This page includes relevant UK contents insurance statistics for 2023, such as:

- The evolution of the UK contents insurance market

- The impact on average UK contents insurance costs

- Contents insurance claims statistics outlining the most common claims made by customers

As of 2023, the average UK home contains almost £52,000 worth of contents. This means it’s important to work out exactly how much contents insurance cover you need in order to fully protect your personal possessions.

Our contents insurance report collates over 100 recent UK contents insurance statistics, alongside our own data, to analyse patterns and show how the market is changing. We can use this to compare contents insurance stats over time and suggest what the future might hold for UK customers.

Top 10 UK contents insurance statistics 2023

- The average cost of contents insurance in the UK for Confused.com customers is £62 a year.

- Nationally, the cost of contents insurance rose 27% between 2015 and 2022 (and nearly +32% between January and March 2023 compared to the same period in 2015).

- Choosing a £250 excess on your contents insurance policy could save you up to 11% a year compared to having £0 excess.

- Around 1 in 5 (22%) private renters don’t have contents insurance.

- Accidental damage is the most commonly cited reason for buying contents insurance (22%).

- Almost 4 in 5 (79%) of contents insurance claims made in 2021 were successful.

- The average UK contents insurance payout in 2021 was almost £1,400. For Confused.com customers in 2022, this was £3,260.

- In 2021, there were more than 4.28 million UK contents insurance policies in existence, worth almost £284 million.

- More than a quarter (27.58%) of premiums in 2021 resulted in a payout, at a cost of £78.3 million to the industry.

- The most commonly insured items for Confused.com customers are laptops and jewellery, representing 47% and 40% of respective contents insurance quotes during 2020-23.

Types of UK contents insurance

In the UK, there are 2 types of contents insurance:

- New-for-old insurance tends to cost more, but a payout should be enough to buy a brand new table.

- Indemnity insurance accounts for wear and tear of your belongings. For example, if a leak ruins your 3-year-old table, then a successful claim would likely pay out for you to buy another 3-year-old table.

Remember, contents insurance is different to buildings insurance. Buildings insurance covers the cost of repairing and rebuilding the structure of your home - the roof, ceilings, walls, and floor- , but not the contents of your home.

There are also 3 main types of contents insurance policy available:

- Bedroom-rated - the insurer works out the amount of cover you need based on the number of bedrooms in your home. Typically, this provides between £40,000 and £50,000 worth of cover as standard, and is normally enough for the typical home. You should make sure this is enough to cover your personal possessions before agreeing to this type of policy though.

- Sum insured - You‘re responsible for calculating contents insurance and how much cover you need. The insurer doesn’t work this out for you. You can use an online contents calculator to work this out or you can do it yourself.

- Unlimited sum insured - This covers your contents without a limit so there’s no fear of being under-insured.

UK contents insurance cost statistics

What is the average cost of contents insurance?

According to our data between December 2022 and May 2023, the average cost of UK contents insurance is £62 (or the equivalent of £1.19 per week). This is almost half the average amount reported by the ABI in February 2023 (£116).

We compare up to 64 home insurance providers across the UK to help you find our cheapest quote. You can claim a free reward when you buy contents insurance through Confused.com too.

Consumer Price Index (CPI) statistics for house contents insurance

The Consumer Price Index (CPI) is used by the UK Government to judge the rate of inflation and track the cost of various items. As of 2022, the CPI for house contents insurance stood at 127.1, meaning that costs in this year were 27% more expensive than in 2015.

A breakdown of the annual Consumer Price Index (CPI) for house contents insurance between 2012 and 2022

Between 2015-22, there was a steady rise in the average cost of home insurance relative to 2015 figures, reaching a CPI of 108.3 in 2020.

During 2020-21, UK homeowners saw an average drop of 4.6% in their premiums, largely thanks to a reduced number of break-ins and cases of water damage during the Covid-19 lockdowns.

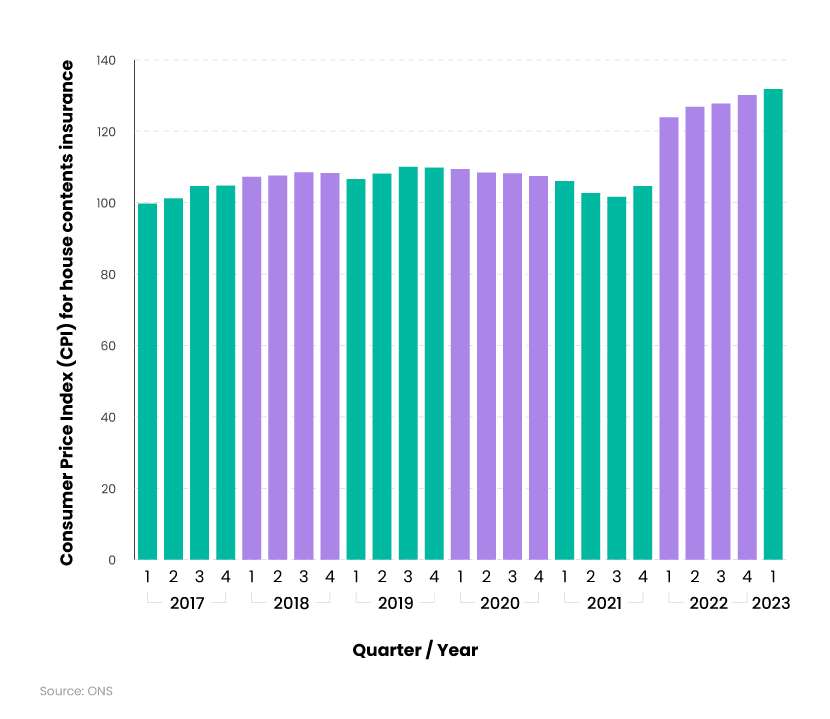

A breakdown of the quarterly Consumer Price Index (CPI) statistics for house contents insurance between 2017 and 2023

Between 2017-23, there were significant fluctuations in the Consumer Price Index (CPI) for UK contents insurance. In Q2 2017, the CPI shifted from 101.2 - where prices were 1.2% more compared to 2015 - to 110 in Q3 2019. Here, average costs were 10% more than the 2015 average.

Since Q1 2022, the CPI for UK contents insurance has increased dramatically. At the start of the year the figure increased from 123.9 to 130.1 by Q4 2022, representing a rise of over 30% compared to 2015.

As of Q1 2023, the CPI for contents insurance stood at 131.8. This means consumers in this quarter were paying nearly a third (32%) more in 2023 than those in 2015.

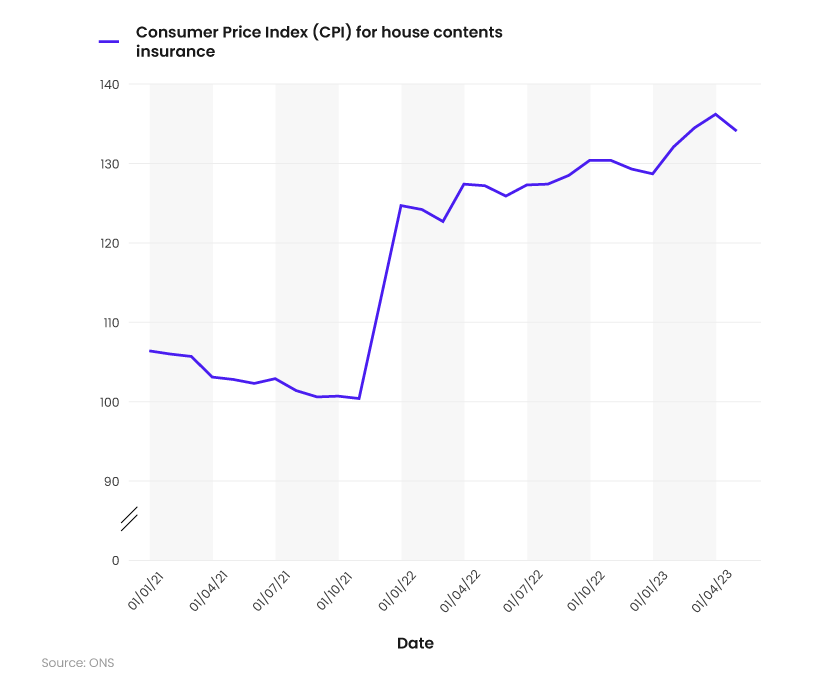

A breakdown of the monthly Consumer Price Index (CPI) statistics for house contents insurance between 2021 and 2023

Throughout 2021, the CPI for UK contents insurance steadily decreased, from 106.4 in January to a low of 100.4 in November. Since then, the CPI for UK contents insurance has dramatically increased, reaching a peak of 136.2 as of April 2023.

In May 2023, this dropped to 134.1. This meant the average UK contents insurance costs were more than a third (34.1%) higher compared to May 2015.

What factors can affect the cost of UK contents insurance?

The cost of your contents insurance can be affected by:

- The value of your possessions.For example, you would need to name any high-value items over £1,000 on your main policy.

-

Where you live. - The type of home you live in.

- Your home’s security.

- Whether you rent or own your home.

- Who you live with.

- The risk of crime in the local area.

- Whether your home is in a flood risk area.

- Whether you work from home.

According to the ONS, almost 1 in 6 (16%) British workers worked from home between September 2022 and January 2023, with more than a quarter (28%) splitting their time between home and office.

Numerous factors can affect whether you’re covered to work from home by your contents insurance policy. These include:

- The type of work you do

- Who your employer is

- What equipment you’ll be using

For the majority of office/hybrid work, this should have little to no impact on your contents insurance. But, it’s worth checking with your employer and insurer to see what is and isn’t covered. For example, damage, loss, or theft of contents may not be covered under certain packages.

Are you living in a shared property with other people? If so, then you may want to look into shared house contents insurance to ensure your possessions are adequately covered against loss, theft, or damage.

Contents insurance statistics across the UK

Contents insurance is just one of the many different types of home insurance policies available across the UK.

According to our home insurance statistics, an estimated 7 million UK households are without home insurance. This means around a quarter of UK homes could be vulnerable should they fall victim to damage, destruction, or theft.

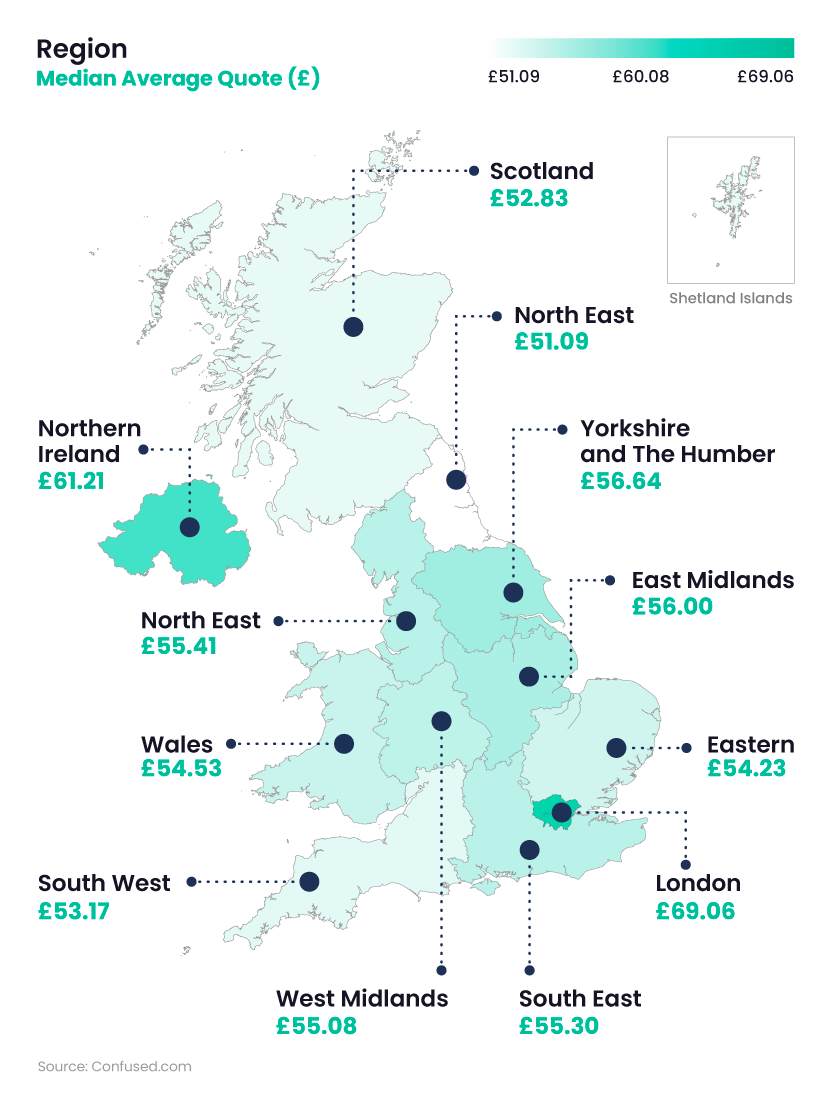

A breakdown of UK average contents insurance costs by region

| Region | % of total number of quote requests | Median average quote |

|---|---|---|

|

London

|

16.12%

|

£69.06

|

|

South East

|

15.46%

|

£55.30

|

|

Eastern

|

10.14%

|

£54.23

|

|

North West

|

9.60%

|

£55.41

|

|

South West

|

9.43%

|

£53.17

|

|

Scotland

|

8.08%

|

£52.83

|

|

West Midlands

|

7.86%

|

£55.08

|

|

Yorkshire and The Humber

|

7.85%

|

£56.64

|

|

East Midlands

|

6.58%

|

£56.00

|

|

Wales

|

3.93%

|

£54.53

|

|

North East

|

3.71%

|

£51.09

|

|

Northern Ireland

|

1.19%

|

£61.21

|

(Source: Confused.com)

When it comes to average cost, contents insurance coverage across the UK isn’t evenly distributed. For example:

- Residents in the North East of England tend to pay the least for their contents insurance, with an average cost of £51.09 per quote

- This is followed by households in Scotland and the South West of England, where the average cost of home insurance is between £52 and £53

On average, the most expensive regions in the UK for contents insurance between 2020-23 tend to be in London (£69.06). Then it’s Northern Ireland (£61.21).

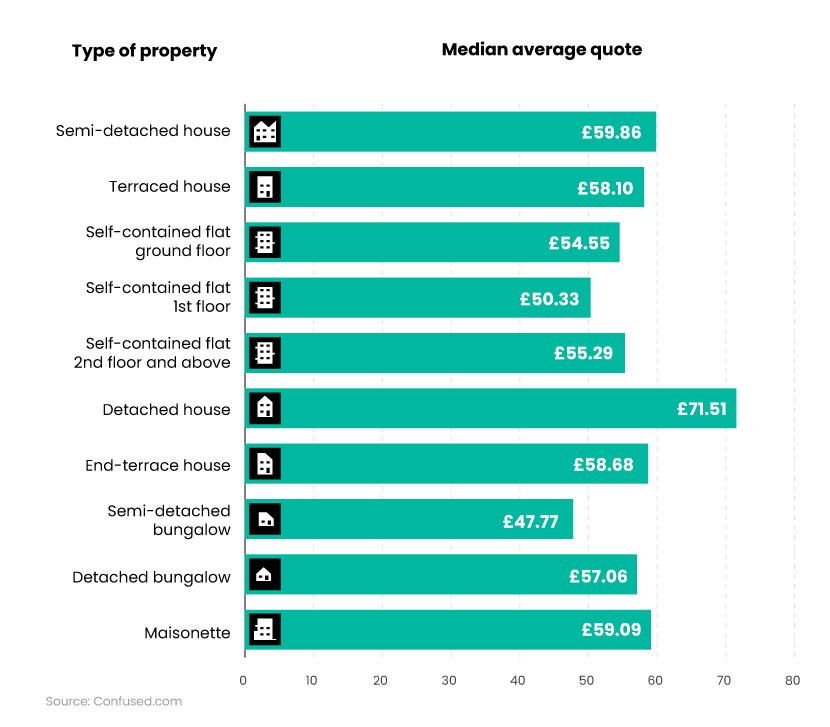

Average UK contents insurance costs by property type

If you rent a flat, the only type of flat insurance you need is contents. Your landlord should have buildings insurance in place to cover the cost of building repairs. That includes permanent fixtures too.

Between December 2022 and May 2023, the average price of contents insurance for someone living in a flat was £55 for the year. But the price you end up paying can vary depending on the type of flat you live in.

A breakdown of the average contents insurance costs in the UK by type of property

| Type of property | % of total number of quote requests | Median average quote |

|---|---|---|

|

Semi-detached house

|

19.09%

|

£59.86

|

|

Terraced house

|

16.60%

|

£58.10

|

|

Self-contained flat ground floor

|

15.23%

|

£54.55

|

|

Self-contained flat 1st floor

|

15.05%

|

£50.33

|

|

Self-contained flat 2nd floor and above

|

12.25%

|

£55.29

|

|

Detached house

|

7.83%

|

£71.51

|

|

End-terrace house

|

3.81%

|

£58.68

|

|

Semi-detached bungalow

|

2.60%

|

£47.77

|

|

Detached bungalow

|

2.41%

|

£57.06

|

|

Maisonette

|

1.64%

|

£59.09

|

(Source:Confused.com)

Based on quotes between June 2020 and June 2023, the average cost of contents insurance was cheapest for semi-detached bungalows (£47.77), followed by:

- Self-contained flats on the 1st floor (£50.33)

- Ground floor (£54.55)

- Second floor and above (£55.29)

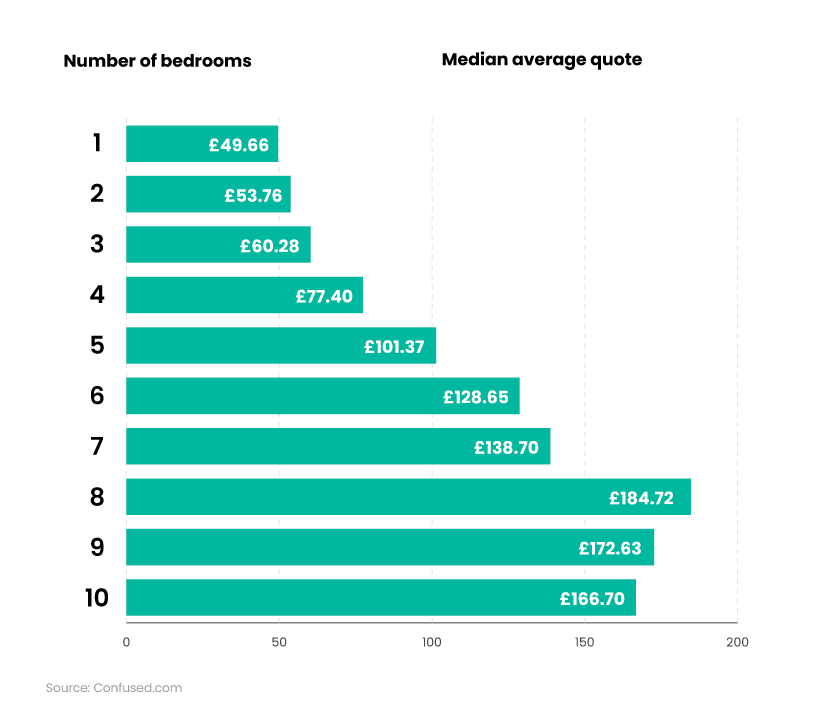

Average cost of contents insurance by number of bedrooms

The average cost of contents insurance tends to decrease along with the number of bedrooms in a property. For example, the price of contents insurance for a single bedroom property was £49.66 on average between June 2020 and June 2023. This is more than 3 times cheaper than the average price of contents insurance for a typical 10 bedroom property in the UK (£166.70).

A breakdown of average UK contents insurance costs by number of bedrooms

| Number of bedrooms | % of total number of quote requests | Median average quote |

|---|---|---|

|

1

|

18.91%

|

£49.66

|

|

2

|

39.93%

|

£53.76

|

|

3

|

30.87%

|

£60.28

|

|

4

|

7.58%

|

£77.40

|

|

5

|

2.00%

|

£101.37

|

|

6

|

0.46%

|

£128.65

|

|

7

|

0.13%

|

£138.70

|

|

8

|

0.07%

|

£184.72

|

|

9

|

0.02%

|

£172.63

|

|

10

|

0.02%

|

£166.70

|

(Source: Confused.com)

In terms of the number of bedrooms, 2 and 3 bedroom properties generated the most quotes between 2020-23. These accounted for around 7 in 10 (70.8%) quotes during this period.

The average contents insurance cost for 2 bed houses was around £53.76. This was almost £7 a year cheaper than the average contents insurance cost for 3 bed houses in the UK.

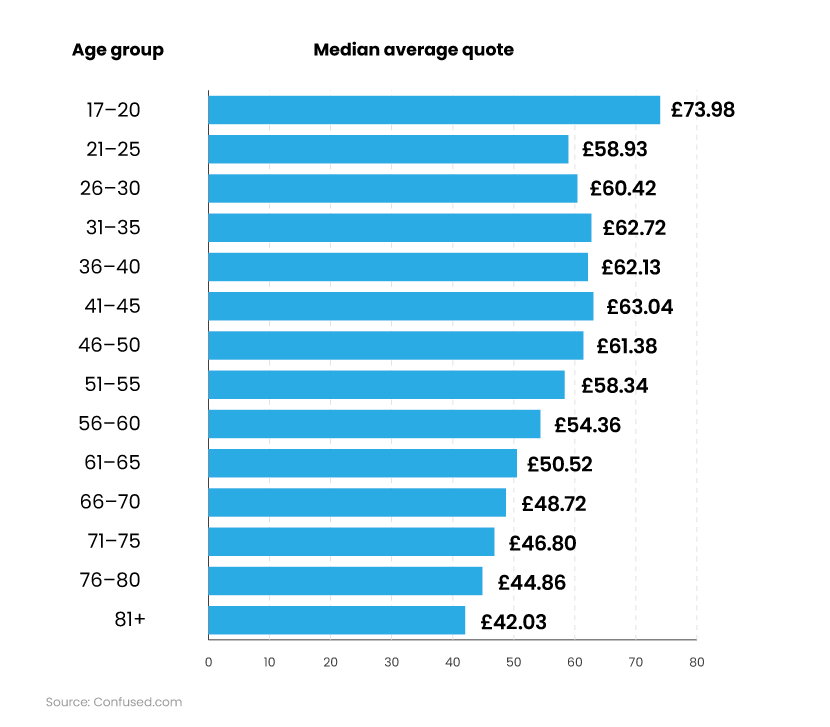

Average UK contents insurance costs by age group

Generally speaking, the average cost of contents insurance decreases as you get older. Between 2020-23, those aged 81 and over were quoted at £41.02 a year to insure their belongings. This was around a third (32.1%) less compared to those aged 26-30 (£60.42).

However, from the age of 21, average contents insurance costs tend to increase slightly year-on-year. For example, it increases from £58.93 to £63.04 for those aged between 41-45 years old.

A breakdown of average UK contents insurance costs by age

| Age group | % of total number of quote requests | Median average quote |

|---|---|---|

|

17-20

|

1.86%

|

£73.98

|

|

21-25

|

7.03%

|

£58.93

|

|

26-30

|

11.94%

|

£60.42

|

|

31-35

|

14.10%

|

£62.72

|

|

36-40

|

13.80%

|

£62.13

|

|

41-45

|

11.80%

|

£63.04

|

|

46-50

|

10.94%

|

£61.38

|

|

51-55

|

10.39%

|

£58.34

|

|

56-60

|

8.79%

|

£54.36

|

|

61-65

|

6.95%

|

£50.52

|

|

66-70

|

5.46%

|

£48.72

|

|

71-75

|

4.76%

|

£46.80

|

|

76-80

|

3.06%

|

£44.86

|

|

81+

|

3.36%

|

£42.03

|

(Source: Confused.com)

In 2022, students got their students contents insurance for £59.15 with Confused.com. But this price depends on different factors like:

- Where you live

- The value of your items

- Local crime rates

UK student contents insurance statistics

In a 2021 YouGov poll, almost a third (31%) of UK full-time students aged 18-24 claimed they didn’t understand what contents insurance covers.

A typical student could easily have more than £3,000 worth of possessions when they head off to university. Therefore,buying adequate cover helps them to ensure protection against damage, theft, and destruction.

Students are a target group when it comes to criminals. According to Save The Student, around 1 in 20 (6%) students have been burgled or experienced a break-in while at university.

The ONS reported that 16.6% of all personal crime is reported by students. So not having contents insurance as a student could end up costing you more in the long run if you’re not suitably protected.

Some university halls may provide a basic level of student contents insurance. But, this may only include a limited range of items, and usually, they must be in your room at the time of a break-in, with windows and doors fully secured. Ensure you fully read and understand the terms and conditions of your policy before committing to it.

Average UK contents insurance costs by payment method

Paying for your contents insurance annually could help reduce the cost of your home insurance, with savings of up to 20%.

A breakdown of average UK contents insurance costs between annual and monthly payments.

| Payment method | % of total number of quote requests | Median average quote |

|---|---|---|

|

Annual

|

61.66%

|

£53.63

|

|

Monthly

|

38.33%

|

£61.08

|

(Source: Confused.com)

As of 2023, the average price of contents insurance for Confused.com customers was £53.63, and made up nearly 62% of all quotes.

By comparison, the cost of contents insurance per month averaged at £61.08 – around 12% more than those who chose to pay annually.

Get a contents insurance quote today to see how much you could save on your policy.

Average UK contents insurance costs by amount of excess

Another factor to consider is how much voluntary excess to pay. Based on Confused.com data between January and June 2023, a £250 voluntary excess could reduce your contents insurance costs by as much as 11%. This is compared to a similar policy with no excess.

But you need to pay this amount against any claim made on your home insurance.

A breakdown of UK average contents insurance costs by excess amount

| Amount of excess | % of total number of quote requests | Median average quote |

|---|---|---|

|

0

|

35.11%

|

£63.24

|

|

150

|

29.70%

|

£55.18

|

|

250

|

33.46%

|

£50.79

|

|

400

|

1.73%

|

£57.49

|

(Source: Confused.com)

Generally speaking, the more excess you select on your contents insurance the cheaper it should be. That’s according to our quote data between 2020-23. For example, the average cost of a policy with £250 excess was £13 a year less compared to one with no excess (£63.24 vs £50.79).

But this figure increased for those who had a policy with £400 of excess to £57.49 a year on average.

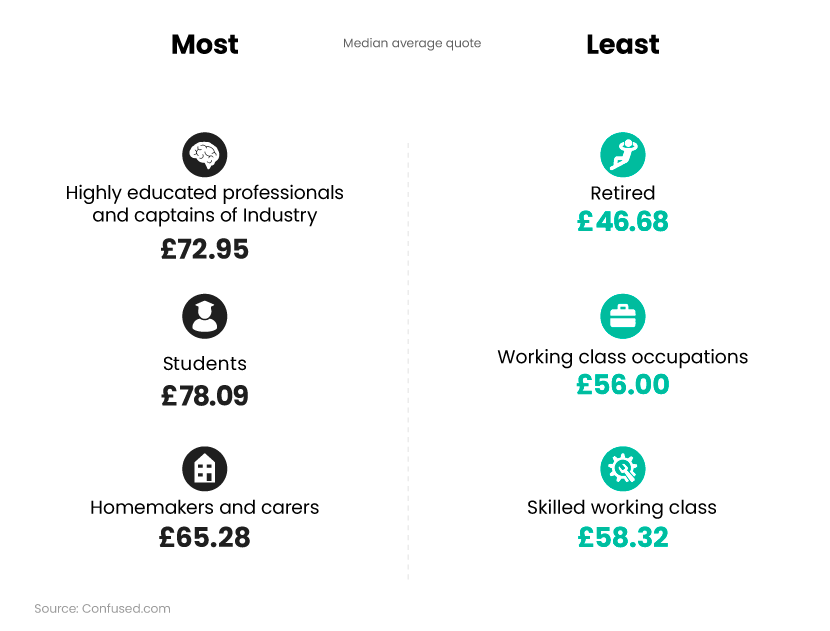

Average cost of contents insurance by occupational class

Contents insurance tends to be cheapest for those who are retired. If you’re retired, you can expect to pay around £46.68 for a typical contents insurance policy. Retirees accounted for nearly 18% of our quotes in 2020-2023.

A breakdown of average contents insurance cost by employment status

| Occupational class | % of total number of quote requests | Median average quote |

|---|---|---|

|

White collar workers

|

36.23%

|

£60.00

|

|

Retired

|

17.65%

|

£46.68

|

|

Skilled working class

|

14.38%

|

£58.32

|

|

Middle class occupations

|

13.47%

|

£59.83

|

|

Working class occupations

|

11.96%

|

£56.00

|

|

Unemployed

|

7.57%

|

£59.48

|

|

Highly educated professionals and captains of Industry

|

5.98%

|

£72.95

|

|

Homemakers and carers

|

5.58%

|

£65.28

|

|

Students

|

2.78%

|

£78.09

|

(Source: Confused.com)

At the other end of the scale, students faced some of the most expensive contents insurance quotes between 2020-23, averaging at £78.09. But this was the smallest represented group in our study, representing less than 3% of all quotes during this period.

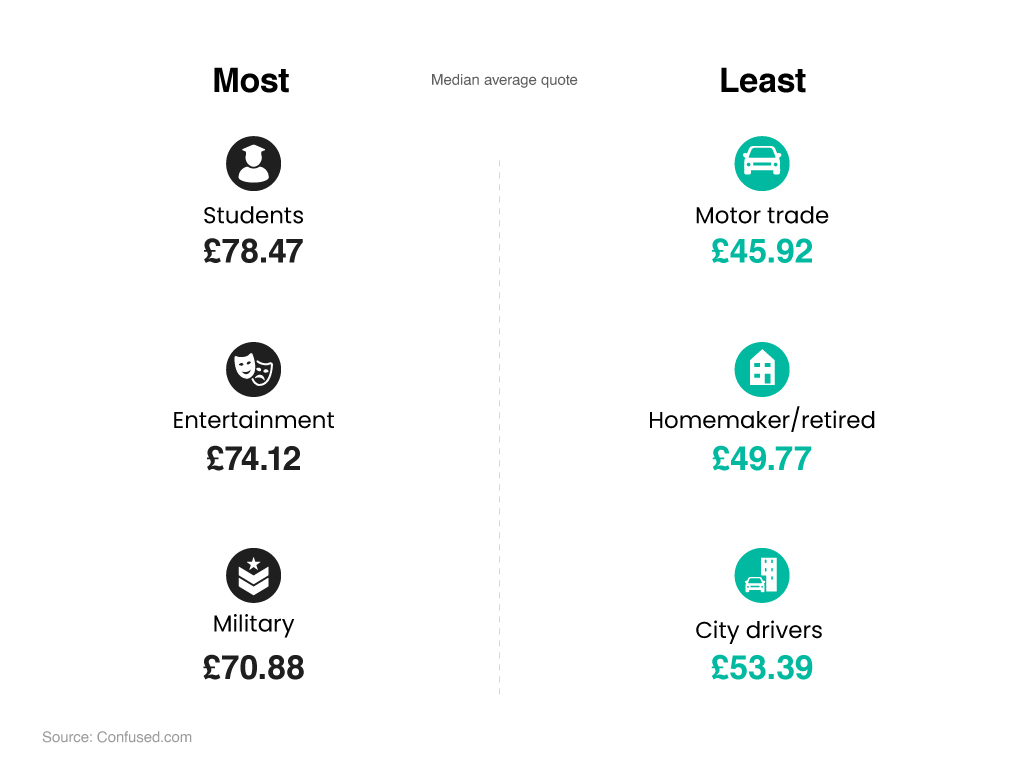

Average cost of contents insurance by type of employment

On average, those working in the motor trade can expect to pay the least for their contents insurance (£45.92), followed closely by homemakers and those who are retired (£49.77).

The most expensive average costs of contents insurance tends to be for those working in:

- Entertainment (£74.12)

- Finance and insurance (£68.08)

- Journalism (£66.95)

A breakdown of average contents insurance cost by type of work

| Occupational category | % of total number of quote requests | Median average quote |

|---|---|---|

|

Professional

|

23.17%

|

£61.84

|

|

Homemaker/retired

|

22.70%

|

£49.77

|

|

Office jobs

|

13.15%

|

£58.92

|

|

Unemployed

|

7.80%

|

£59.76

|

|

Skilled workers

|

7.54%

|

£59.36

|

|

Service jobs

|

5.00%

|

£57.54

|

|

Teaching

|

4.56%

|

£60.84

|

|

Charity/social work

|

4.46%

|

£58.24

|

|

Medical professional

|

4.45%

|

£62.36

|

|

Unskilled workers

|

3.70%

|

£55.92

|

|

Students

|

2.73%

|

£78.47

|

|

Sales office-based

|

2.38%

|

£61.59

|

|

Utilities

|

1.93%

|

£58.78

|

|

City drivers

|

1.74%

|

£53.39

|

|

Finance/insurance

|

1.46%

|

£68.08

|

|

Licence/gaming trade

|

1.37%

|

£57.92

|

|

Construction onsite

|

1.33%

|

£60.09

|

|

Motor trade

|

1.18%

|

£45.92

|

|

Emergency services

|

1.04%

|

£58.15

|

|

Agricultural work

|

1.03%

|

£57.94

|

|

Shop owners/proprietor

|

1.01%

|

£59.74

|

|

Motorway drivers

|

0.94%

|

£58.50

|

|

Arts

|

0.80%

|

£67.54

|

|

Entertainment

|

0.55%

|

£74.12

|

|

Sales travelling

|

0.39%

|

£65.78

|

|

Military

|

0.35%

|

£70.88

|

|

Journalism

|

0.28%

|

£66.95

|

|

Competitive sports

|

0.22%

|

£58.59

|

|

Office jobs

|

0.08%

|

£59.76

|

(Source: Confused.com)

The most popular industry selected in Confused.com quote data between 2020-23 was the professional sector (23.17%). For these people, the average price of contents insurance was £61.84.

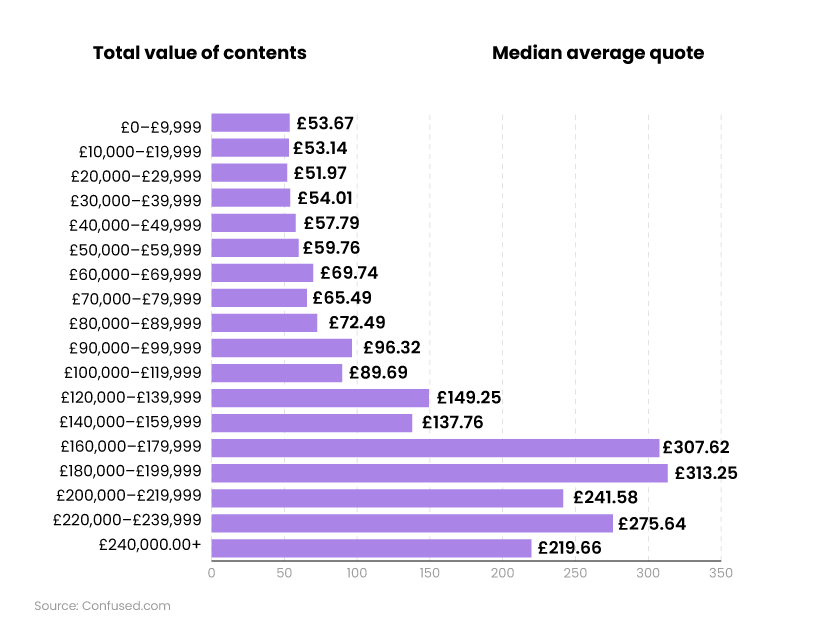

Average cost of contents insurance by total value of contents

Generally speaking, as the total value of your contents increases, so does the average cost of your contents insurance.

Between 2020 and 2023, over a quarter (25.75%) of Confused.com quotes were to insure items with a combined value of £20,000-£29,999. That makes it the most requested quote value during this period. It’s also the cheapest average quote for contents insurance, at £51.97.

A breakdown of average contents insurance cost by value of contents

| Amount of cover required | % of total number of quote requests | Median average quote |

|---|---|---|

|

£0-£9 999

|

6.58%

|

£53.67

|

|

£10 000-£19 999

|

9.43%

|

£53.14

|

|

£20 000-£29 999

|

25.75%

|

£51.97

|

|

£30 000-£39 999

|

14.66%

|

£54.01

|

|

£40 000-£49 999

|

18.33%

|

£57.79

|

|

£50 000-£59 999

|

13.58%

|

£59.76

|

|

£60 000-£69 999

|

2.19%

|

£69.74

|

|

£70 000-£79 999

|

4.52%

|

£65.49

|

|

£80 000-£89 999

|

1.52%

|

£72.49

|

|

£90 000-£99 999

|

0.37%

|

£96.32

|

|

£100 000-£119 999

|

2.05%

|

£89.69

|

|

£120 000-£139 999

|

0.19%

|

£149.25

|

|

£140 000-£159 999

|

0.52%

|

£137.76

|

|

£160 000-£179 999

|

0.04%

|

£307.62

|

|

£180 000-£199 999

|

0.02%

|

£313.25

|

|

£200 000-£219 999

|

0.09%

|

£241.58

|

|

£220 000-£239 999

|

0.01%

|

£275.64

|

|

£240 000+

|

0.14%

|

£219.66

|

(Source: Confused.com)

Once the total value of your items starts going above £60,000, then the average cost of contents insurance increases to around £69.74 per year.

On average, someone who’s insuring items worth more than £120,000 can expect to pay anywhere between £149.25 and £307.62 for their annual policy. That’s almost 6 times more than those insuring £30,000 worth of contents.

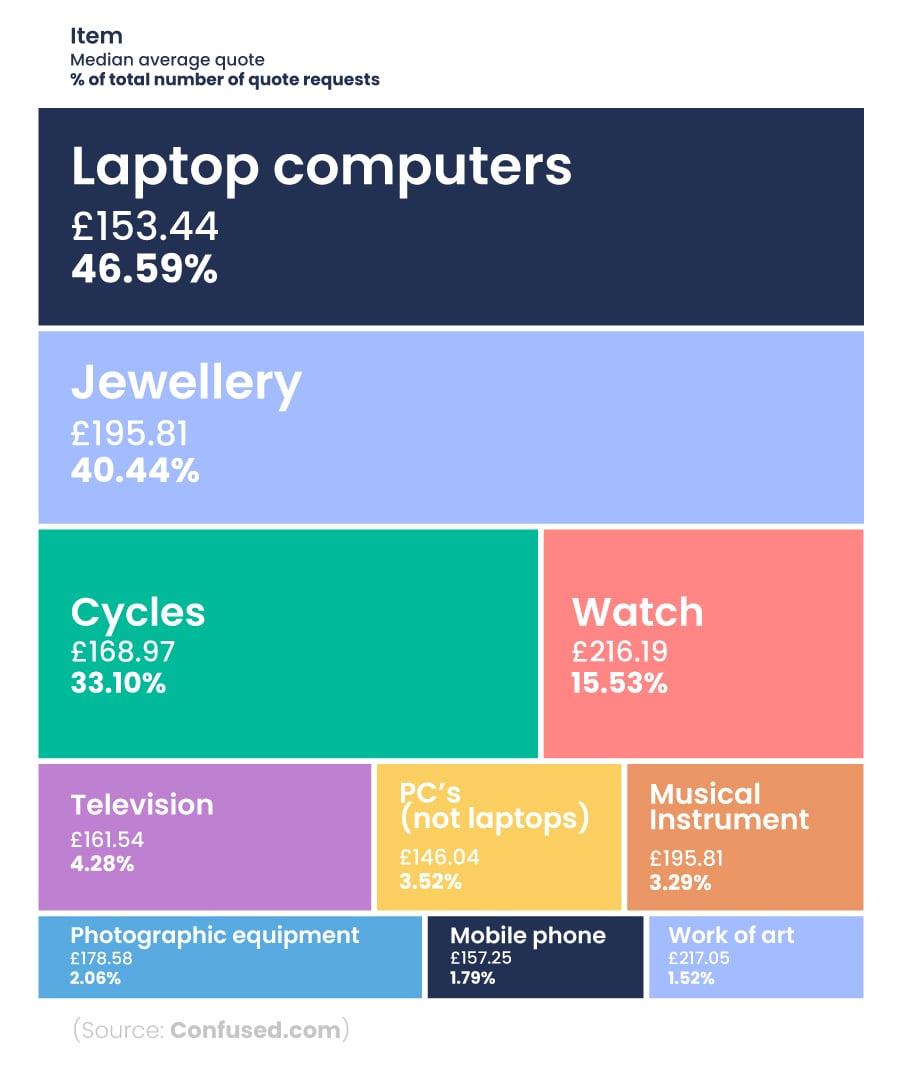

Most common items insured on UK contents insurance policies

The 2 most common items that customers insure on their contents insurance are laptops (46.59%) and jewellery (40.44%). That’s according to our quote data.

Typically, the average price of contents insurance for a laptop was around £153.44 between 2020-23, rising to £195.81 for policies protecting jewellery.

A breakdown of most commonly insured items on UK contents insurance

| Item | % of total number of quote requests | Number of quote requests | Median average quote |

|---|---|---|---|

|

Laptop computers

|

46.59%

|

1 276 704

|

£153.44

|

|

Jewellery

|

40.44%

|

1 108 097

|

£195.81

|

|

Cycles

|

33.10%

|

907 069

|

£168.97

|

|

Watch

|

15.53%

|

425 633

|

£216.19

|

|

Television

|

4.28%

|

117 304

|

£161.54

|

|

PCs (Inc. Accessories not laptops)

|

3.52%

|

96 399

|

£146.04

|

|

Musical instrument

|

3.29%

|

90 133

|

£171.91

|

|

Photographic equipment

|

2.06%

|

56 346

|

£178.58

|

|

Mobile phone

|

1.79%

|

48 951

|

£157.25

|

|

Work of art

|

1.52%

|

41 784

|

£217.05

|

On average, the cheapest contents insurance policies were for those insuring hearing aids (£147.47).

However, the most expensive policies tended to be for insuring items such as:

- Works of art (£217.05)

- Watch (£216.19)

- Clothing (£210.89)

A breakdown of items that increase the average cost of contents insurance the most

| Item | % of total number of quote requests | Median average quote |

|---|---|---|

|

Item containing silver

|

0.19%

|

£223.89

|

|

Work of art

|

1.52%

|

£217.05

|

|

Watch

|

15.53%

|

£216.19

|

|

Containing precious stones

|

0.75%

|

£211.44

|

|

Clothing

|

0.95%

|

£210.89

|

|

Fur

|

0.04%

|

£202.24

|

|

Picture

|

1.30%

|

£202.15

|

|

Masonic regalia

|

0.01%

|

£198.80

|

|

Containing gold

|

0.50%

|

£198.63

|

|

Jewellery

|

40.44%

|

£195.81

|

(Source: Confused.com)

Overall, contents insurance policies covering items containing silver are the most expensive to insure. On average, these policies cost £223.89 between 2020 and 2023, almost £5 a year more than policies insuring works of art.

A breakdown of items that increase the average cost of contents insurance the least

| Item | % of total number of quote requests | Median average quote |

|---|---|---|

|

Television games consoles

|

0.20%

|

£143.31

|

|

PCs (inc accessories not laptops)

|

3.52%

|

£146.04

|

|

Angling equipment

|

0.46%

|

£147.00

|

|

Hearing aid

|

1.39%

|

£147.47

|

|

Portable television

|

0.02%

|

£149.27

|

|

Laptop computers

|

46.59%

|

£153.44

|

|

Portable audio equipment

|

0.13%

|

£153.71

|

|

Mobile phone

|

1.79%

|

£157.25

|

|

Stamp collection

|

0.20%

|

£160.97

|

|

Television

|

4.28%

|

£161.54

|

(Source: Confused.com)

Between 2020 and 2023, the cheapest contents insurance quotes were for policies insuring television games consoles (£143.31). These are closely followed by PCs (£146.04).

Angling equipment and hearing aids were also relatively cheap by comparison, with both types of contents insurance policy averaging at around £147 for the year.

Contents insurance statistics by type of home ownership

Average UK contents insurance costs by type of home ownership

The most common type of quote generated by Confused.com customers between 2020-23 was for an unfurnished, rented property from a private landlord. This represented almost 2 in 5 (39.42%) quotes during this period with a mid-range average price of £57.64.

A breakdown of average contents insurance costs by type of home ownership

| Type of home ownership | % of total number of quote requests | Median average quote |

|---|---|---|

|

Renting unfurnished from a private landlord

|

39.42%

|

£57.64

|

|

Mortgaged and occupied by you

|

20.96%

|

£57.65

|

|

Owned and occupied by you

|

12.78%

|

£49.87

|

|

Renting unfurnished from council

|

11.91%

|

£56.52

|

|

Housing association

|

9.15%

|

£56.34

|

|

Renting furnished from a private landlord

|

5.54%

|

£68.72

|

|

Renting furnished from council

|

0.24%

|

£57.69

|

(Source: Confused.com)

Between 2020 and 2023, the cheapest average contents insurance cost was for property that was owner occupied. At just under £50 for the year, nearly 13% of customers requested this across the 3-year period.

But those living in furnished, rental accommodation from a private landlord can expect to pay the most for their contents insurance. On average, this came out at £68.72,almost £20 a year more than the cheapest option.

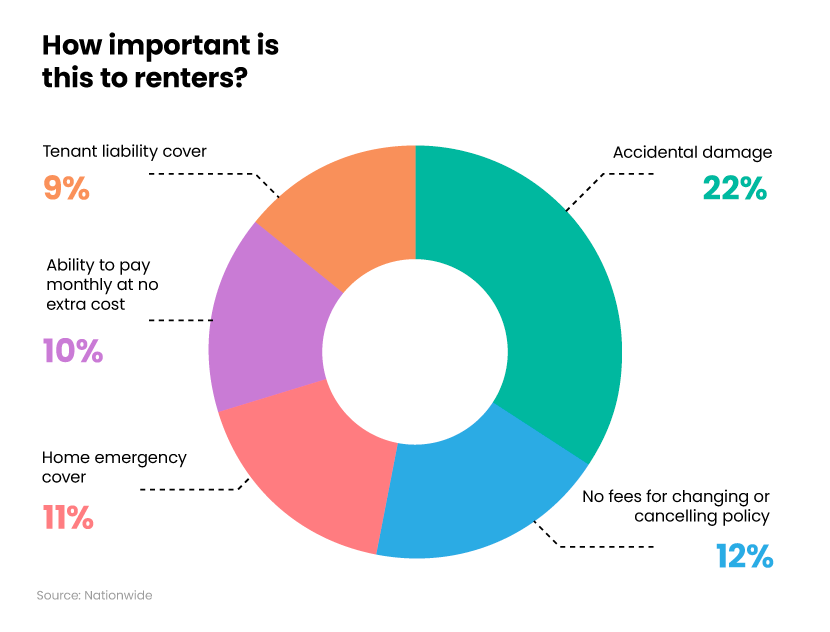

Contents insurance statistics for private renters

In a survey of more than 1,000 tenants, Nationwide Building Society found that half (52%) of the UK’s 4.4 million private renters had contents insurance. This leaves more than 2 million privately-rented households potentially unprotected against loss, theft, or damage to their possessions.

Nationwide’s study also found that:

- More than a fifth (22%) had no contents cover in place, with more than a quarter (26%) unsure if they had contents insurance or not.

- Almost 1 in 5 people wrongly believed it was the landlord’s responsibility to arrange contents insurance. Others didn’t get cover as a way of reducing monthly outgoings.

- Just under a half (48%) were worried that they might cause damage to their possessions in the future.

Separate landlords insurance is available for those who rent out properties to others. If the property is rented out furnished, then you may want to consider contents cover as a way to protect your items. Tenants insurance is also available for renters who wish to protect their personal belongings while renting.

Incidentally, accidental damage was the most commonly cited reason for private renters buying contents insurance (22%). That’s followed by no fees for changing/cancelling their policy (12%), and home emergency cover (10%).

A breakdown of how important different elements of home insurance are to private renters

The study also found that:

- Renters were paying for cover which they didn’t need. More than a quarter (26%) paid for buildings insurance, which is the landlord’s responsibility.

- Almost a third (32%) admitted to not cancelling their policy when they moved out of their rented accommodation.

- More than a third (34%) admitted to not knowing whether contents insurance was a requirement of their tenancy agreement.

- Almost 2 in 5 (39%) were ordered to arrange contents insurance by their landlord in 2021. And over two-thirds (67%) were asked for proof of contents insurance before they could sign their tenancy agreement.

UK contents insurance claims statistics

Between July and December 2021, less than 2% of claims made by UK insurance holders were for contents insurance. Insurers accepted over three-quarters (78.62%) of these claims, and the average payout was almost £1,400 per claim.

A breakdown of contents insurance claims statistics for the UK in 2021

| Claims frequency | 1.78% |

|---|---|

|

Claims acceptance rate

|

78.62%

|

|

Average claims payout

|

£1,394.77

|

|

Claim complaints as a % of claims

|

5.81%

|

|

Sum of average number of policies in force

|

4,281,111

|

|

Total retail premiums (written)

|

£283.96mn

|

|

% of premiums paid out in claims

|

27.58%

|

There were more than 4.28 million UK contents insurance policies in force in 2021.These cost nearly £284 million in total.

Of this, insurers paid out over a quarter (27.58%) of total premiums in claims for the second half of 2021. This came to £78.3 million.

Ourguide on how to make a home insurance claim can give you more information on the claims process and whether it’s worth making a claim against your policy.

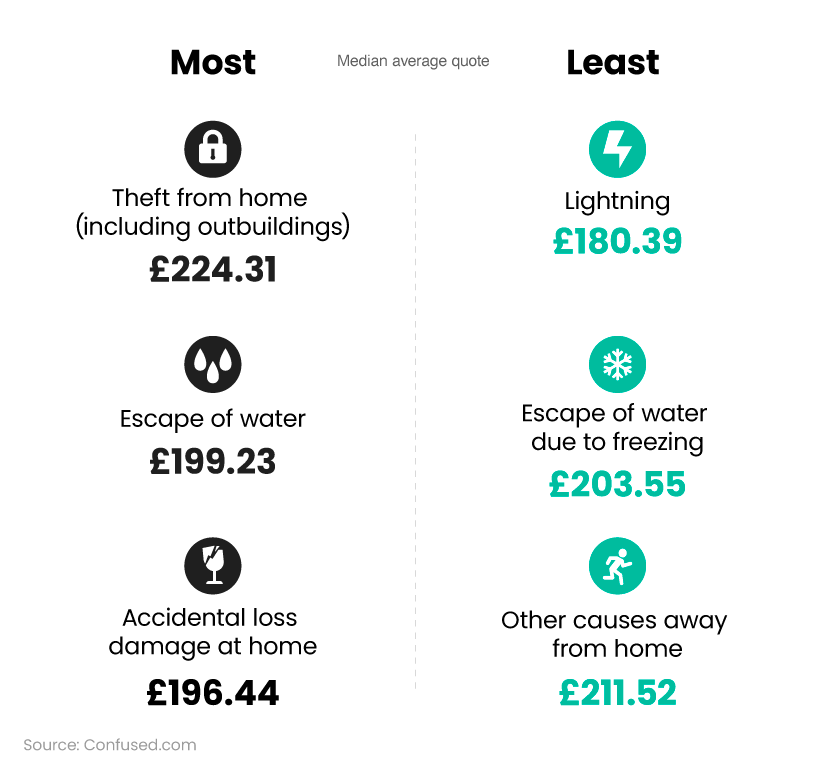

UK contents insurance claims statistics by type of claim

As home insurance isn’t mandatory, some may choose to save money and avoid buying a contents insurance policy. But according to our research, the average contents insurance claim in 2022 was £3,260. If the average Confused.com customer pays £62 a year for their policy, it would take them 52 years to spend this amount without making a claim.

Between 2020 and 2023, the most common type of contents insurance claim was accidental loss caused by damage at home. Nearly a quarter (24.58%) of quotes during this period were because of this, and cost £196.44 on average.

A breakdown of contents insurance claims statistics by type of claim between 2020 and 2023

| Type of claim | % of total number of quote requests | Number of quote requests | Median average quote |

|---|---|---|---|

|

Accidental loss damage at home

|

24.58%

|

146,616

|

£196.44

|

|

Theft from home including outbuildings

|

8.36%

|

49,875

|

£224.31

|

|

Escape of water

|

8.24%

|

49,145

|

£199.23

|

|

Accidental loss damage Away from home

|

7.32%

|

43,688

|

£220.03

|

|

Theft away from home

|

3.86%

|

23,035

|

£237.73

|

|

Accidental loss damage outside home

|

1.37%

|

8,191

|

£210.45

|

|

Theft from outside home

|

1.36%

|

8,138

|

£223.84

|

|

Food in freezer

|

1.23%

|

7,358

|

£178.26

|

|

Fire

|

1.07%

|

6,362

|

£206.52

|

|

Storm

|

0.91%

|

5,420

|

£217.97

|

|

Other causes at home

|

0.78%

|

4,680

|

£186.07

|

|

Flood

|

0.61%

|

3,632

|

£339.67

|

|

Malicious damage at home

|

0.31%

|

1,854

|

£197.95

|

|

Lightning

|

0.29%

|

1,749

|

£180.39

|

|

Escape of water due to freezing

|

0.24%

|

1,444

|

£203.55

|

|

Other causes away from home

|

0.18%

|

1,091

|

£211.52

|

(Source: Confused.com)

Theft from the home (including outbuildings) and escape of water were the next most common, with average costs of £224.31 and £199.23, respectively.

Flood claims increased contents insurance costs the most between 2020 and 2023. In total, they amounted to 0.61% of quotes during this period, at an average cost of £339.67.

Earthquakes and falling aerials both generated average quote costs below £100 a year. This was followed by arson at £161.83. All 3 incidents are considered rare in the world of contents insurance claims, and have contributed to just 0.03% of total quotes between 2020 and 2023.

In order to make a successful claim, it’s important to be honest and accurate with your insurer. Otherwise, you risk invalidating your house insurance and either receiving a partial payout or none at all.

Flood insurance claim statistics

A standalone flood insurance policy doesn’t exist in the world of home insurance because contents insurance policies should cover flooding as standard. Contents cover helps with the cost of repair, or replaces possessions if your home gets flooded.

Our data between May 2022 and May 2023 shows that the average cost of a claim for flood damage was £11,489.

The Environment Agency (EA) estimates that 1 in 6 properties in England are at risk of flood from rivers and seas, amounting to approximately 5.2 million homes. Also, the British Geological Survey (BGS) claims that up to 290,000 properties in England are also located in areas prone to risk from groundwater flooding.

Thankfully, since the launch of the Flood Re scheme in 2016, affordable home insurance with flood cover has now become a lot easier.

To be eligible for the scheme, your home insurance policy must be in your name, and your property must be:

- Built before 1 January 2019

- In a council tax band

- Used for residential purposes

Leasehold and residential buy-to-let properties should be covered by the scheme, providing they meet these criteria.

How does making a claim affect your contents insurance no-claims discount (NCD)?

Making a claim on your contents insurance policy may affect your no-claims discount (NCD), particularly when it comes to renewing your policy the following year.

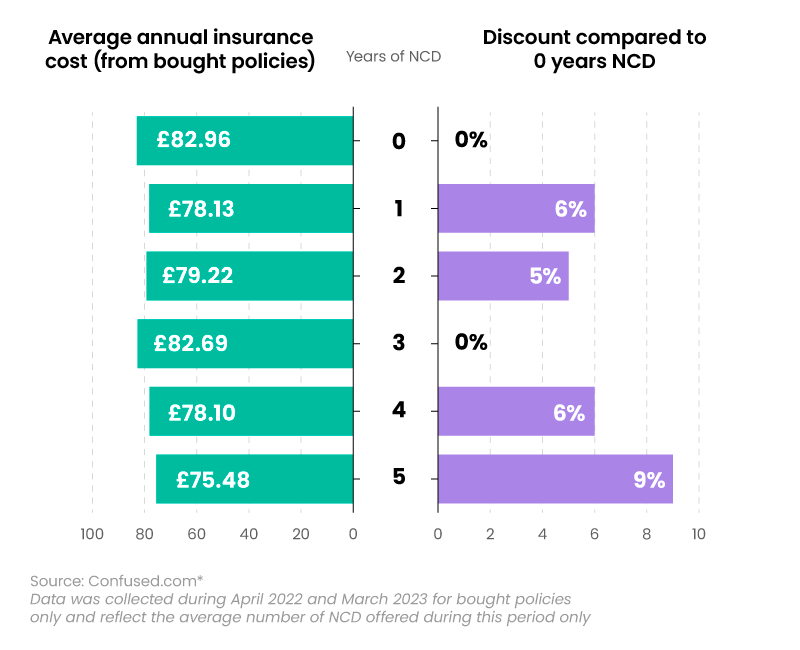

A breakdown of average annual insurance costs for contents insurance and discount received for different levels of NCD

Our data between April 2022 and March 2023 shows that the average contents insurance policy with 0 years NCD was £82.69.

On average, customers saved the most with 5 years NCD (9%), followed by 1 year and 4 years (both 6%).

Contents insurance FAQs

What does contents insurance cover?

Contents insurance covers the cost of replacing or repairing your personal items if they’re destroyed, damaged, or stolen. This tends to include various household items that aren’t considered part of the structure or building. For example:

- Furniture

- Clothes

- Electronic equipment

- White goods

- Tools

- Jewellery

Is contents insurance mandatory?

No, contents insurance isn’t mandatory or a legal requirement. But having a contents insurance policy in place can help you protect your personal items against damage, destruction, or theft.

Do tenants need contents insurance?

No, tenants aren’t required to have contents insurance. But if their personal possessions become damaged, destroyed, or stolen, then the cost of repair or replacement won’t be covered. So it’s advisable to have a contents insurance policy in place, in order to protect these personal items.

How much contents insurance do I need?

The amount of contents insurance you need depends on the total cost of all your possessions. If you undervalue your contents, your insurer’s payout may not be enough to cover the cost of repair or replacement. If you overestimate the value of your items, then you could end up paying more than you need to for your contents insurance.

Is £50,000 enough for contents insurance?

As of 2023, the average UK home is estimated to contain around £52,000 worth of items. Therefore a contents insurance policy covering items up to the combined value of £50,000 might be enough. But this depends on how much your items are worth, and the repair or replacement cost if they get damaged, destroyed, or stolen. It’s important to accurately calculate the total value of your household items in order to get the most appropriate policy for you.

How much does contents insurance cost?

The cost of contents insurance varies depending factors such as:

- The value of your possessions

- Where you live

- The type of home you have

- Your home security

- Who you live with

- The risk of crime

- The risk of flooding in the local area

Between 2020-23, the cost of contents insurance ranged between £42 and £340 for the year.

What is the average cost of contents insurance?

Between December 2022 and May 2023, the average cost of contents insurance was £62. In February 2023, the ABI reported that the national average for contents insurance was £116.

How much is contents insurance per month?

Between 2020-23, the average cost of contents insurance per month was £61.08. This is compared to £53.63 for an annual policy.

How much is contents insurance for renters in the UK?

Between 2020-23, contents insurance for renters in the UK ranged between £56.52 and £68.72. The amount depended on whether they were renting from the council or a private landlord, and whether the property was furnished or unfurnished.

How much is student contents insurance?

As of 2022, the average cost of student contents insurance was £59.15.

How much is contents insurance for a flat?

Between December 2022 and May 2023, average contents insurance for a flat was around £55 a year.

Is content insurance worth it?

In the unfortunate event that your personal possessions become damaged, destroyed, lost, or stolen, then having a contents insurance policy in place is definitely worth it. Otherwise, you’re faced with replacing them yourself, if they were to be lost, stolen, or damaged.

How soon can you claim on contents insurance?

Generally, there’s no rule on how long you have to wait before making a claim on your contents insurance policy. In theory, as soon as your policy is live, you should be able to make a claim. But it’s worth checking the terms and conditions of your policy before setting this up. You’re advised to contact your insurance provider as soon as the incident has happened. Some incidents (such as flooding) can get worse the longer you leave it.

Can you cancel contents insurance anytime?

Yes, you should be able to cancel your contents insurance policy at any time. There is usually a 14-day ‘cooling off’ period after initially buying your policy. But, in order to cancel your contents insurance policy, you may have to pay an admin fee, which can be up to £50 depending on your provider.

Contents insurance glossary

Bedroom rated contents insurance

Bedroom rated contents insurance is where the insurer works out the amount of content cover you require, also called the ‘sum insured’. It’s usually based on the number of bedrooms in your property.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures the average change in the price paid by consumers for various goods and services in the UK over a given period of time.

Contents insurance

Contents insurance covers the loss, theft, or damage to items in your home that aren’t part of its structure. It covers the cost of replacing or repairing your possessions should they become destroyed, damaged, or stolen.

Home emergency cover

Home emergency cover helps with the cost for urgent repairs to the utilities in your property (i.e. water, gas, and electricity). It may also cover:

- Boilers and heating

- Plumbing and drainage

- Roof damage

- Electrical failures

- Broken windows,doors, and locks

- Lost keys

- Pest infestation

But, this could vary between providers, so it’s worth checking with your insurer to see what is and isn’t covered by your policy.

Indemnity insurance

Indemnity insurance accounts for wear and tear of your possessions. If your items become damaged or destroyed, it will replace like-for-like, rather than a brand new item.

New-for-old insurance

New-for-old insurance can replace items with a brand new version if they become damaged, destroyed, or stolen.

No-claims discount (NCD)

No-claims discount (NCD), or no-claims bonus (NCB), is a discount awarded to your insurance policy as a reward for not making a claim over the previous 12 months.

Personal possessions insurance

Personal possessions insurance should cover anything you own that’s worth £1,000 or less. This is usually an additional fee on top of your standard contents insurance policy. But it covers your items against theft or damage when you take them out of the house.

Students contents insurance

Students' insurance protects your personal belongings while at university and living away from home. This can be in private rented or student accommodation, as well as halls of residence on campus.

Sum insured contents insurance

Sum insured contents insurance is where you - not the insurer,- are responsible for calculating contents insurance and the amount of cover you need.

Unlimited sum insured contents insurance

Unlimited sum contents insurance is where all your contents are covered without limit, meaning you don’t need to calculate how much your possessions are worth.

)