,936.20

|

55,435.23

|

|

2034

|

47,457.46

|

1,439.04

|

7.80%

|

2,021.17

|

7,132.24

|

10,957.37

|

62,567.48

|

|

2035

|

50,304.91

|

96,550.11

|

7.80%

|

2,277.44

|

7,530.91

|

13,234.81

|

70,098.39

|

|

2036

|

53,323.21

|

101,803.58

|

7.80%

|

2,549.09

|

7,940.68

|

15,783.90

|

78,039.07

|

|

2037

|

56,522.60

|

107,195.17

|

7.80%

|

2,837.03

|

8,361.22

|

18,620.93

|

86,400.29

|

|

2038

|

59,913.95

|

112,719.36

|

7.80%

|

3,142.26

|

8,792.11

|

21,763.19

|

95,192.40

|

|

2039

|

63,508.79

|

118,369.21

|

7.80%

|

3,465.79

|

9,232.80

|

25,228.98

|

104,425.20

|

|

2040

|

67,319.32

|

124,136.22

|

7.80%

|

3,808.74

|

9,682.63

|

29,037.72

|

114,107.82

|

|

2041

|

71,358.48

|

130,010.10

|

7.80%

|

4,172.26

|

10,140.79

|

33,209.98

|

124,248.61

|

|

2042

|

75,639.99

|

135,978.63

|

7.80%

|

4,557.60

|

10,606.33

|

37,767.58

|

134,854.94

|

|

2043

|

80,178.39

|

142,027.36

|

7.80%

|

4,966.05

|

11,078.13

|

42,733.64

|

145,933.08

|

(Source: Confused.com via Gov.uk)

Assuming a salary growth rate of 6% a year and an interest rate of 7.8% (based on government figures at the time of writing), this means a typical student could earn £26,500 by the end of 2024. This could equate to £135 being paid off their total student debt, with a further £3,778 of accumulated interest.

As time goes on, and assuming the salary growth rate and interest rates remain the same*, the average UK student may be earning over £80,000 by 2043. By this stage, they should have paid off around £42,733 of their student debt, yet could have accumulated almost £146,000 in interest on their original loan.

Under current government plans, those on Plan 5 will have their student debt wiped after 40 years if they haven’t repaid it within that time.

*These calculations do assume that the salary growth rate and interest rate will remain constant over time. In reality, this is unlikely to happen as both will likely change over time with successive governments and changes to the RPI/rates of inflation. This could have a knock-on effect on student loan repayments, the amount of accumulated interest, and the extent to which a student’s loan is repaid. For a full methodology of how the data was calculated, please consult the sources and methodology at the end of this page.

When are the student maintenance loan dates?

UK student finance dates differ between universities. Students in England, Wales, and Northern Ireland get their first maintenance loan when their course starts. This is usually paid in September or October.

The next instalments are usually in January 2025 and April 2025, to coincide with the start of each term.

Students in Scotland can expect to receive their student finances on regular monthly dates, usually the 7th of each month.

Tuition fees are also split into 3 instalments. Normally, 25% is paid at the start of your first term, 25% at the start of your second term, and the remaining 50% at the start of the final term. But this is paid directly to your university from your student loan. This means any money you get from your student loan can be added to your living expenses at university.

Heading to university this year? Check out our ultimate student moving checklist before you go to make sure you have everything you need in place for the big day.

Student finance FAQs

When did student loans start in the UK?

Student loans in the UK were first introduced in 1990/91 as part of a government student support package.

How many years of student finance can you get in the UK?

Usually, student finance is only available for your first higher education course. You can have a maximum of 16 years of part-time funding. Anything over this is likely to be self-funded.

How long does it take for student finance to be approved in the UK?

It can take up to 6 weeks for a student finance application to be approved. Although, the average application processing time in the UK tends to be around 3 weeks. This depends on the volume of applications at the time of sending, and whether all of your evidence is correct and in order.

When is the deadline for student finance in the UK?

The deadline for student finance in the UK is 17 May 2024 for new students and 21 June 2024 for continuing students. This will ensure students have their funding in place for the start of their course(s) in September 2024.

Does student finance count as income?

No. Generally speaking, student finance doesn’t count as income. If you get regular payments of a grant, it won’t reduce your means-tested benefits. But, if you receive a one-off payment, such as a grant, it may be counted as capital, not income. This could impact your means-tested benefits.

How many student loans can you take out?

You can usually only receive a student loan for your first university course. If you’ve already studied a higher education course, you may not receive student financial support for your subsequent applications. Students can get a maximum of 16 years of funding for part-time study. After this point, you’ll likely have to self-fund any further university study.

What percentage of student loans are repaid?

The UK government expects that just over a quarter (27%) of full-time undergraduates starting in the 2022-23 academic year will repay their student loans in full. The prediction is this will rise to 61% for those starting their studies in 2023-24.

What’s the average student loan debt in the UK?

As of 2021-22, the average UK student loan debt stood at £29,545. This figure was highest in England (£45,150) and lowest in Scotland (£14,840).

What is the average time to pay off student loans in the UK?

The average time to pay off student loans in the UK varies depending on many factors, such as your post-graduate salary, how much has been borrowed, when you studied, and which payment plan you’re on.

In 2023, the average UK graduate earned almost £26,500 when they left university and accumulated an average student debt of just over £45,000. Assuming an average salary rise, no overpayments, and an interest rate between 3-4%, their student loan would still not be repaid after 30 years and would therefore be written off.

When does student debt get written off in the UK?

When your student debt gets written off depends on which repayment plan you’re on. For example, students on Plan 1 will have debts written off 25 years after the April they were first due to repay (providing this was on or after 1 September 2006). If this was after 1 September 2006, your student loan will be written off when you turn 65 years old.

How is student loan interest calculated?

Student loan interest is charged from the day you get your first student loan payment, up until your loan has been repaid in full or written off. Interest is added to your existing balance each month, and is charged at either the Retail Price Index (RPI) or BoE base rate plus 1% (whichever is lower). As of 21 July 2023, the current student loan interest rate for Plan 1 student loans stood at 6%.

Why is university so expensive?

According to recent student cost of living statistics, the cost of university is more expensive in 2023 compared to previous years largely thanks to the rise in tuition fees, from £1,000 a year in 1998 to £9,250 a year. This is driven by increased running costs (i.e. wages, energy bills, cost of materials, upgrades, etc.). Rather than absorb these additional costs, universities have passed them on to the students. Secondly, the UK's cost of living is higher in 2023 compared to previous years. This has had a knock-on effect on all aspects of student living, including food, accommodation, transport, and social activity costs.

Student finance glossary

Household income threshold

The amount you need to be earning in order to qualify for a maintenance loan. There’s a maximum and minimum threshold depending on which part of the UK you’ll be studying, and whether you’ll be living at home while at university.

Maintenance grant

Additional money given to students by the government that helps pay towards living costs. You can apply for a maintenance grant at the same time as a student loan through your student finance application. But, unlike a maintenance loan, you don’t need to pay this money back.

Maintenance loan

A student loan provided by the government that helps pay towards living expenses while at university. This is usually used for rent, bills, food, and nights out. You apply for the maintenance loan through the same process as the tuition fee loan. Once you start making repayments, this will be a joint sum of the two loans.

Student bursary

Money offered to a student based on their academic abilities, household income, or a mixture of both. Sometimes called a scholarship, this can help pay towards various university expenses, such as tuition fees, learning resources, and transport costs. Funding can last anywhere between 1 year and the full length of the course, and doesn’t have to be repaid (unless you leave the course early).

Tuition fee loan

Money that you apply for to help cover your tuition fees. This is paid directly to the course provider, and repayments begin after you finish the course and start earning over a given salary threshold.

Sources and methodology

https://commonslibrary.parliament.uk/research-briefings/cbp-7857/

https://researchbriefings.files.parliament.uk/documents/CBP-7857/CBP-7857.pdf

https://www.statista.com/statistics/298902/higher-education-spending-uk/

https://researchbriefings.files.parliament.uk/documents/SN01079/SN01079.pdf

https://www.savethestudent.org/student-finance/maintenance-loans.html

https://wordsrated.com/student-loan-debt-in-the-united-kingdom/

https://www.natwest.com/life-moments/students-and-graduates/student-living-index.html

https://www.gov.uk/repaying-your-student-loan

https://www.gov.uk/apply-for-student-finance

https://www.gov.uk/guidance/how-interest-is-calculated-plan-1

https://www.bbc.co.uk/news/uk-68534953

https://www.studentbeans.com/blog/uk/student-finance-maintenance-loan-payment-dates-2022

https://www.practitioners.slc.co.uk/media/1248/sfe_part_time_loans_guide_1718_d.pdf

https://www.student-loan-calculator.co.uk/

Average student debt and repayment calculations

Even though the average student's starting salary is probably somewhere between £18k and £23k, salary data starts at £25,000 as this is the current threshold for paying back your student loan.

Projected student loan repayment figures assume an interest rate of 7.8% (as this is the capped rate introduced by the government at the time of writing).

A salary growth rate of 6% was used (based on the most recent government figures available at the time of writing).

Projections are used for those students on Plan 5 (as this will be the most relevant and up-to-date for students starting university in 2023-24).