"Keep your cover up-to-date. As your life evolves, so should your insurance policy. You should review your insurance policy regularly to ensure it still fits your needs. Check it's still right for you after big life events, like buying a house or having a child."

How do I compare life insurance quotes?

Tell us how much cover you want

Tell us how long you want your policy to last

Tell us whether you want a single or joint policy

Tell us about yourself and your lifestyle

Do I need life insurance?

It's not a legal requirement to get life insurance. But it could give your family or dependents financial stability. A payout may help to ease any financial burdens.

A good time to think about buying a life insurance policy is when big life events happen:

-

Getting married: Reduce the burden on your loved ones. A life insurance payout could help cover the cost of your joint financial commitments.

-

Having a child: Knowing that your dependents can get financial support if you die can help ease your worries.

-

Buying a house: For many people, buying a house is one of the biggest financial commitments they ever make. Life insurance could cover mortgage costs to help prevent your family from getting into debt.

Do single people need life insurance?

Single person life insurance can be a good idea and is worth considering. You might need it if you're a single parent, to help pay off a mortgage, or to cover funeral costs. Even if you don't have dependents, single person life insurance can help if you've got debts. Or, if you want to leave money to a charity when you die.

Do I need life insurance if I have cover through my employer?

You may have group life insurance cover through your employer, often referred to as death in service benefit. But, you may still want to buy a personal life insurance policy. Personal life cover allows the policyholder more control about how the death benefits are paid. It's worth checking how much coverage the policy with your employer includes. Keep in mind that this coverage stops if you change employers.

Buy life insurance and choose a £75 gift card with Confused.com Rewards*

*Get reward after 6 months of your policy being active. Excludes over 50s guaranteed acceptance policies and can’t be used alongside cashback offers. T&Cs apply. **Restrictions apply, see https://www.amazon.co.uk/gc-legal

£75 Gift Card**

£75 Gift Card**

£75 gift card

£75 gift card

£75 gift card

£75 gift card

How does life insurance work?

Decide on the level of cover you want

When you buy life insurance, you choose how long you want cover for and the amount of cover you need. Calculate how much your family would need to cover the mortgage, bills, and everyday costs.

Keep your policy active with monthly payments

You pay for life insurance with monthly payments. You make regular payments to cover the time you chose for the policy. To keep your policy active, you need to keep up with your payments.

Your insurance provides a payout

If you die while your policy is active, your loved ones or beneficiaries receive a payout. The payout amount depends on if you have a level term or decreasing term life insurance policy.

What are the main types of life insurance?

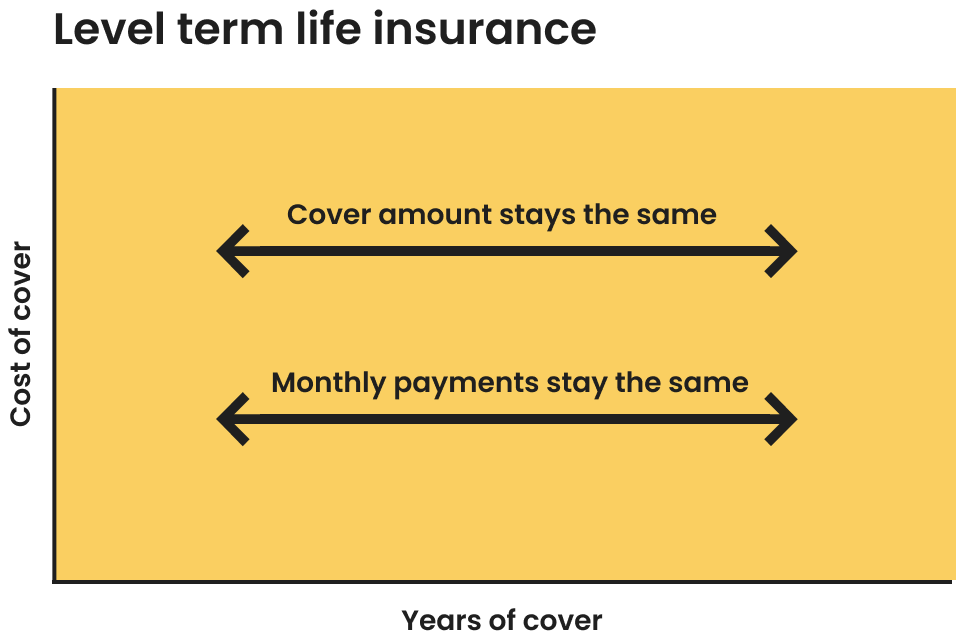

Level term life insurance

Level term life insurance pays a set amount of money if you die while covered. You choose how long you want the policy to last and the amount of money you'd like your policy to pay out.

-

This type of policy gives you the certainty of knowing how much your family would get if you died while covered.

-

The total payout is the same no matter how long the policy has been active.

-

This level of cover may be suitable for you if, for example, you have an interest only mortgage.

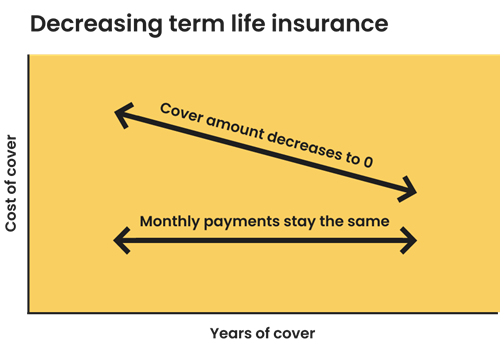

Decreasing term life insurance

Decreasing term life insurance means the amount of coverage you have decreases over time. It's normally used to protect your mortgage, which should decrease over time too.

-

The total payout amount decreases over the policy term as your mortgage is paid off.

-

It's a good option for covering mortgages or long-term loans that decrease over time as you pay them off.

-

Decreasing life insurance means you don't pay for more coverage than you need.

How much life insurance cover do I need?

The amount of coverage you need for your life insurance policy depends on what you want it to pay for. This could include:

-

Paying off your mortgage

-

Clearing any debts that you still owe

-

Supporting your family with living costs

-

Paying towards your funeral costs

-

Money towards a child's education

-

Leaving money to a charity that you care about

The Association of British Insurers (ABI) says 96.9% of term life insurance claims were paid in 2022. The average claim payout was £73,578. If you're unsure how much cover you need, use our life insurance calculator.

How long should my cover last?

Your personal circumstances affect how long you might want your life insurance policy to last. You may want it to last until your youngest child is 18. Or to cover the time left on your mortgage.

Whole life insurance pays a lump sum to your family whenever you die. It covers the whole of your life, as long as you've continued to pay for the policy. So you're not limited by the length of the policy or your age.

This is different from term life insurance. Term life only pays out if you die during the policy's set period. If you die after a term life insurance policy finishes, your loved ones don't get a payout.

Update your cover after big life events

What does life insurance cover?

What's typically covered?

It's good to understand what your life insurance covers. It varies from one policy or insurer to another. But there are some things that are typically covered, such as:

-

Most common causes of death

-

Terminal illnesses such as dementia, motor neurone disease, and multiple sclerosis

-

Accidental deaths, for example, car accidents

What's not typically covered?

Exclusions relating to your life insurance policy should be outlined in your policy terms and conditions. But some common exclusions are:

-

Pre-existing conditions, including any illness or injury that existed before you bought your policy

-

Dangerous or high-risk activities such as extreme sports

-

Drug and alcohol abuse

How much does life insurance cost?

How much you pay for life insurance depends on your personal circumstances. Your age is likely to impact how much you pay. Prices for 20-year-olds start from £2.832 per month, whereas the starting price is around £12.632 per month for those who are 50. Here's how much you might pay depending on when you buy your policy:

| Age when the policy is bought | Price per month2 |

|---|---|

|

20 years old

|

£2.83

|

|

30 years old

|

£3.95

|

|

40 years old

|

£5.57

|

|

50 years old

|

£12.63

|

2Cheapest quote offered on a 25 year policy with £100,000 of cover for an individual with no medical conditions and no history of smoking. Based on Confused.com data March 2024.

3Cheapest quote offered on a 25 year policy with £100,000 of cover for a 40 year old smoker. Based on Confused.com data March 2024.

What affects the price of life insurance?

- Your age could affect how much you pay. Life insurance usually gets more expensive as you get older. This is because there's a higher chance of health issues or death during the policy term.

- If you have a pre-existing health condition, you're likely to pay more.

-

Smoking can affect how much you pay. Life insurance costs approximately £11.213 per month for a 40-year-old smoker. This compares to a starting cost of £5.572 for a 40-year-old non-smoker.

- Certain lifestyle choices such as drinking alcohol can impact how much you pay. This is because it puts you at a higher risk of serious injuries or medical conditions.

- The type and amount of cover you choose affects how much you pay. For example, a whole life policy, instead of a term life policy, is likely to cost more.

Can I get cheaper life insurance?

Here are some things you can do to get the most out of your life insurance cover and to keep costs down:

-

Compare policies. Shop around to find cover that's suitable for you. Look at what's included and excluded in the policy. If you already have a policy, check that the cover still meets your needs.

-

Don't take out more cover than you need. Work out how much cover you need to ensure you have enough to protect your family. Consider mortgage payments, debts, future expenses like your children's education.

-

Reduce the length of your policy. Choose a shorter policy term if you only need cover for a specific amount of time. For example, if you have 20 years left on your mortgage, reduce the length of your policy to 20 years.

-

Follow healthier habits. You can reduce health risks by stopping smoking and managing your weight. Insurers consider factors like height and weight. They use these factors to assess your risk. The healthier you are, the less you are likely to pay.

-

Get life insurance when you're young. Buying a policy when you're young can be cheaper as younger people have a lower risk of health issues.

We compare trusted life insurance companies to find you our best deals

See all companiesWhy compare life insurance quotes with Confused.com?

-

Get rewarded when you buy life insurance

Choose a £75 voucher with Confused.com Rewards after you've paid for 6 months of your life insurance.

-

We work with trusted providers

We work with 10 trusted UK providers, so you have a range of options to choose from.

-

Our content is reviewed by our expert panel

Our experts are dedicated to helping our customers find the deal that is right for their needs and budget.

-

We're 100% independent

We're not owned by any insurance company. Our prices are always the best available based on the details you provide, no matter the provider.

Other types of life insurance

Depending on your needs, you may want to consider buying additional types of cover:

Critical illness cover

Critical illness cover enhances life insurance with extra protection. It pays a tax-free lump sum for specified illnesses. You can use a payout to cover things like healthcare, treatment, or family support if needed.

Income protection

Income protection, also called loss of earnings insurance, protects your income if you can't work due to sickness or injury. It offers regular payments to you and your family when you can't work, helping cover living costs like mortgages, loans, and bills.

Mortgage life insurance

Mortgage life insurance is designed to pay off your mortgage when you die. It's a type of decreasing term life insurance. This means the payout your beneficiaries get decreases in line with your mortgage balance. So if you die at the start of your policy, they get a larger payout than if you die at the end.

Joint life insurance

Joint life insurance covers two people with shared financial interests, like a mortgage. If one person dies, the policy pays out once and ends, leaving the other person uninsured. If you only need one payout, joint cover may be the best option as it tends to be cheaper than buying two separate policies.

Frequently asked questions

Is life insurance taxable?

Life insurance can be taxed if your estate is over £325,000. Your estate consists of all assets passed on after death, including life insurance. Usually, no inheritance tax is owed if you leave your estate to your spouse, civil partner, or charity. If your estate is under £325,000 after payout, you generally wouldn't pay inheritance tax.

But if it exceeds £325,000, consider putting your life insurance in trust. This keeps it separate from your estate, so no inheritance tax applies. Learn more about inheritance tax regulations on Gov.uk.

Can I get life insurance with a pre-existing condition?

Yes, you can get life insurance with pre-existing medical conditions. Illnesses like diabetes, asthma, and high blood pressure are usually covered, but you may need to pay more for the policy.

Terminal illnesses and high-risk conditions may not be covered. Providers vary in defining high-risk illnesses. Get a quote to check coverage for your condition.

Can I cancel life insurance?

Yes, you can cancel your life insurance. Keep in mind that if you decide to buy life insurance again at a later date, you might have to pay more for the same level of cover you have now. Think carefully before cancelling as the cost of life insurance increases with age.

What happens to my policy if I'm struggling to meet monthly repayments?

If you're having trouble with monthly payments, get in touch with your life insurance provider as soon as possible. They might be able to adjust your policy or set up a payment plan.

Missing one payment isn't likely to lead to the cancellation of your policy, as long as you can catch up on payments. But, if you miss several, your policy might get cancelled. That means no payout and wasted premiums.

Some insurance providers allow a grace period for payments. For example, you might have 30 days after the due date. But, each provider differs, so it's wise to contact them early.

Can I get financial help if my partner dies?

If your partner dies, you receive a lump sum payout from a joint life insurance policy, which then ends.

You might qualify for extra benefits like the funeral expenses payment. It helps those with low incomes cover funeral costs. Another option is the bereavement support payment. It offers monthly support after your partner passes away.

Remember to apply within 3 months for full benefits. You have up to 21 months to make a claim.

For more information on financial support if your partner dies, visit GOV.uk.

Page last reviewed: 10 April 2024

Reviewed by: Matthew Harwood