Remortgaging lets you switch your current mortgage deal to a new one. This is often done to save money on your existing mortgage or borrow additional money against your property.

You can remortgage anytime, but the ideal time is when your current deal ends. This avoids moving onto your lender's standard variable rate (SVR), which can often be higher. Switching when your deal expires also avoids early repayment fees.

With mortgage rates rising recently, it's essential to consider your options when your deal ends. It’s worth researching the current remortgage market and thinking about how you might be affected by moving to higher rates.

If you’re remortgaging, consult an independent broker with access to the whole market. These brokers can help find you the best deal for your circumstances.

Key remortgage statistics

- According to the FCA, remortgages over Q1 2023 total £17.5 billion, over £10 billion less than this time last year.

- According to the Building Societies Association (BSA), in 2022, 539,591 remortgages were sold to UK homeowners at a total cost of £113 billion.

- BSA figures also show that by August 2023, just 253,782 remortgages were sold to UK homeowners at a total cost of around £51 billion.

- The average 2-year rate for a 75% LTV mortgage as of June 2023 is 5.5%, up from 2.87% last year, according to the Bank of England.

- According to the Office for National Statistics, there are 818,489 mortgages with fixed terms below 2% coming to an end during 2023, which will likely move onto higher rates. Homeowners who borrowed £100,000 and are moving from a 2% to a 4% interest rate will see their monthly repayments increase by £104.

- The Bank of England base rate is currently 5.25% - a 15-year high.

- Gross remortgage lending at the end of 2021 totalled £93 billion according to UK Finance data.

The remortgage market in the UK

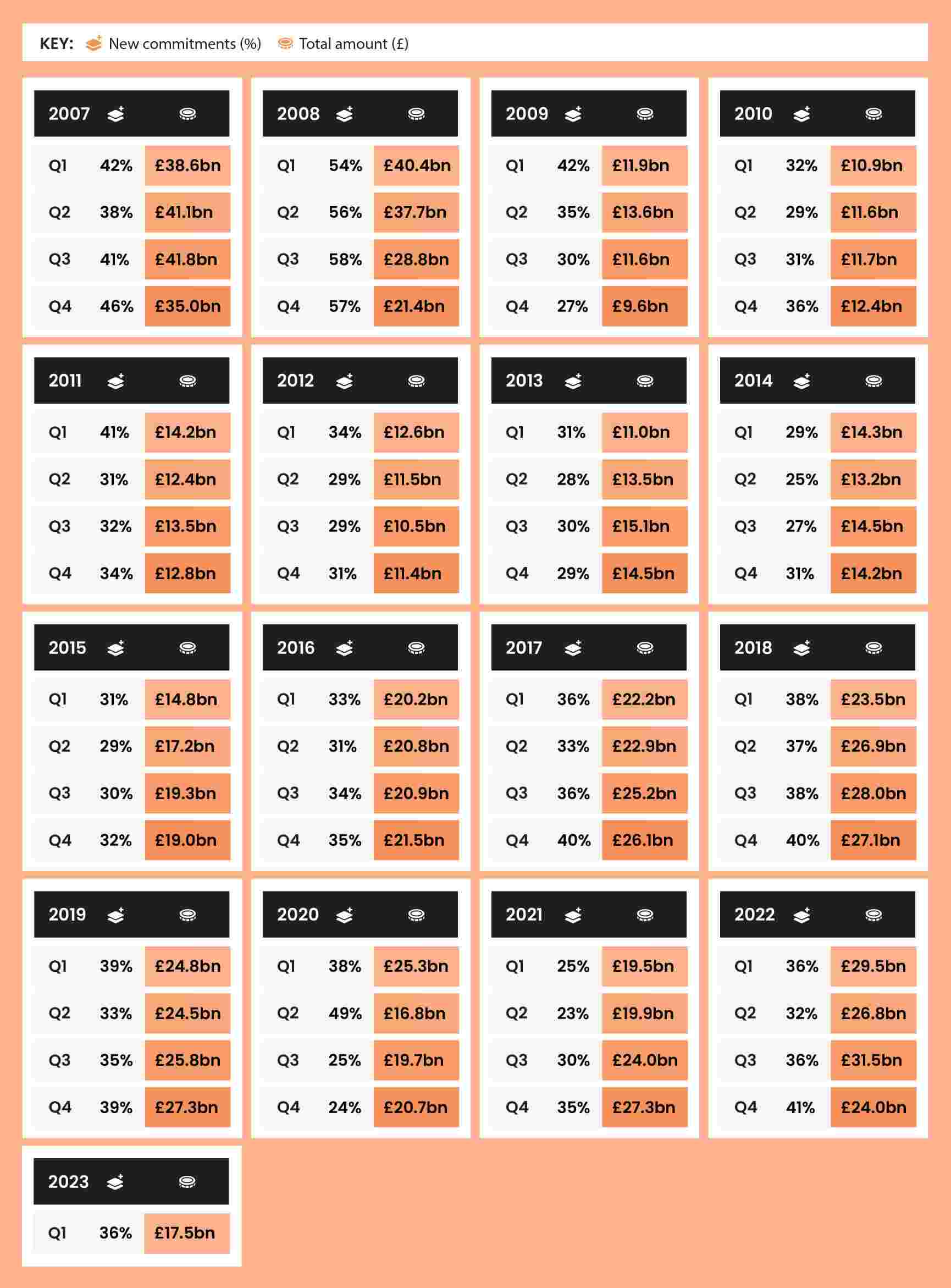

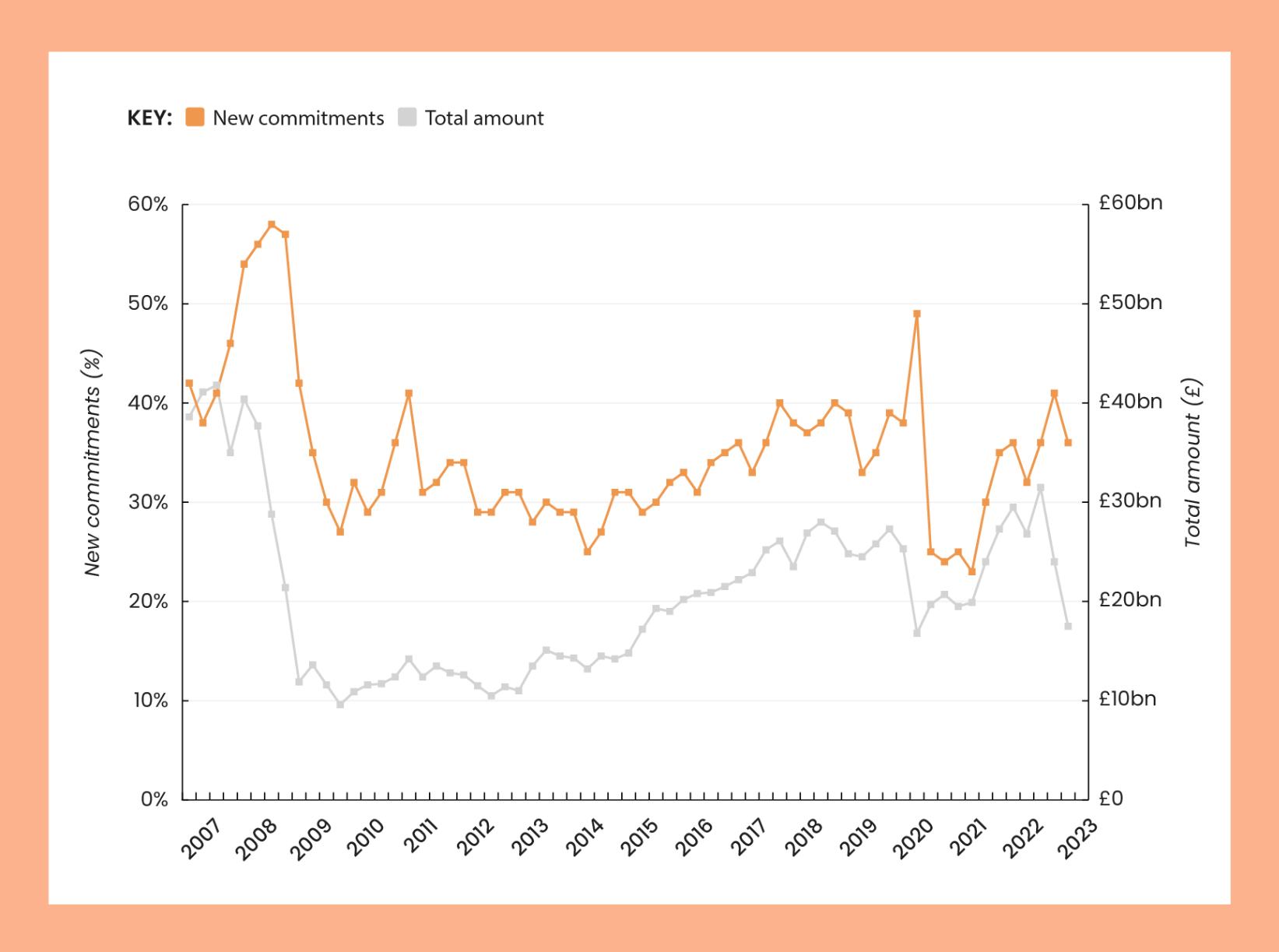

Remortgages typically account for around 20-50% of new commitments in any quarter.

During the first quarter of 2023, £17.5 billion worth of remortgages were approved - 36% of the total new commitments made in the quarter. This is over £10 billion less than recorded last year, where £29.5 billion was approved in remortgages.

| Year | Quarter | New commitments | Total amount |

|---|---|---|---|

|

2007

|

Q1

|

42%

|

£38.6bn

|

|

2007

|

Q2

|

38%

|

£41.1bn

|

|

2007

|

Q3

|

41%

|

£41.8bn

|

|

2007

|

Q4

|

46%

|

£35.0bn

|

|

2008

|

Q1

|

54%

|

£40.4bn

|

|

2008

|

Q2

|

56%

|

£37.7bn

|

|

2008

|

Q3

|

58%

|

£28.8bn

|

|

2008

|

Q4

|

57%

|

£21.4bn

|

|

2009

|

Q1

|

42%

|

£11.9bn

|

|

2009

|

Q2

|

35%

|

£13.6bn

|

|

2009

|

Q3

|

30%

|

£11.6bn

|

|

2009

|

Q4

|

27%

|

£9.6bn

|

|

2010

|

Q1

|

32%

|

£10.9bn

|

|

2010

|

Q2

|

29%

|

£11.6bn

|

|

2010

|

Q3

|

31%

|

£11.7bn

|

|

2010

|

Q4

|

36%

|

£12.4bn

|

|

2011

|

Q1

|

41%

|

£14.2bn

|

|

2011

|

Q2

|

31%

|

£12.4bn

|

|

2011

|

Q3

|

32%

|

£13.5bn

|

|

2011

|

Q4

|

34%

|

£12.8bn

|

|

2012

|

Q1

|

34%

|

£12.6bn

|

|

2012

|

Q2

|

29%

|

£11.5bn

|

|

2012

|

Q3

|

29%

|

£10.5bn

|

|

2012

|

Q4

|

31%

|

£11.4bn

|

|

2013

|

Q1

|

31%

|

£11.0bn

|

|

2013

|

Q2

|

28%

|

£13.5bn

|

|

2013

|

Q3

|

30%

|

£15.1bn

|

|

2013

|

Q4

|

29%

|

£14.5bn

|

|

2014

|

Q1

|

29%

|

£14.3bn

|

|

2014

|

Q2

|

25%

|

£13.2bn

|

|

2014

|

Q3

|

27%

|

£14.5bn

|

|

2014

|

Q4

|

31%

|

£14.2bn

|

|

2015

|

Q1

|

31%

|

£14.8bn

|

|

2015

|

Q2

|

29%

|

£17.2bn

|

|

2015

|

Q3

|

30%

|

£19.3bn

|

|

2015

|

Q4

|

32%

|

£19.0bn

|

|

2016

|

Q1

|

33%

|

£20.2bn

|

|

2016

|

Q2

|

31%

|

£20.8bn

|

|

2016

|

Q3

|

34%

|

£20.9bn

|

|

2016

|

Q4

|

35%

|

£21.5bn

|

|

2017

|

Q1

|

36%

|

£22.2bn

|

|

2017

|

Q2

|

33%

|

£22.9bn

|

|

2017

|

Q3

|

36%

|

£25.2bn

|

|

2017

|

Q4

|

40%

|

£26.1bn

|

|

2018

|

Q1

|

38%

|

£23.5bn

|

|

2018

|

Q2

|

37%

|

£26.9bn

|

|

2018

|

Q3

|

38%

|

£28.0bn

|

|

2018

|

Q4

|

40%

|

£27.1bn

|

|

2019

|

Q1

|

39%

|

£24.8bn

|

|

2019

|

Q2

|

33%

|

£24.5bn

|

|

2019

|

Q3

|

35%

|

£25.8bn

|

|

2019

|

Q4

|

39%

|

£27.3bn

|

|

2020

|

Q1

|

38%

|

£25.3bn

|

|

2020

|

Q2

|

49%

|

£16.8bn

|

|

2020

|

Q3

|

25%

|

£19.7bn

|

|

2020

|

Q4

|

24%

|

£20.7bn

|

|

2021

|

Q1

|

25%

|

£19.5bn

|

|

2021

|

Q2

|

23%

|

£19.9bn

|

|

2021

|

Q3

|

30%

|

£24.0bn

|

|

2021

|

Q4

|

35%

|

£27.3bn

|

|

2022

|

Q1

|

36%

|

£29.5bn

|

|

2022

|

Q2

|

32%

|

£26.8bn

|

|

2022

|

Q3

|

36%

|

£31.5bn

|

|

2022

|

Q4

|

41%

|

£24.0bn

|

|

2023

|

Q1

|

36%

|

£17.5bn

|

Remortgages by region

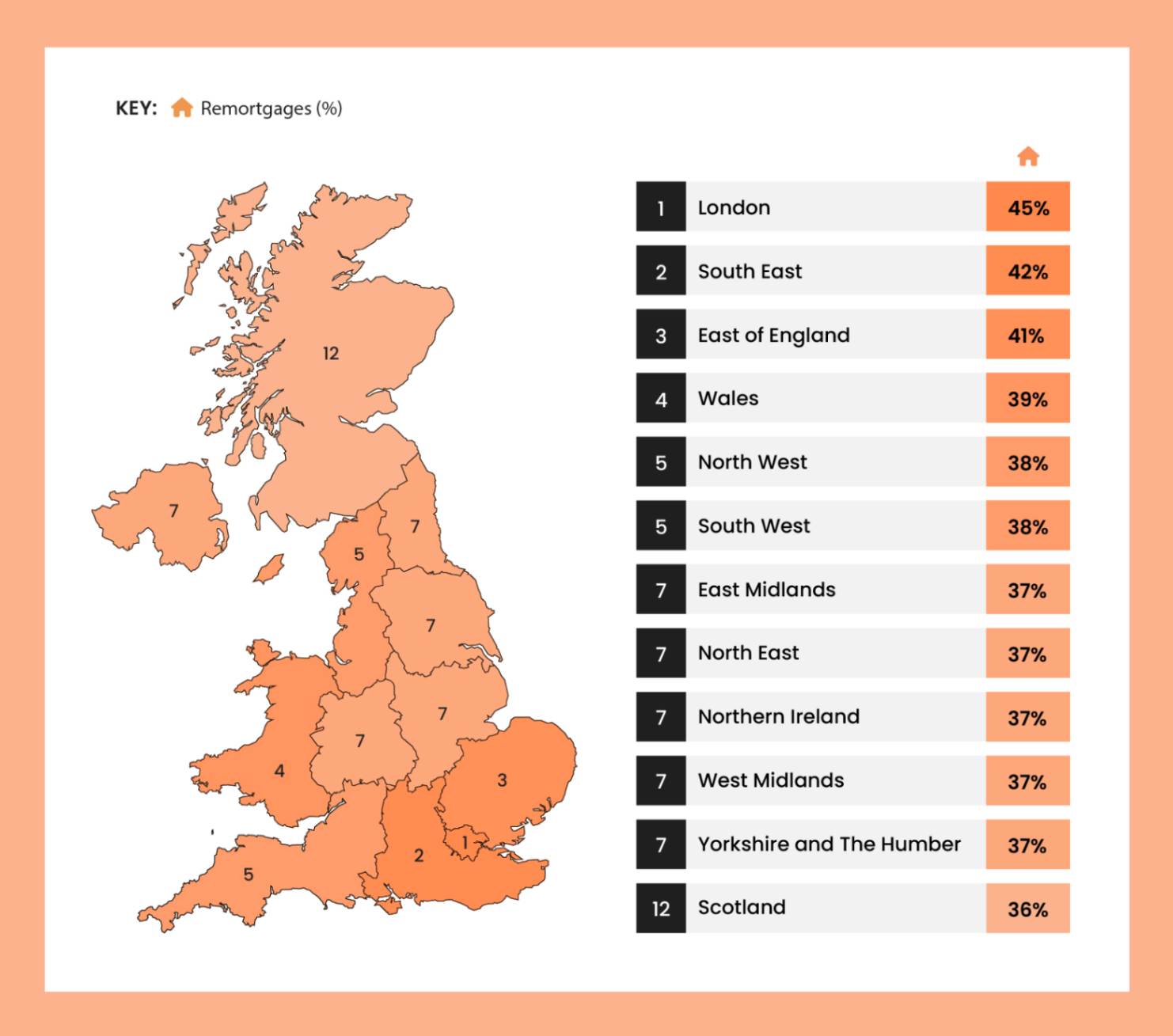

In 2019, homeowners took out 568,538 mortgages in total. Of this, 221,730 were remortgages - accounting for almost 2 in 5 (39%) mortgages taken out in the UK.

London saw the most significant percentage of remortgages in relation to total mortgages sold. In 2019, Londoners took out 65,487 mortgages, of which 29,286 (45%) were remortgages.

Homeowners in Scotland recorded the lowest percentage of remortgages, with 36% of total mortgages coming from remortgages.

| Rank | Region | Total number of Remortgages | Total number of sales | Remortgages (%) |

|---|---|---|---|---|

|

1

|

London

|

29,286

|

65,487

|

45%

|

|

2

|

South East

|

23,896

|

57,186

|

42%

|

|

3

|

Eastern

|

23,765

|

57,870

|

41%

|

|

4

|

Wales

|

8,692

|

22,542

|

39%

|

|

5

|

North West

|

24,388

|

64,139

|

38%

|

|

5

|

South West

|

27,455

|

71,765

|

38%

|

|

7

|

East Midlands

|

17,281

|

46,837

|

37%

|

|

7

|

North East

|

7,903

|

21,374

|

37%

|

|

7

|

Northern Ireland

|

5,203

|

13,909

|

37%

|

|

7

|

West Midlands

|

17,669

|

47,674

|

37%

|

|

7

|

Yorkshire and The Humber

|

18,311

|

49,468

|

37%

|

|

12

|

Scotland

|

17,846

|

50,205

|

36%

|

Value of UK remortgages

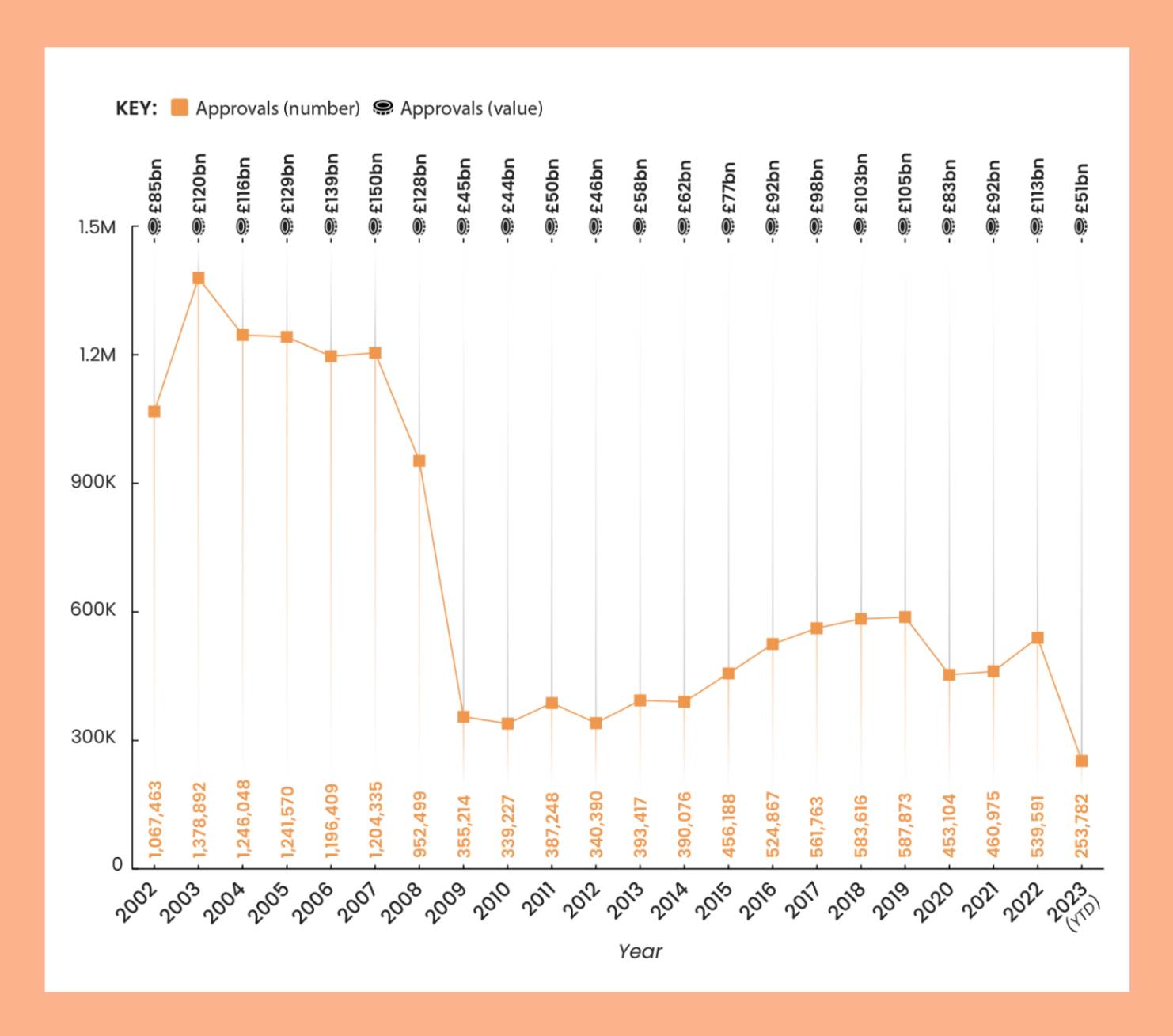

Remortgages were much more common 2 decades ago. At their peak in 2003, there were 1.38 million remortgages taken out by UK homeowners, coming in at a total value of £120 billion.

Despite the number of remortgages more than halving since then, the total value of remortgages has remained high. In 2022, 539,591 remortgages amounted to £113 billion. The average remortgage has increased dramatically in value over the last 20 years.

In 2023, there were 253,782 remortgages approved by the end of August, a total value of £51.2 billion. Considering this data is based on the first half of the year, this number appears much lower than in previous years.

| Year | Value (Approvals) | Number (Approvals) |

|---|---|---|

|

2002

|

£85bn

|

1,067,463

|

|

2003

|

£120bn

|

1,378,892

|

|

2004

|

£116bn

|

1,246,048

|

|

2005

|

£129bn

|

1,241,570

|

|

2006

|

£139bn

|

1,196,409

|

|

2007

|

£150bn

|

1,204,335

|

|

2008

|

£128bn

|

952,499

|

|

2009

|

£45bn

|

355,214

|

|

2010

|

£44bn

|

339,227

|

|

2011

|

£50bn

|

387,248

|

|

2012

|

£46bn

|

340,390

|

|

2013

|

£58bn

|

393,417

|

|

2014

|

£62bn

|

390,07

|

|

2015

|

£77bn

|

456,188

|

|

2016

|

£92bn

|

524,867

|

|

2017

|

£98bn

|

561,763

|

|

2018

|

£103bn

|

583,616

|

|

2019

|

£105bn

|

587,873

|

|

2020

|

£83bn

|

453,104

|

|

2021

|

£92bn

|

460,975

|

|

2022

|

£113bn

|

539,591

|

|

2023 YTD

|

£51bn

|

253,782

|

Average UK mortgage rates

The interest rate you can secure on your mortgage depends on various factors, including your loan-to-value (LTV) ratio, financial circumstances, and the Bank of England base rate.

Your LTV ratio is the ratio of your loan amount against the value of your property. For example, if you borrow £90,000 to buy a £100,000 property, your LTV will be 90%. The lower your LTV ratio, the better mortgage deals you typically get access to. It can be worth saving a larger deposit to get a lower LTV.

Lenders also look at your financial circumstances when determining what rate they might offer you. For example, if you have a poor credit rating, you may be seen as higher risk meaning a lender may charge you higher rates.

The Bank of England base rate changes based on broader economic issues and inflation and directly influences tracker mortgage rates. It also affects SVRs and discount mortgage rates.

Those already locked into a fixed deal won't see any change in their rate. But fluctuations in the base rate also mean that fixed-rate deals available in the market may change. If you’re due to remortgage soon, you’re likely to face a much higher rate than you’re currently on due to the substantial increase to the base rate over the past couple of years.

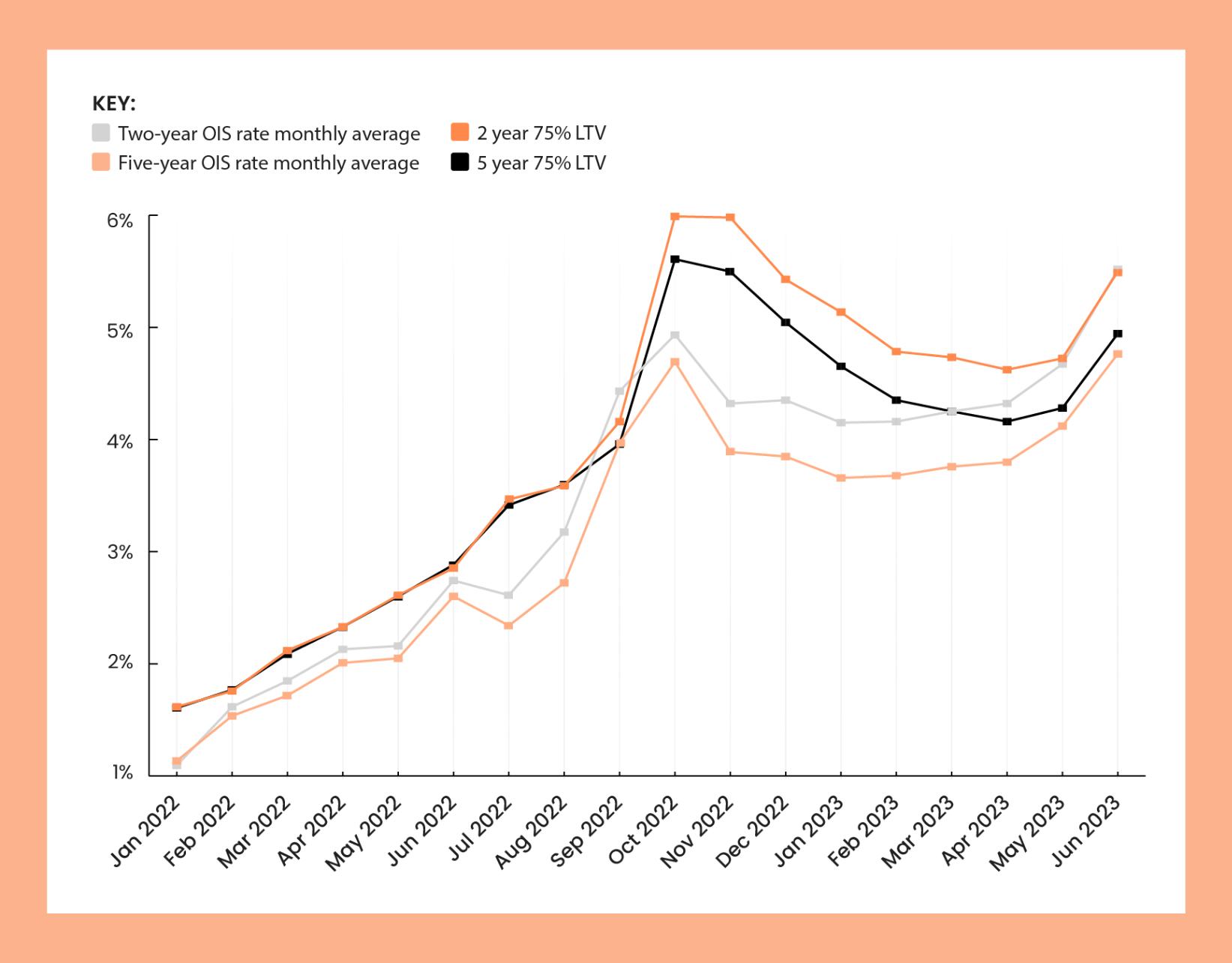

To illustrate the current mortgage rates in the UK, we can compare the average rates for homeowners looking to borrow or remortgage with an LTV of 75% for either 2 or 5 years.

- The average 2-year rate for a 75% LTV as of June 2023 is 5.5%. For a 5-year rate, it’s 4.95%.

- This time last year, in June 2022, the average 2-year rate for a 75% LTV was 2.87%, and the average rate for a 5-year deal was 2.90%.

Overnight index swap (OIS) rates are monthly averages of daily rates to 30 June for 2- and 5-year fixed-rate mortgages with LTVs of 75% that are used by lenders to price their mortgage products. Average rates will differ depending on your LTV percentage and other circumstances.

Those looking to remortgage this year may be able to find better rates than the average rates recorded here. Shop around or consult whole-of-market mortgage brokers to find the best deal.

| Date | Two-year OIS rate monthly average | Five-year OIS rate monthly average | 2 year 75% LTV | 5 year 75% LTV |

|---|---|---|---|---|

|

Jan-22

|

1.12%

|

1.16%

|

1.64%

|

1.63%

|

|

Feb-22

|

1.64%

|

1.56%

|

1.78%

|

1.79%

|

|

Mar-22

|

1.87%

|

1.74%

|

2.14%

|

2.11%

|

|

Apr-22

|

2.15%

|

2.03%

|

2.35%

|

2.35%

|

|

May-22

|

2.18%

|

2.07%

|

2.63%

|

2.62%

|

|

Jun-22

|

2.76%

|

2.62%

|

2.87%

|

2.90%

|

|

Jul-22

|

2.63%

|

2.36%

|

3.48%

|

3.43%

|

|

Aug-22

|

3.19%

|

2.74%

|

3.60%

|

3.61%

|

|

Sep-22

|

4.44%

|

3.98%

|

4.17%

|

3.97%

|

|

Oct-22

|

4.94%

|

4.70%

|

5.99%

|

5.61%

|

|

Nov-22

|

4.33%

|

3.90%

|

5.98%

|

5.50%

|

|

Dec-22

|

4.36%

|

3.86%

|

5.43%

|

5.05%

|

|

Jan-23

|

4.16%

|

3.67%

|

5.14%

|

4.66%

|

|

Feb-23

|

4.17%

|

3.69%

|

4.79%

|

4.36%

|

|

Mar-23

|

4.26%

|

3.77%

|

4.74%

|

4.26%

|

|

Apr-23

|

4.33%

|

3.81%

|

4.63%

|

4.17%

|

|

May-23

|

4.68%

|

4.13%

|

4.73%

|

4.29%

|

|

Jun-23

|

5.52%

|

4.77%

|

5.50%

|

4.95%

|

Mortgages coming to an end

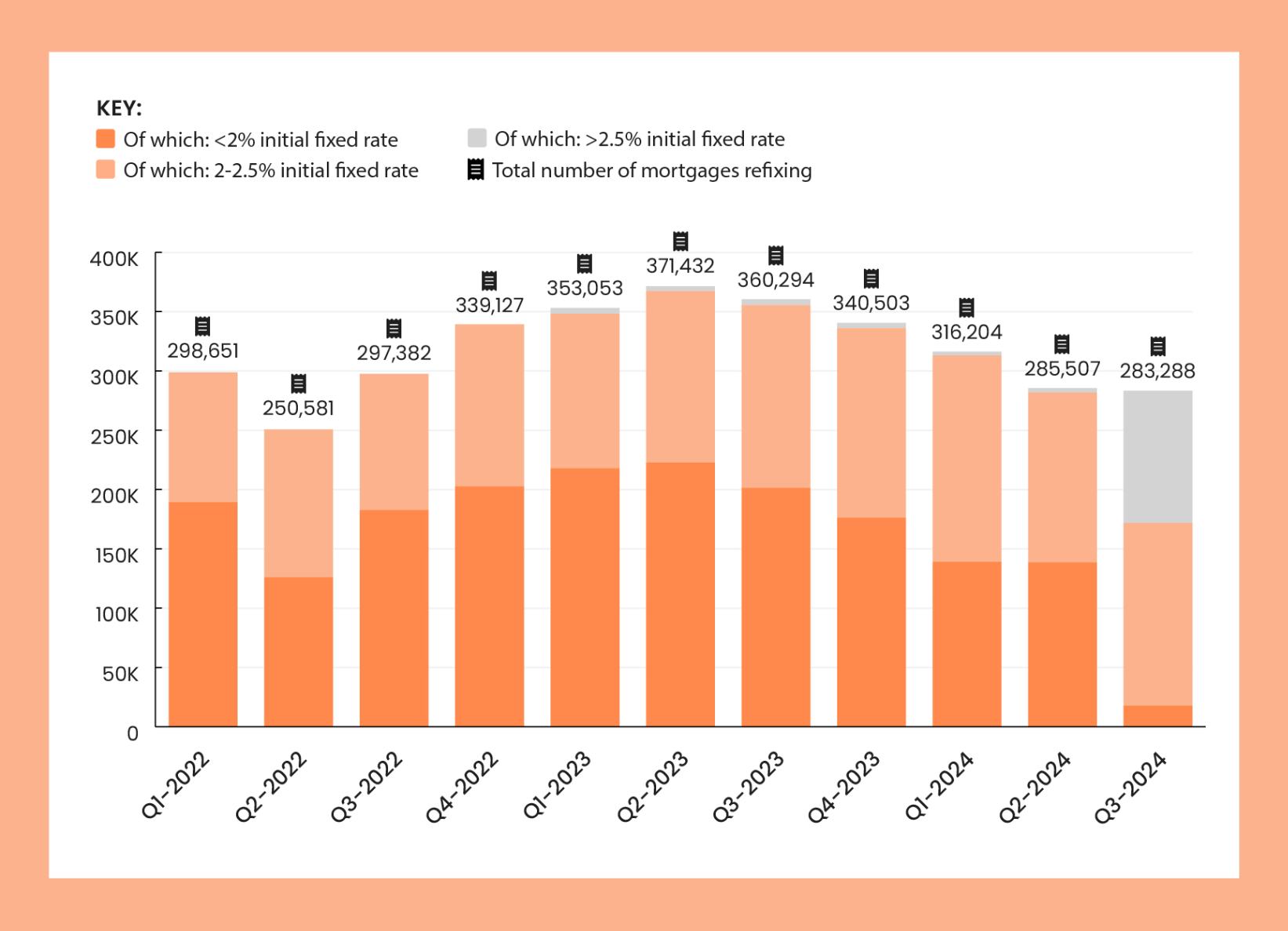

Homeowners usually remortgage when they reach the end of the initial fixed-rate term on their current mortgage.

One of the problems facing UK homeowners today is the dramatic increase in interest and remortgage rates seen over the past year. Those reaching the end of their fixed term will now have to move onto different rates, likely much higher than their previous remortgage rates.

For example, not a single homeowner whose fixed term ended in 2022 had a rate of more than 2.5%. As we’ve seen, the average fixed rate for a 5-year 75% LTV by December 2022 was 5.05%. Homeowners whose fixed terms are ending are seeing new rates of more than double what they were paying before, and their monthly repayments are rising significantly.

There are a total of 818,489 mortgages with fixed terms below 2% coming to an end during 2023. This year, the lowest fixed rate for a 5-year 75% LTV mortgage was 4.17%, recorded in April. This means over 800,000 UK homeowners will likely remortgage at rates around double that of before.

| Quarter | Total number of mortgages refixing | Of which: <2% initial fixed rate | Of which: 2-2.5% initial fixed rate | Of which: >2.5% initial fixed rate |

|---|---|---|---|---|

|

Q1-2022

|

298,651

|

189,179

|

109,473

|

0

|

|

Q2-2022

|

250,581

|

126,188

|

124,393

|

0

|

|

Q3-2022

|

297,382

|

182,760

|

114,622

|

0

|

|

Q4-2022

|

339,127

|

202,731

|

136,396

|

0

|

|

Q1-2023

|

353,053

|

217,892

|

130,210

|

4,952

|

|

Q2-2023

|

371,432

|

222,676

|

144,638

|

4,118

|

|

Q3-2023

|

360,294

|

201,516

|

154,039

|

4,739

|

|

Q4-2023

|

340,503

|

176,405

|

159,561

|

4,536

|

|

Q1-2024

|

316,204

|

138,929

|

174,047

|

3,228

|

|

Q2-2024

|

285,50

|

138,709

|

142,937

|

3,860

|

|

Q3-2024

|

283,288

|

17,768

|

154,052

|

111,469

|

Mortgage repayments increase

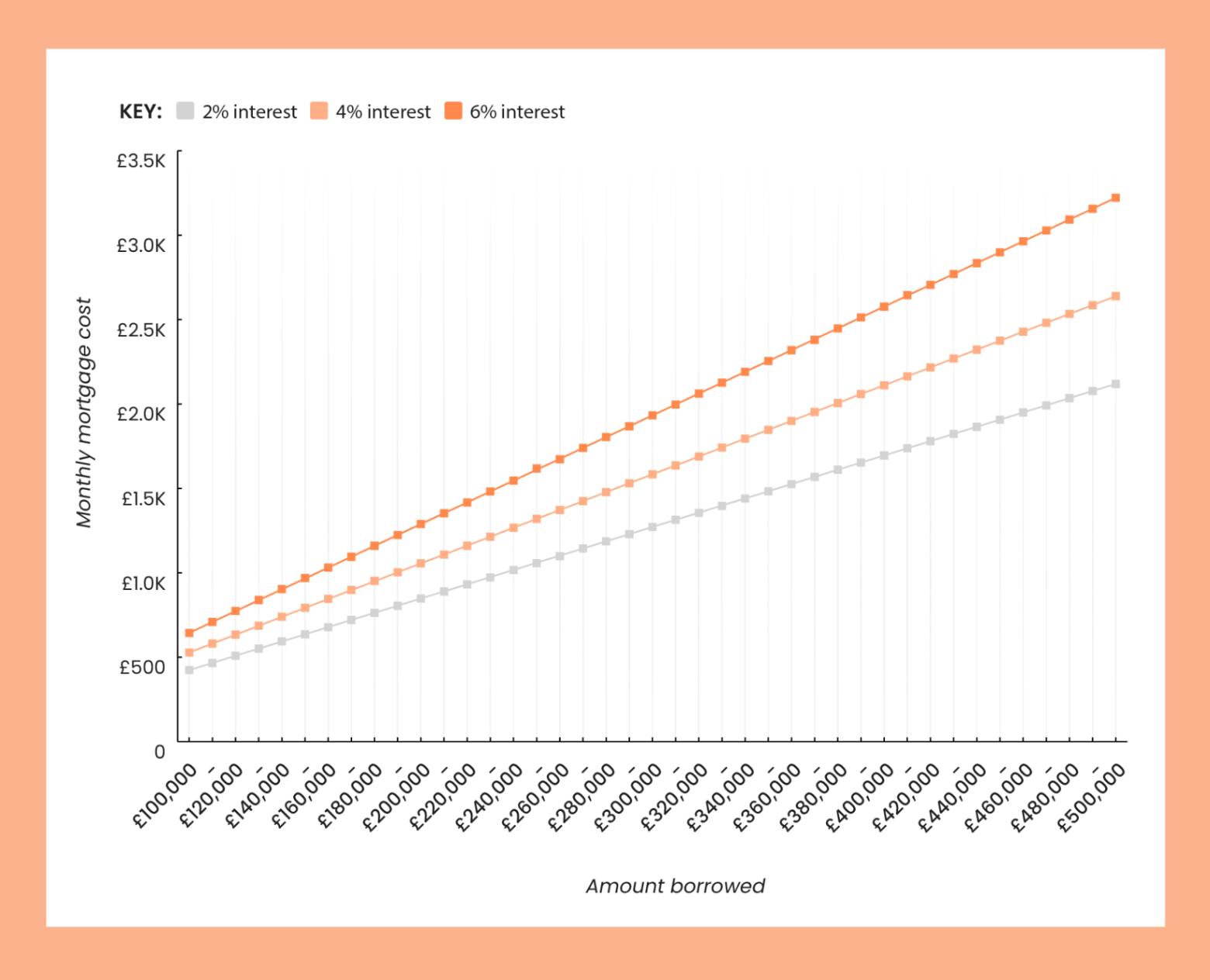

With the UK's rising interest rates, many homeowners are concerned about their monthly mortgage repayments. To shed light on this, we've illustrated the impact on monthly repayments for different mortgage values with a shift in interest rates, specifically from 2% to 4% and from 2% to 6%.

Note that the following figures assume a 25-year capital and repayment mortgage with a constant loan-to-value (LTV) percentage. Actual monthly repayments can vary based on these factors, among others.

Moving from 2% to 4% interest

With over 800,000 UK homeowners likely to remortgage from rates below 2% onto rates above 4% this year, we visualise what this looks like for mortgage repayments.

- Homeowners who’ve borrowed £100,000 will see their monthly repayments increase from £424 to £528 - a £104 increase.

- Homeowners who’ve borrowed £500,000 will see their payments rise by over £500 per month, increasing from £2,119 to £2,639.

Moving from 2% to 6% interest

Some homeowners may face a mortgage rate rise from 2% to around 6%. Your offered rate depends on your specific circumstances and when you apply for your remortgage.

- Homeowners with £100,000 to pay back will see their payments increase from £424 to £644 each month.

- Homeowners with outstanding mortgages of £500,000 will see their monthly payments increase from £2,119 to £3,222. These homeowners must find an additional £1,103 a month to meet their repayments.

Note that these rates are used to illustrate the effects of rising interest rates on UK homeowners. Homeowners looking to remortgage this year can find the best rates by researching lenders and consulting whole-of-market mortgage brokers.

| Amount borrowed | 2% interest (monthly mortgage cost) | 4% interest (monthly mortgage cost) | 6% interest (monthly mortgage cost) |

|---|---|---|---|

|

£100,000

|

£424

|

£528

|

£644

|

|

£110,000

|

£466

|

£581

|

£709

|

|

£120,000

|

£509

|

£633

|

£773

|

|

£130,000

|

£551

|

£686

|

£838

|

|

£140,000

|

£593

|

£739

|

£902

|

|

£150,000

|

£636

|

£792

|

£966

|

|

£160,000

|

£678

|

£845

|

£1,031

|

|

£170,000

|

£721

|

£897

|

£1,095

|

|

£180,000

|

£763

|

£950

|

£1,160

|

|

£190,000

|

£805

|

£1,003

|

£1,224

|

|

£200,000

|

£848

|

£1,056

|

£1,289

|

|

£210,000

|

£890

|

£1,108

|

£1,353

|

|

£220,000

|

£932

|

£1,161

|

£1,417

|

|

£230,000

|

£975

|

£1,214

|

£1,482

|

|

£240,000

|

£1,017

|

£1,267

|

£1,546

|

|

£250,000

|

£1,060

|

£1,320

|

£1,611

|

|

£260,000

|

£1,102

|

£1,372

|

£1,675

|

|

£270,000

|

£1,144

|

£1,425

|

£1,740

|

|

£280,000

|

£1,187

|

£1,478

|

£1,804

|

|

£290,000

|

£1,229

|

£1,531

|

£1,868

|

|

£300,000

|

£1,272

|

£1,584

|

£1,933

|

|

£310,000

|

£1,314

|

£1,636

|

£1,997

|

|

£320,000

|

£1,356

|

£1,689

|

£2,062

|

|

£330,000

|

£1,399

|

£1,742

|

£2,126

|

|

£340,000

|

£1,441

|

£1,795

|

£2,191

|

|

£350,000

|

£1,483

|

£1,847

|

£2,255

|

|

£360,000

|

£1,526

|

£1,900

|

£2,319

|

|

£370,000

|

£1,568

|

£1,953

|

£2,384

|

|

£380,000

|

£1,611

|

£2,006

|

£2,448

|

|

£390,000

|

£1,653

|

£2,059

|

£2,513

|

|

£400,000

|

£1,695

|

£2,111

|

£2,577

|

|

£410,000

|

£1,738

|

£2,164

|

£2,642

|

|

£420,000

|

£1,780

|

£2,217

|

£2,706

|

|

£430,000

|

£1,823

|

£2,270

|

£2,770

|

|

£440,000

|

£1,865

|

£2,322

|

£2,835

|

|

£450,000

|

£1,907

|

£2,375

|

£2,899

|

|

£460,000

|

£1,950

|

£2,428

|

£2,964

|

|

£470,000

|

£1,992

|

£2,481

|

£3,028

|

|

£480,000

|

£2,035

|

£2,534

|

£3,093

|

|

£490,000

|

£2,077

|

£2,586

|

£3,157

|

|

£500,000

|

£2,119

|

£2,639

|

£3,222

|

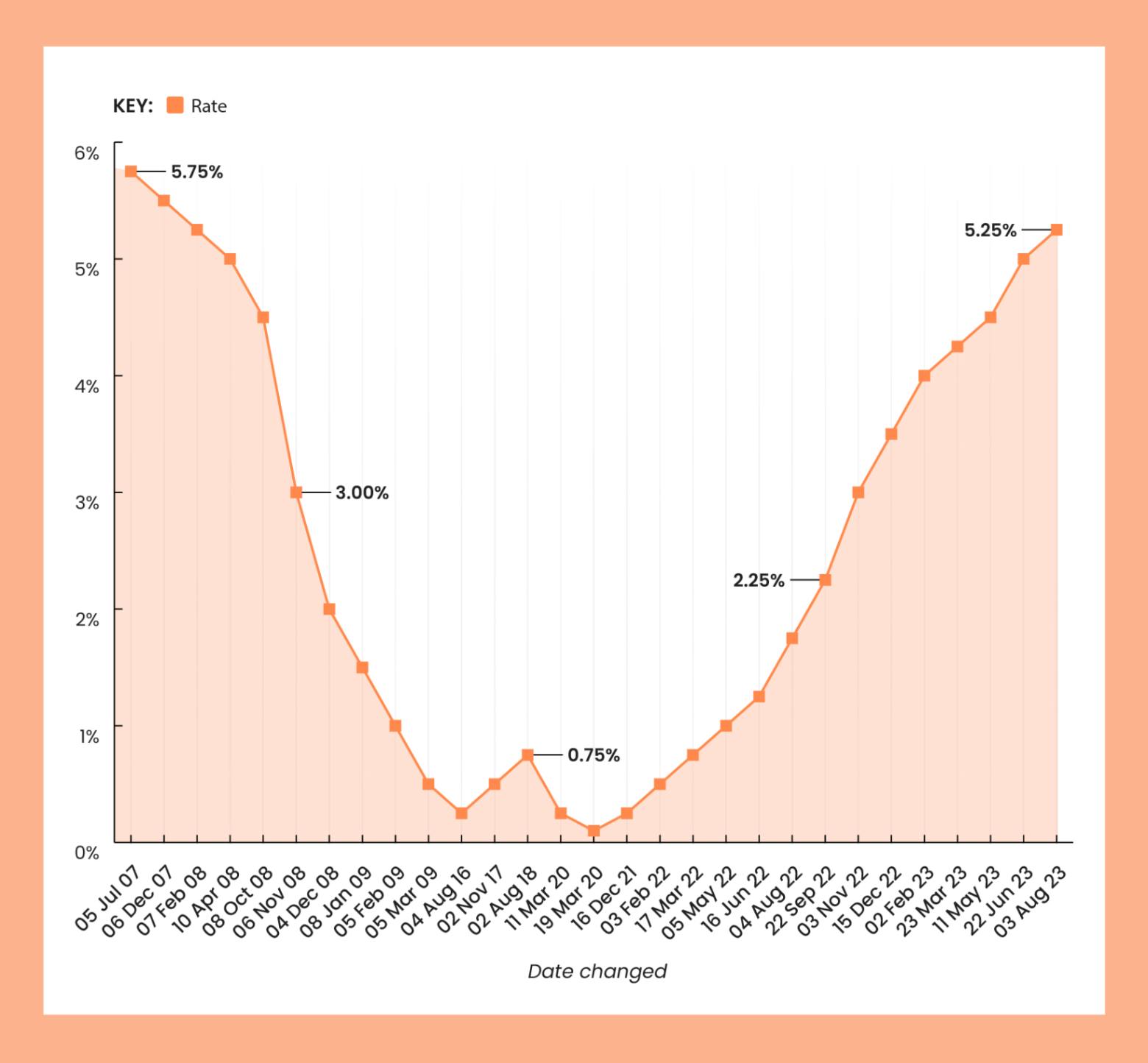

The UK base rate

The Bank of England increases or decreases the base rate based on broader economic pressures. Currently, the UK is facing a cost of living crisis where inflation has risen significantly. As a result, the Bank of England has increased the base rate 14 consecutive times since the end of 2021.

The UK base rate is currently 5.25%. This means the base rate is at its highest in over 15 years, close to its 20-year-high of 5.75%, recorded in July 2007.

According to the Office for Budget Responsibility, the base rate will continue to rise to combat inflation until 2028. The base rate is forecasted to grow another 2.78% as we move towards 2028. But, the Bank of England decided to keep the base rate at 5.25% at the last Monetary Policy Committee meeting.

This base rate directly influences tracker mortgage rates. If the base rate goes up, so do the rates on tracker mortgages. The base rate also influences SVRs and discount mortgage rates, along with the rates on fixed mortgages available in the market.

| Date Changed | Rate |

|---|---|

|

03-Aug-23

|

5.25%

|

|

22-Jun-23

|

5.00%

|

|

11-May-23

|

4.50%

|

|

23-Mar-23

|

4.25%

|

|

02-Feb-23

|

4.00%

|

|

15-Dec-22

|

3.50%

|

|

03-Nov-22

|

3.00%

|

|

22-Sep-22

|

2.25%

|

|

04-Aug-22

|

1.75%

|

|

16-Jun-22

|

1.25%

|

|

05-May-22

|

1.00%

|

|

17-Mar-22

|

0.75%

|

|

03-Feb-22

|

0.50%

|

|

16-Dec-21

|

0.25%

|

|

19-Mar-20

|

0.10%

|

|

11-Mar-20

|

0.25%

|

|

02-Aug-18

|

0.75%

|

|

02-Nov-17

|

0.50%

|

|

04-Aug-16

|

0.25%

|

|

05-Mar-09

|

0.50%

|

|

05-Feb-09

|

1.00%

|

|

08-Jan-09

|

1.50%

|

|

04-Dec-08

|

2.00%

|

|

06-Nov-08

|

3.00%

|

|

08-Oct-08

|

4.50%

|

|

10-Apr-08

|

5.00%

|

|

07-Feb-08

|

5.25%

|

|

06-Dec-07

|

5.50%

|

|

05-Jul-07

|

5.75%

|

Fixed-rate or variable rate

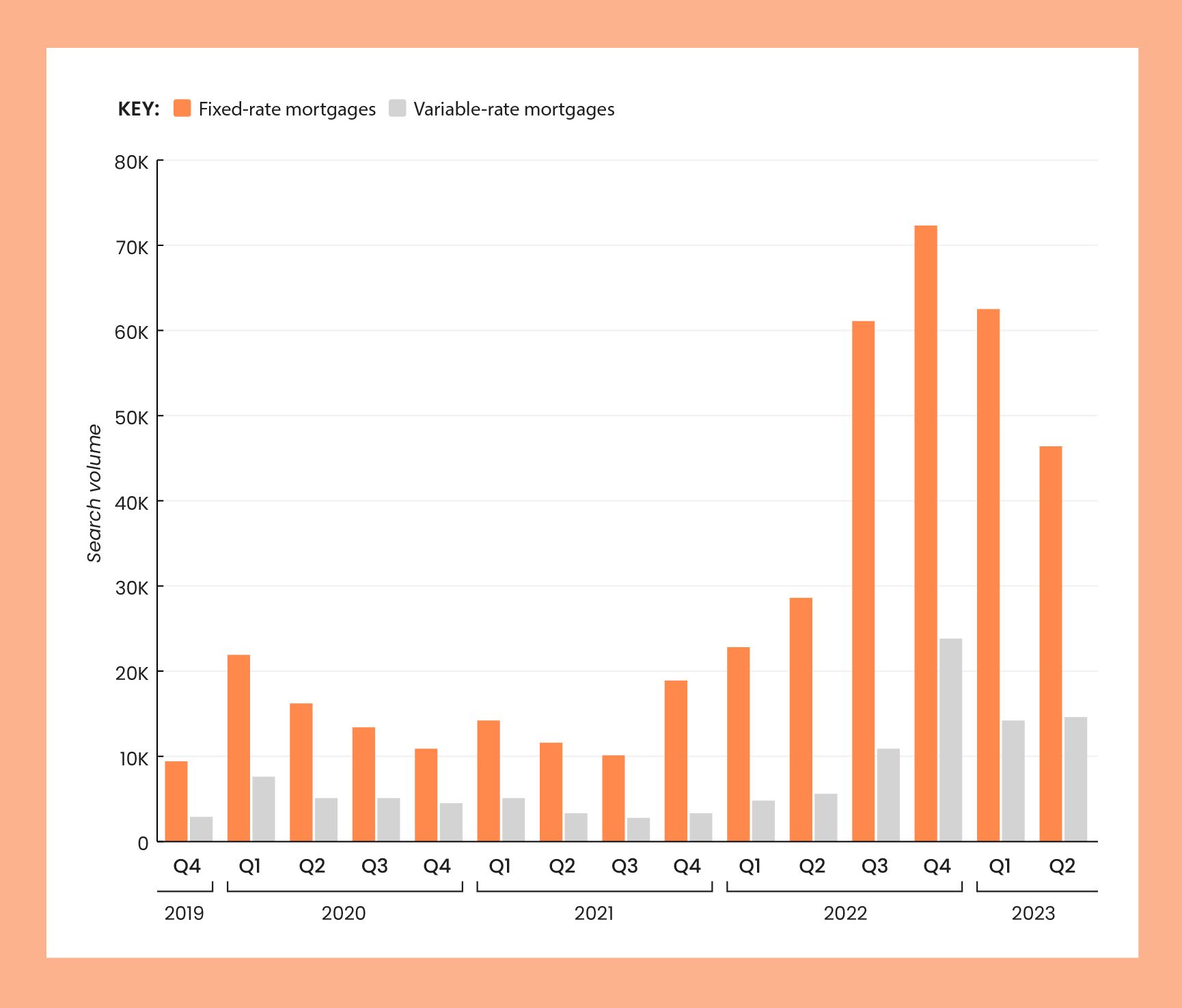

Online searches for fixed-rate mortgages have been consistently higher than for variable-rate mortgages. Over the second quarter of 2022, there were 46,400 searches for fixed-rate mortgages, compared with 14,600 for variable-rate mortgages.

This suggests that fixed-rate mortgages are more popular with homeowners in the UK than variable-rate mortgages.

| Year | Quarter | Fixed rate (Search volume) | (Variable rate Search volume) |

|---|---|---|---|

|

2019

|

Q4

|

9,400

|

2,880

|

|

2020

|

Q1

|

21,900

|

7,600

|

|

2020

|

Q2

|

16,200

|

5,100

|

|

2020

|

Q3

|

13,400

|

5,100

|

|

2020

|

Q4

|

10,900

|

4,500

|

|

2021

|

Q1

|

14,200

|

5,100

|

|

2021

|

Q2

|

11,600

|

3,300

|

|

2021

|

Q3

|

10,100

|

2760

|

|

2021

|

Q4

|

18,900

|

3,300

|

|

2022

|

Q1

|

22,800

|

4,800

|

|

2022

|

Q2

|

28,600

|

5,600

|

|

2022

|

Q3

|

61,100

|

10,900

|

|

2022

|

Q4

|

72,300

|

23,800

|

|

2023

|

Q1

|

62,500

|

14,200

|

|

2023

|

Q2

|

46,400

|

14,600

|

Buy-to-let remortgage lending

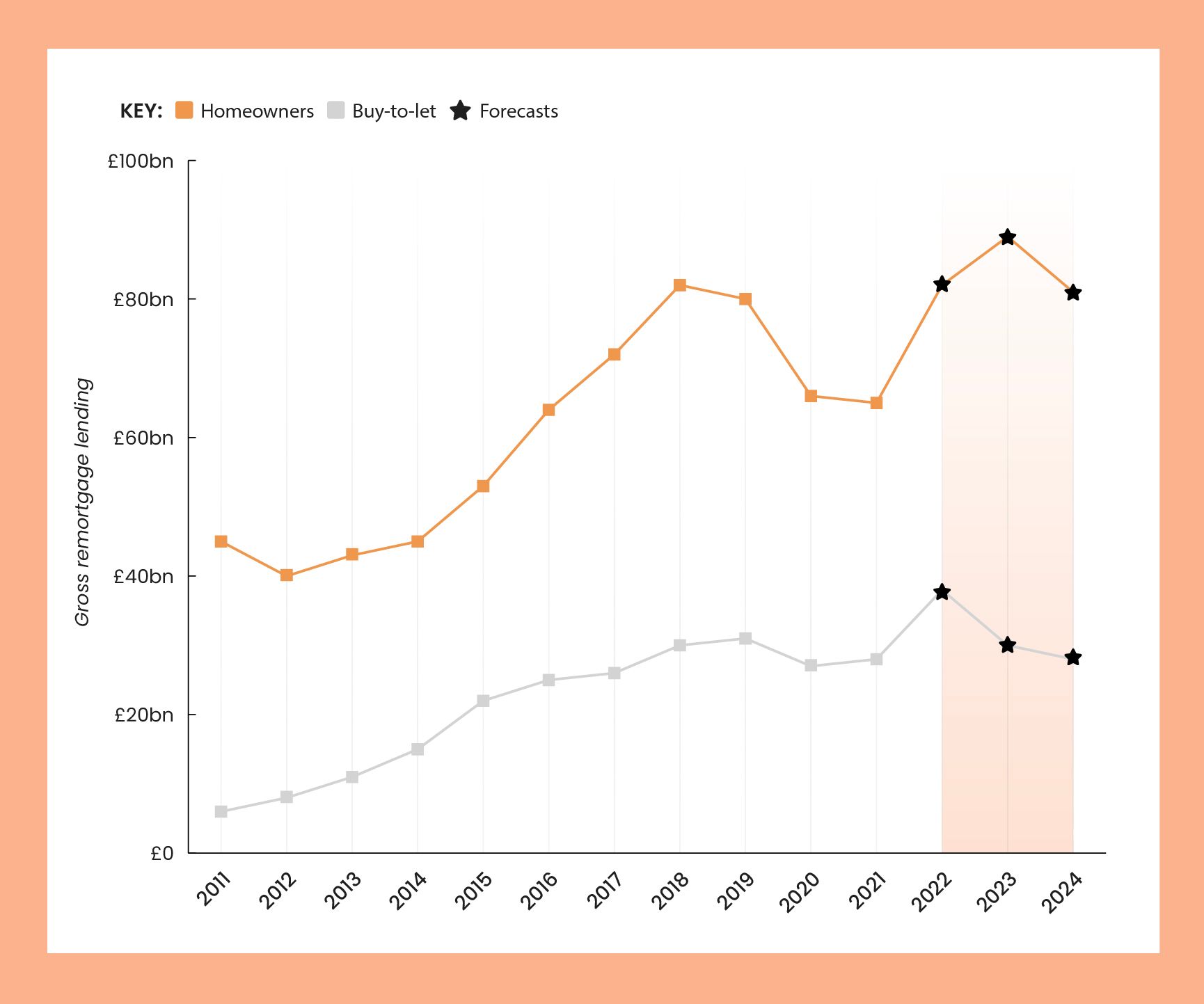

Gross remortgage lending at the end of 2021 totalled £93 billion. This comprised £65 billion in remortgages for homeowners and £28 billion for buy-to-let landlords. Current forecasts show that gross homeowner remortgages are set to increase to a higher volume than buy-to-let lending.

Gross remortgage lending for homeowners is expected to be £82 billion at the end of 2022, compared to £38 billion for buy-to-let landlords. This is set to fall to £30 billion for landlords in 2023, while homeowner lending is expected to increase to £89 billion.

| Year | Homeowners (Gross remortgage lending) | Buy-to-let (Gross remortgage lending) |

|---|---|---|

|

2011

|

£45bn

|

£6bn

|

|

2012

|

£40bn

|

£8bn

|

|

2013

|

£43bn

|

£11bn

|

|

2014

|

£45bn

|

£15bn

|

|

2015

|

£53bn

|

£22bn

|

|

2016

|

£64bn

|

£25bn

|

|

2017

|

£72bn

|

£26bn

|

|

2018

|

£82bn

|

£30bn

|

|

2019

|

£80bn

|

£31bn

|

|

2020

|

£66bn

|

£27bn

|

|

2021

|

£65bn

|

£28bn

|

|

2022 (Forecasts)

|

£82bn

|

£38bn

|

|

2023 (Forecasts)

|

£89bn

|

£30bn

|

|

2024 (Forecasts)

|

£81bn

|

£28bn

|

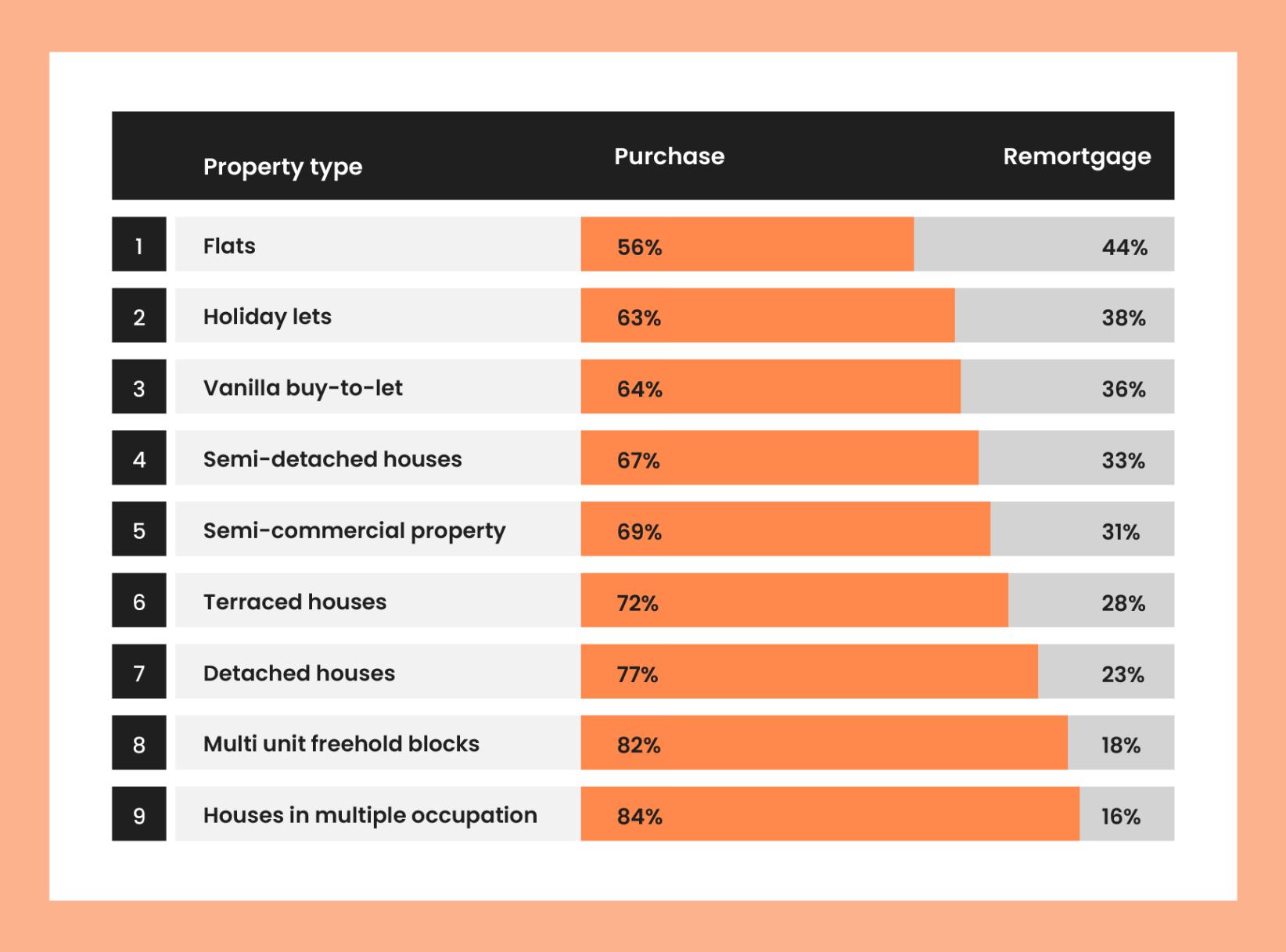

Flats were the most common type of property that saw buy-to-let landlords remortgage by the middle of 2022. Over 2 in 5 (44%) buy-to-let lending transactions were remortgages in the first 2 quarters of 2022.

Over 3 quarters (77%) of lending transactions on buy-to-let detached houses were purchase mortgages, compared to around one-quarter (23%) of remortgages.

| Rank | Property type | Purchase | Remortgage |

|---|---|---|---|

|

1

|

Flats

|

56%

|

44%

|

|

2

|

Holiday lets

|

63%

|

38%

|

|

3

|

Vanilla buy-to-let

|

64%

|

36%

|

|

4

|

Semi-detached houses

|

67%

|

33%

|

|

5

|

Semi-commercial property

|

69%

|

31%

|

|

6

|

Terraced houses

|

72%

|

28%

|

|

7

|

Detached houses

|

77%

|

23%

|

|

8

|

Multi unit freehold blocks

|

82%

|

18%

|

|

9

|

Houses in multiple occupation

|

84%

|

16%

|

Survey results

Key findings

- Over a third of Brits reported remortgaging due to their current fixed-rate deal ending.

- 3 in 10 responders were excited about the potential benefits of remortgaging.

- Over half of responders were concerned about the potentially higher interest rates they would face when they remortgage.

- Over 3 in 4 Brits reported they were more concerned about mortgage rates and housing than 5 years ago.

- Over 4 in 5 responders reported that their concern impacted their mental health, with 2 in 5 seeking therapy or counselling.

We surveyed Brits on their attitudes towards remortgaging and the current mortgage market in the UK. Almost 9 in 10 have remortgaged in the last 5 years.

| Have you remortgaged in the last 5 years? | All |

|---|---|

|

Yes

|

86.20%

|

|

No, but plan to in the next year

|

13.80%

|

The most common reason for remortgaging in the UK was the end of a fixed term. Over a third (36%) of responders reported remortgaging because their current fixed term was ending or had ended.

The second most common reason for remortgaging in the UK was to find a better deal. Over 1 in 5 responders (22%) reported they remortgaged to secure a cheaper deal on their mortgage and save on their mortgage repayments.

When you reach the end of your initial fixed-rate period, your lender moves you onto their SVR. This is likely to be higher than your previous rate and that of other mortgage deals available. It’s usually best to remortgage to another deal to save money.

| What was the primary reason for your most recent remortgage (or planned remortgage)? | All | Female | Male |

|---|---|---|---|

|

My fixed term is coming/came to an end

|

36.00%

|

35.70%

|

36.50%

|

|

To secure a cheaper deal

|

22.00%

|

20.90%

|

23.90%

|

|

To fund home renovations

|

19.20%

|

22.50%

|

13.70%

|

|

Debt consolidation

|

8.20%

|

9.60%

|

5.90%

|

|

To release equity for other investments

|

5.40%

|

3.80%

|

8.00%

|

|

I moved/am moving house and need(ed) to increase the size of my mortgage

|

6.70%

|

5.30%

|

9.10%

|

|

I moved/am moving house and need(ed) to decrease the size of my mortgage

|

1.90%

|

1.40%

|

2.70%

|

|

Other (please specify)

|

0.60%

|

0.80%

|

0.30%

|

35.1% of responders felt neutral about the remortgaging process, stating it was just a necessary process. However, 3 in 10 (30.9%) were excited about the potential benefits of remortgaging. This percentage was higher for females (33.5%) than males (26.5%).

One main benefit of remortgaging is saving money on your mortgage repayments. By switching to another deal, you can potentially get a lower interest rate and save some money.

Over 1 in 5 (22.7%) responders reported feeling anxious or worried about remortgaging. This was slightly higher for males than females (24.1% versus 21.9%).

A small minority of responders (6%) reported they were dreading the process of remortgaging. This was around the same for males and females (5.9% and 6.1% respectively).

| How do you feel about the process of remortgaging? | All | Female | Male |

|---|---|---|---|

|

Excited about the potential benefits

|

30.90%

|

33.50%

|

26.50%

|

|

Neutral - it's just a necessary process

|

35.10%

|

34.00%

|

37.00%

|

|

Anxious or worried

|

22.70%

|

21.90%

|

24.10%

|

|

Confused or unsure

|

5.00%

|

4.10%

|

6.40%

|

|

Dreading it

|

6.00%

|

6.10%

|

5.90%

|

|

Other (please specify)

|

0.30%

|

0.50%

|

0.00%

|

Over half of our responders (52.1%) reported they were concerned about the potentially higher interest rates they might face when they remortgage. This was the biggest concern for both men and women.

The second most common concern was the current economic climate (29.8%), with men more likely to be concerned about this (31.6%) than women (28.7%). Men were also more than twice as likely as females to be worried about their property value (15.8% compared to 7.3%).

Mortgage rates are significantly higher today than in recent years, currently at a 15-year high. If you decide to remortgage, you may find the rates available are higher than your current fixed-rate deal. The best way to find a good deal is to shop around and consult whole-of-market mortgage brokers.

| If you have concerns or are dreading the remortgage process, can you specify why? Select all that apply. | All | Female | Male |

|---|---|---|---|

|

About the current economic climate

|

29.80%

|

28.70%

|

31.60%

|

|

Worried about potential higher interest rates

|

52.10%

|

54.50%

|

48.00%

|

|

Bad past experience

|

15.30%

|

14.20%

|

17.20%

|

|

Lack of understanding about the process

|

12.10%

|

10.80%

|

14.20%

|

|

About property value

|

10.50%

|

7.30%

|

15.80%

|

|

No concerns

|

9.60%

|

7.20%

|

13.70%

|

|

Other (please specify)

|

0.50%

|

0.50%

|

0.50%

|

Over 3 in 4 (75.1%) responders reported being more concerned about mortgage rates and housing than 5 years ago. Around 2 in 5 (39.6%) said they were significantly more concerned.

1 in 4 respondents stated they were no more concerned about mortgage rates today than they were 5 years ago. This tended to be more true for males (30%) than for females (21.9%).

It's worth speaking to an independent broker when it comes time to remortgage. You want to talk to someone who can compare mortgages from across the market to help find you a suitable deal for your circumstances.

| Given the current economic conditions, would you say you are more concerned about mortgage rates and housing than five years ago? | All | Female | Male |

|---|---|---|---|

|

Significantly more concerned

|

39.60%

|

45.30%

|

30.00%

|

|

Somewhat more concerned

|

35.50%

|

32.90%

|

39.90%

|

|

About the same level of concern

|

20.50%

|

19.60%

|

22.00%

|

|

Somewhat less concerned

|

3.10%

|

1.80%

|

5.40%

|

|

Significantly less concerned

|

1.30%

|

0.50%

|

2.70%

|

Over 4 in 5 (83.3%) responders reported that their concern impacted their mental health, with 16.3% reporting significant effects. Males were more likely not to report that their concerns affected their mental health (20.6%) compared to women (15.3%).

| Have these concerns affected your mental health? | All | Female | Male |

|---|---|---|---|

|

Significantly

|

16.30%

|

17.40%

|

14.50%

|

|

Moderately

|

35.50%

|

38.80%

|

30.00%

|

|

Slightly

|

31.50%

|

31.60%

|

31.40%

|

|

Not at all

|

15.30%

|

12.10%

|

20.60%

|

|

Unsure

|

1.40%

|

0.20%

|

3.50%

|

Around 2 in 5 (39.4%) have sought therapy or counselling for their mental health due to their concerns surrounding mortgage rates and housing. This was significantly higher for women (49.6%) than men (19.4%).

If concerns about remortgaging, or any other financial matters, are affecting your mental health, support is available from charities such as Mind and the Mental Health & Money Advice service.

| Due to these concerns, have you sought or considered professional help or interventions for your mental health? Select all that apply. | All | Female | Male |

|---|---|---|---|

|

Yes, I've sought therapy or counselling

|

39.40%

|

49.60%

|

19.40%

|

|

Yes, I've considered therapy or counselling but haven't sought it

|

28.70%

|

26.20%

|

33.60%

|

|

Yes, I've started or increased medication

|

10.60%

|

8.40%

|

14.80%

|

|

Yes, I've considered starting or increasing medication but haven't

|

7.00%

|

5.30%

|

10.20%

|

|

No, I haven't considered or sought any interventions

|

24.10%

|

18.00%

|

36.00%

|

Frequently asked remortgage questions

What is a remortgage?

Remortgaging involves switching your current mortgage to a new deal, either with your existing lender or a different one. This is often done to secure a better interest rate or to release equity from a property.

Why would I consider remortgaging?

There are various reasons for remortgaging:

- To take advantage of a lower interest rate

- To fix your mortgage rate for a certain period

- To release equity from your home

- To consolidate debts

- To switch from an interest-only to a repayment mortgage

When is a good time to remortgage?

It's often beneficial to start looking at remortgage options a few months before your current mortgage deal ends. This will give you sufficient time to find a suitable offer and complete the application process. It's also wise to keep an eye on interest rates and the property market.

Yes, there can be several fees involved, such as:

- Early repayment charges from your current lender

- Valuation fees

- Legal fees

- Arrangement fees for the new mortgage

Can I remortgage if I have poor credit?

Remortgaging with poor credit can be more challenging, but it’s not impossible. There are specialist lenders who cater to those with less-than-perfect credit histories. However, the rates may not be as competitive.

How long does the remortgaging process take?

The remortgaging process can take anywhere from 4 to 8 weeks, depending on the complexity of the application and whether any issues arise during the valuation or legal stages.

Can I remortgage to buy another property?

Yes, you can remortgage to release equity from your existing property for the purpose of buying another property, often referred to as a 'let-to-buy' mortgage.

Should I use a mortgage broker?

A mortgage broker can provide valuable advice tailored to your circumstances and help you navigate the range of available mortgage products. However, this service usually comes at a cost, either through fees or commission.

Methodology

The percentage of loans that are remortgages, the amount lent for remortgages, and remortgage lending by type of lender were taken from the Financial Conduct Authority's (FCA) mortgage lending statistics - June 2023 (going back to 2007).

Remortgaging approval rates and values were recorded according to the Building Societies Association's mortgage & housing statistics.

Figures taken from the Office for National Statistics' How increases in housing costs impact households article, based on Bank of England data:

- The number of fixed-rate mortgages coming up for renewal

- Outstanding mortgages by type and period of initial interest rate

- Potential monthly mortgage payments when remortgagin

Remortgages by region were recorded according to the FCA's mortgage product sales data by geographic area.

How the Bank of England base rate has changed over the last few years was recorded using the Bank of England Database.

The average quoted rates on 2-year and 5-year fixed-rate mortgages were taken from the Bank of England's Financial Stability Report.

The value of home purchases and buy-to-let remortgages as a percentage of all home loans were recorded from UK Finance's Mortgage Market Forecasts 2023-2024.

The share of buy-to-let remortgages, compared to purchases by property type, were recorded from Statista.

Search data from Google Ads Keyword Planner was used to show the level of interest between fixed and variable rate remortgages.

A survey of 1,000 Brits (627 females and 373 males) was conducted on remortgaging in the UK.