They might be little, but their vet bills can quickly get big. But help is at hand. Small mammal insurance can help cover the cost of vet bills.

So don't bury your head in the sawdust when it comes to finding small mammal insurance. Getting the right policy can make sure your tiny companions are covered - So you can go back to hearing the pitter-patter of tiny claws.

What counts as a small pet or small mammal?

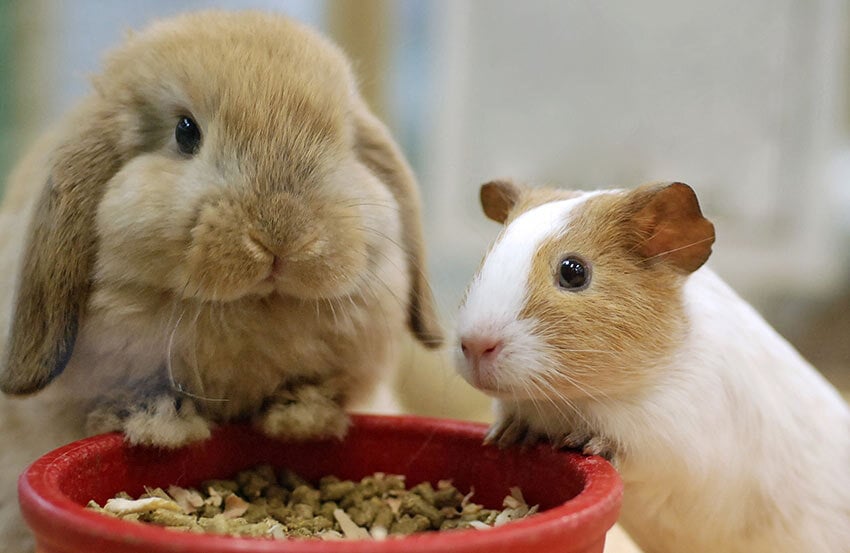

A small pet or mammal could be the following:

-

Guinea pigs

-

Hamsters

-

Rats

-

Ferrets

-

Chinchillas

-

Gerbils

-

Mice

-

Pygmy hedgehogs

Rabbits sometimes come under this category too, but often you're better off finding specific rabbit insurance.

Some insurers might class small animals as exotic pets, so it's always important to read the fine print when getting a pet insurance.

Insurers often group cats and dogs separately from other animals because they're the most common household pets. They also have different needs and risks associated, which allows insurers to tailor policies and pricing.

Why it's important to insure small pets

Though your furry friend may be small, their vet bills can quickly get big.

Even a mouse can prove very costly if you need to take it to the vet. Routine consultations for small animals can easily reach upwards of £60. So before you get your whiskers in a twist - it might be worth comparing insurance policies.

Small mammals can be particularly fragile, and are particularly susceptible to unexpected illnesses or accidents. Small mammal insurance can step in here, and cover your tiny companions financially if they need treatment.

Guinea pig insurance: what does it cover and what to expect

Guinea pigs are known for their gentle and social nature, making them great companions. Especially for families with children.

These little furballs can live up to around 6 years old if they're properly cared for. Sadly, they're also known to be at risk of a number of health problems. Here are some of the most common to look out for:

-

Respiratory infections

-

Scurvy

-

Tumours

-

Urinary problems

-

Abscesses due to infection

-

Parasite or fungal infections

Sniffles, sneezes, or surprise squeaks - getting insurance can help cover the cost of vet treatment if your guinea pig needs it.

The cost of insuring your guinea pig can depend on what type of policy you choose. If you want your guinea pig covered throughout their life, choosing a comprehensive lifetime pet insurance policy is the most thorough.

Buying an accident-only policy is a cheaper option, but won't cover your guinea pig if they get ill.

Hamster insurance: is it worth it in the UK?

It can be harder to find small mammal insurance for hamsters, but they're still in need of protection. Because even the fastest wheel-spinner needs a safety net.

These tiny mammals are delicate due to their size, so need to be handled with care. Some of the most common hamster health problems include:

-

Hair loss

-

Skin diseases

-

Abscesses

-

Diarrhoea

-

Respiratory infections

Vet fees for hamsters can vary, but expect to pay around £40-£60 for a consultation. Emergency appointments and specialised care can be even more expensive.

Rat insurance: finding the right cover

Despite their bad rep, rats are highly intelligent, clean, and social animals. They can be highly affectionate, and often enjoy being petted or handled.

Like any other small mammal, rats are prone to a number of health issues. Here are a few to watch out for:

-

Respiratory infection

-

Tumours

-

Skin problems

-

Parasites

Buying an insurance policy is a good idea due to the potential for unexpected vet costs.

Rat insurance can be expensive, especially if you have multiple rats or if you opt for comprehensive coverage.

It's also worth knowing that most insurers will not cover pre-existing conditions. So if your rat already has a health issue, the insurance may not cover related treatment.

Ferret insurance: why ferrets may need specialist cover

Ferrets can make entertaining and engaging pets. They're playful and curious, as well as fairly easy to train. But vet bills can sneak up like a ferret at play - so it's worth considering getting them insured.

Whether they’re tunnelling into trouble or just feeling off, buying insurance for your ferret might be a good option. Especially as they can live for around 5-10 years, making them a longer-term commitment.

Here are some of the most common health issues that affect ferrets:

-

Heart disease

-

Parasitic infections

-

Lymphoma

-

Urinary problems

-

Respiratory infections

Remember: Your small animal's pre-existing medical conditions usually won't be covered by your insurer. These are any conditions that developed before your pet insurance policy started. You have to pay to treat these conditions.

Comparing small animal insurance providers

When looking for the right policy, shopping around is always a good idea.

Dogs and cats lead the pack when it comes to pet insurance, and some UK insurers might not cover other animals. So finding a policy for your small mammal might take a bit more digging.

But don't fret. There's plenty of specialised pet insurance providers out there for your pint-sized pals.

Is small pet insurance right for you?

Whether small pet insurance is right for you is a personal choice. You'll need to take into account your own budget, as well as your furry friend's needs.

It's always worth weighing up the cost vs the benefits. Small mammal insurance can be pricey, but so is veterinary care. So it's up to you to decide if buying a policy is worth it.

There are other options if you're not sold on the idea of buying an insurance policy. You could set up a dedicated savings pot for your pet's future needs. This could safeguard against potential vet bills or unexpected costs during your time with your pet.

As a nation of pet lovers, we understand how valuable it is to know our furry friends are covered if anything were to happen. The best thing to do if you're unsure is to compare prices.